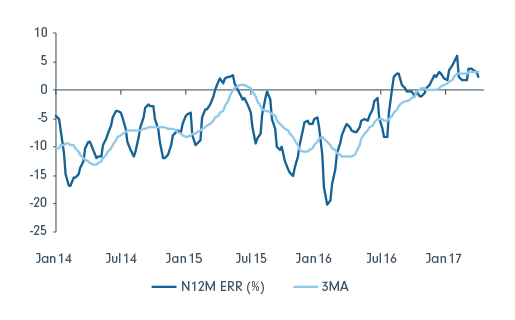

European earnings revisions turning positive

Source: Fidelity, Datastream, Morgan Stanley , data as of 6 Apr 2017. N12M ERR (%) = 12-month earnings revision ratio. 3MA = 3-month moving average.

What we are now seeing is a strong recovery in European stocks, with earnings starting to come through. Margins are recovering and the most recent earnings season in Europe has been the strongest in more than 10 years.

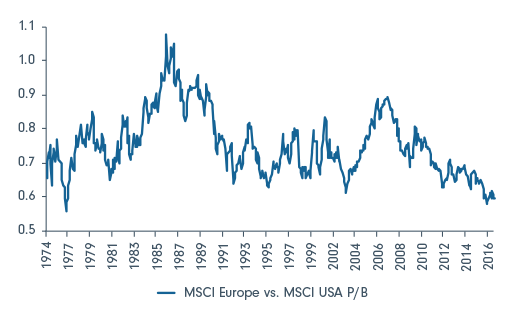

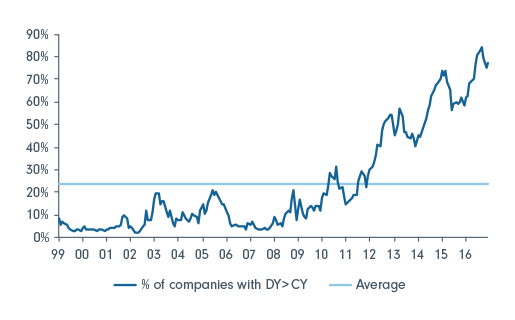

Particularly compelling for European equities is their valuation. As they have been out of favour for much of last year they are trading at a multi-year discount relative to the US on a price-to-book basis. And today, record high numbers of European companies have a dividend yield that exceeds their bond yield.

Source: Datastream, GS Research, data as of 31 March 2017.

Percentage of stocks with dividend yield > bond yield

Source: Datastream, Goldman Sachs Global ECS Research, December 2016. Stoxx Europe 600.

Investments in overseas markets can be affected by currency exchange and this may affect the value of your investment. Investments in small and emerging markets can be more volatile than investments in developed markets.

This document is intended for use by advisers and wholesale investors. Retail investors should not rely on any information in this document without first seeking advice from their financial adviser. You should consider these matters before acting on the information. You should also consider the relevant Product Disclosure Statements (“PDS”) for any Fidelity Australia product mentioned in this document before making any decision about whether to acquire the product. The PDS can be obtained by contacting Fidelity Australia on 1800 119 270 or by downloading it from our website at www.fidelity.com.au. This document may include general commentary on market activity, sector trends or other broad-based economic or political conditions that should not be taken as investment advice. Information stated herein about specific securities is subject to change. Any reference to specific securities should not be taken as a recommendation to buy, sell or hold these securities. While the information contained in this document has been prepared with reasonable care, no responsibility or liability is accepted for any errors or omissions or misstatements however caused. This document is intended as general information only. The document may not be reproduced or transmitted without prior written permission of Fidelity Australia. The issuer of Fidelity’s managed investment schemes is FIL Responsible Entity (Australia) Limited ABN 33 148 059 009. Reference to ($) are in Australian dollars unless stated otherwise.

© 2017 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited.