The journey to date

2022 was a pivotal year for Australian investors, signalling the first rise in the Reserve Bank of Australia (RBA) official cash rate since 2020.

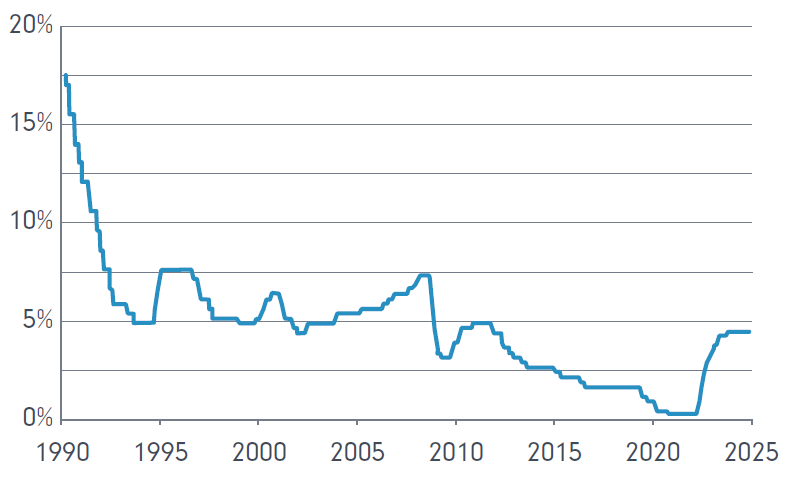

As you can see in Chart 1, up until this point, investors had witnessed an unprecedented decline in the official cash rate following the global financial crisis of 2008.

Cash rates and bond yields fell to record low levels, pushing investors up the risk spectrum to generate higher returns. The incentive to invest in cash or bonds diminished with the RBA official cash rate hitting a low of 0.10% in 2020.

Fast-forward a couple of years and the economic environment changed dramatically. Rising inflation, fuelled by pent-up savings and demand globally after the COVID pandemic, alongside Russia’s invasion of Ukraine, saw key central banks raise rates rapidly and aggressively.

For the first time in a long time, cash offered a reasonable nominal return with the official cash rate reaching 4.35% in November 2023, with many term deposits offering rates of over 5%.

For many investors, cash made sense. Despite equity markets roaring ahead, high inflation and a general sense of geopolitical and market uncertainty saw cash balances materially rise.

Chart 1. RBA official cash rate

Source: RBA Cash Rate Target as at 28 January 2025.

On a global level, we have seen inflation moderate, which has led to various central banks, including the US Federal Reserve and European Central Bank, reducing their official cash rates. Likewise, here in Australia, the Reserve Bank recently made its first rate cut in three years. As cash rates fall, is now the time for investors to rethink their defensive portfolios?

As cash rates fall, the attractiveness of holding money in cash or short-dated investments such as term deposits will diminish and investors will need to consider whether they hold onto cash or seek out other investment opportunities across equities and fixed income assets.

Why duration, why now?

Constructing the defensive part of a portfolio requires a balance of generating yield with portfolio diversification and risk management.

It typically consists of three core building blocks of cash, duration (government bonds) and credit. The risk/return profile of these assets is broad, ranging from (risk-free) cash, and cash-like assets, through to assets such as high yield and emerging market debt, which generally offer high

yields but at the same time behave more akin to equities from a risk/return perspective, given their higher correlation to equities.

One unloved segment of the fixed income market in recent years, which we believe is worthy of attention in the current environment, is duration fixed income assets.

The role of duration assets, such as global bonds or Australian bonds, within a diversified portfolio is primarily to serve as a diversifier to equities, as well as offering a reasonable level of yield.

In recent years, many investors have given up on bonds, as through the era of quantitative easing, bonds provided negligible yields when inflation rose rapidly. Bonds were also volatile and did not provide the diversification benefits to equities investors expected, leading many investors to question the role of bonds within their portfolios.

However, against this new economic backdrop, where inflation continues to moderate and interest rates are expected to fall over time, it may be an opportune time to consider an exposure to bonds for clients with little or no exposure.

There are three main reasons to consider bonds as part of a diversified portfolio:

1. Diversification

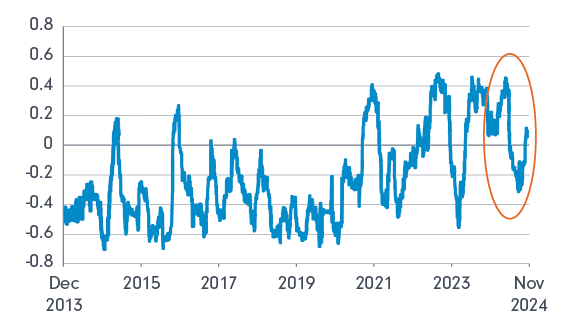

One of the key roles of bonds within a portfolio is to act as a ballast for a portfolio, providing diversification to equities. In the period where we saw market regimes shift from one of low rates, low inflation to higher rates and high inflation, bond market volatility increased materially as markets recalibrated to the new environment.

This saw equity/bond correlation increase, meaning that bonds did not provide protection against down periods in equity markets.

As inflation has moderated, we have seen volatility in bond markets subside and equity/bond correlations fall, thus improving the diversification benefits bonds offer against equities.

Chart 2 below shows the rolling 60-day correlation of the S&P 500 and US Treasuries. While correlations have been volatile, you can see that equity bond correlations have fallen materially as inflation has moderated, reaffirming the diversification benefits of bonds within a portfolio.

Chart 2. Rolling 60-day correlation of SPX and US Treasury index

Source: Fidelity International, Refinitiv Datastream, November 2024

2. Yields and capital return

Bond yields have risen sharply since 2020. US 10-Year Treasury Bond Notes were yielding sub 1% pa in 2020 and are now yielding 4.48% pa at the time of writing this paper.

If inflation moderates and interest rates continue to fall, duration assets including bonds should benefit from a capital returns perspective, as bond returns generally benefit from falling interest rates. Bond yields at such levels are comparable to cash rates.

3. Valuations

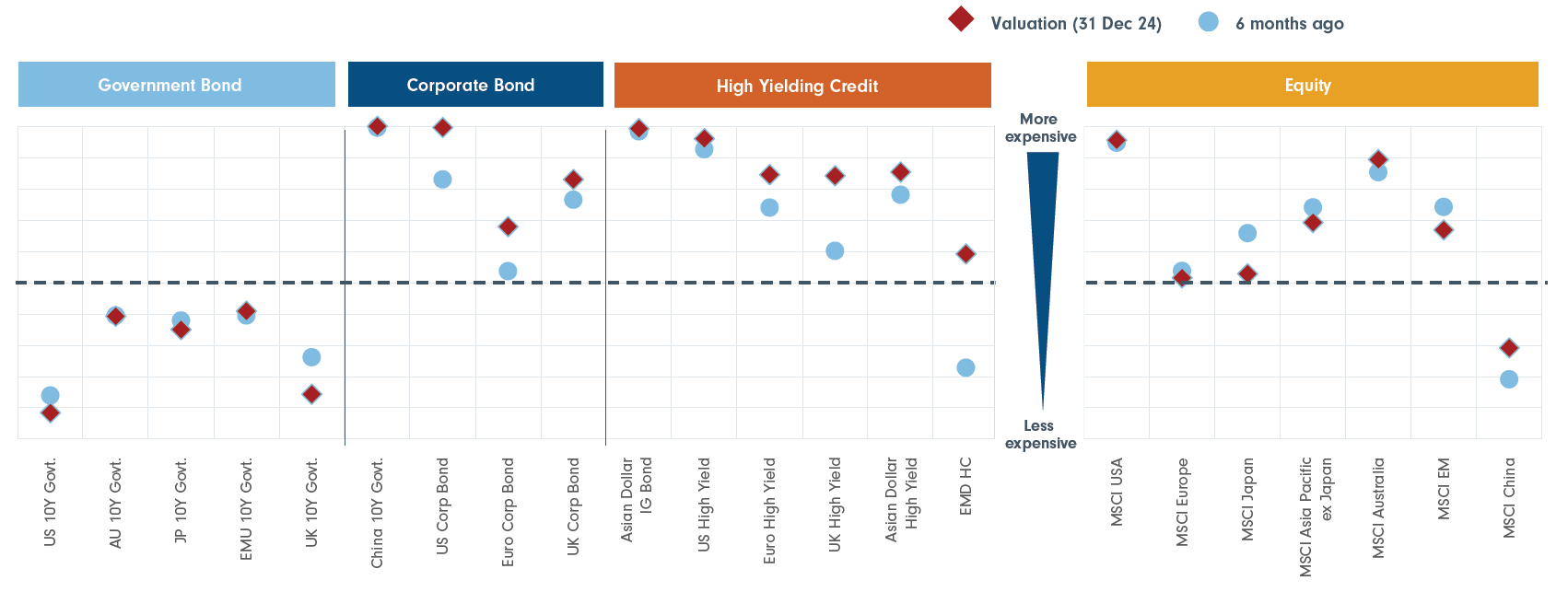

Bonds are also offering reasonable value relative to other parts of the fixed income universe. Assets like US Treasuries are trading at a significant discount compared to corporate bonds and high-yield assets.

While asset prices can remain elevated or depressed over the short to medium term, over the long term, valuation has proven to be an effective measure to assess the future value of an asset, i.e. buying quality assets at depressed valuation tends to be positive for long-term returns.

Chart 3 below shows the valuation of key asset classes as at 31 December 2024. Government bonds, such as US Treasuries, are trading at a material discount to other fixed income assets, such as corporate credit and high yield.

Chart 3. Valuation across major asset classes

Source: Refinitiv Datastream, as at 31 December 2024. ICE BofA Merrill Lynch, Corporate, IG Bond and High Yield indices – OAS, Government bond indices – redemption yields. JPM EMD indices – yield (local currency), spread (hard currency). MSCI equity indices – forward PE. Data since January 2014. EM Corporate Bond data since September 2004 and China 10 Year Government Bond data since July 2007.

Time to review your defensive portfolio allocations

Cash and cash like investment such as term deposits have provided investors with a solid return in recent years as interest rates have risen. Looking further ahead, if inflation continues to moderate it is likely we will see interest rates fall.

In this environment, while not a direct replacement for cash, bonds may play an increasingly important role within the context of a diversified portfolio as a source of yield, capital return and diversification. Now is the time to review your defensive portfolio allocations.