Laying the groundwork

Downside protection tools can assist in mitigating certain portfolio risks. But before even considering the appropriate tool it is important to understand what risk is and how exactly risk mitigation and hedging differ. In addition, costs, timing, and expertise all play a crucial role in selecting which tool(s) to use and how to implement them. Using the right tool at the wrong time can mean that a portfolio is protected but may not perform as expected.

There is no single best solution. But a good framework is to ask these questions:

- What does the portfolio look like?

- What risks are anticipated?

- What is the pricing of available instruments?

A flexible approach is best because each portfolio is unique, and the ideal tool in theory may not be ideal in practice. Sometimes a combination of tools may provide the best protection. The best strategy may also depend on the time horizon. A short term tactical solution can differ from one for the longer term where cost of carry becomes more relevant. Occasionally there may be a single asset not present in your portfolio but which provides a good hedge for specific event risks.

What does risk mean?

To appreciate the specific risks of a portfolio, it is essential to know exactly how the portfolio is positioned. What are its market, sector and stock exposures? For example, it may not be as relevant to protect a fund against an equity market sell-off if the fund is positioned towards quality or defensive stocks relative to the benchmark, because those stocks would be expected to outperform the benchmark in that scenario.

But downside risk can take many flavours, such as:

- Event risk - hedging a specific event such as a sovereign default or a war in the Middle East.

- Protecting against regional, sectoral and company risks, as well as currency exposure. For example, a portfolio concentrated in US stocks is exposed to the country’s political landscape, trade balance, high technology sector weighting and fluctuations in the US dollar against the investor’s domestic currency.

- Benchmark risk - biases at a factor or sector level versus the benchmark. A portfolio represents a manager’s core investment beliefs but factors or sector weights can diverge from the benchmark, introducing a source of risk. For example, if a portfolio is underweight financials relative to the benchmark, an investor may seek ways to increase the exposure to financials to more accurately reflect the markets’ characteristics.

Hedging versus risk mitigation

Downside protection can be thought of as hedging and/or risk mitigation. The two are similar, and there are areas of overlap, but they are not the same.

Hedging strategies are specific, targeted, typically time-bound, and require technical skill, whereas risk mitigation techniques are more general in nature rather than specific, require less technical skill to implement, and are typically thought of as longer term solutions to risk.

To be more exact, good hedging should meet all the following conditions:

- It should be regionally congruent to the portfolio and correlated to it. So it should be directly relevant geographically and sectorally, otherwise it becomes an unrelated short position rather than a hedge.

- It should reduce a negative effect, rather than be intended to add a positive gain; otherwise it becomes an active bet.

- It should be reflective of benchmark risks; otherwise it will not work as a hedge for the portfolio.

- The protection provided needs to be genuine and specific, not a vague protection which risks failing in its objective.

- Risk tolerance considerations, ESG stipulations and other requirements can restrict which strategies can be employed.

Keeping a lid on costs

Costs are a crucial consideration in choosing the protection tool. Timing - choosing when to act - and deciding the proportion of the portfolio to protect, contribute to the charges for protection. Systematic hedging without regard for timing or portfolio structure is generally an expensive strategy and can end up detracting more from portfolio return than from the risk it is intended to protect against.

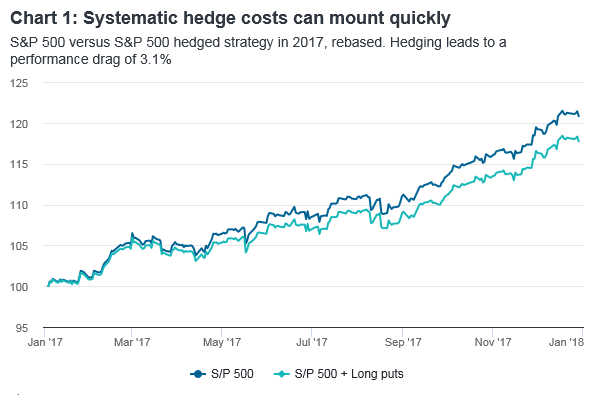

Given that it’s notoriously difficult to time market downturns perfectly, the chances are that investors implement a hedge too early. Maintaining it could require repeatedly renewing the hedge instrument, leading to mounting costs. Chart 1 shows how a 5% out-of-the-money put option hedge, rolled each month, leads to a 3.1% drag on performance over 2017. In a year when the S&P 500 performs at a long term average of 7-8%, this could cause a significant impact on total return.

Note: S&P 500 1 month put options are 5% out-of-the-money and purchased monthly. Source: Bloomberg, January 2017

Table: S&P 500 price returns

Source: Datastream, January 2018

A way to reduce these costs is to wait for catalysts which trigger the sequence of events that eventually lead to the downside effect. When these catalytic events occur it’s possible to react quickly and place a hedge which can protect against much of the downside at a reasonable cost. (A timely response is important as the cost of hedging instruments often rises when such events happen.) For example, before a bear market begins in earnest there is normally a period of rising volatility around the peak - this can provide a signal to start building up portfolio protection.

The other key consideration is selecting how much of the portfolio to hedge. It can be prohibitively expensive to protect the whole portfolio so a decision needs to be made as to which securities it makes most sense to protect. This boils down to a cost/benefit calculation.

For example, suppose that 20% of a portfolio is exposed to risk A. If risk A occurs it will lead to an expected 10% drop in the price of the asset class. In that case the overall portfolio decline will only be 2%. This is an example of the context for deciding whether the cost and resources involved in hedging are worthwhile.

Some hedging tools are expensive and only a big fall would justify the cost. For example, given the efficient pricing of options, the underlying asset has to move against you by at least the amount of the premium beyond their strike price, before the option hedge benefits the portfolio.

Choose your weapon

There are seven main categories of risk mitigation and hedging tools.

Risk mitigation:

- Security selection

- Diversification

- Asset allocation and tactical shifts

- Outsourcing

Hedging:

- Non-linear derivatives

- Delta one hedging

- Dynamic hedging

There is no ‘one size fits all’ downside protection tool and each approach has its pros and cons. The investor must carefully analyse their portfolio, the risks involved, and the characteristics of each tool to decide which tool(s) to use and to what extent. However, we think that the first two risk mitigation tools (security selection and diversification) should be almost universally employed because of their comprehensive benefits for investors.

Conclusion

Investors most fundamentally need to have a clear understanding of what their investment objectives are and how their portfolio is constructed to manage downside risk. There are many protective tools at their disposal but picking the right one, or combination, requires thoughtful analysis and regular adjustment

Takeaways

There are some key principles that investors can follow to help ensure good downside protection:

- Know the portfolio and its risk exposures, and carefully consider which risks to mitigate.

- Security selection and asset mix choices are integral to the risk management process.

- Make the most of the ‘free lunch’ of diversification by allocating across assets with very different risks characteristics.

- Consider hedging to reduce overall market exposure or reduce specific factor exposures, but beware of basis risk and keep a close eye on costs.

- Know your limits and the skillset required to use protection tools effectively. Be prepared to seek specialist assistance when necessary.

- Be flexible. The optimal solution will very likely change with time and circumstances.