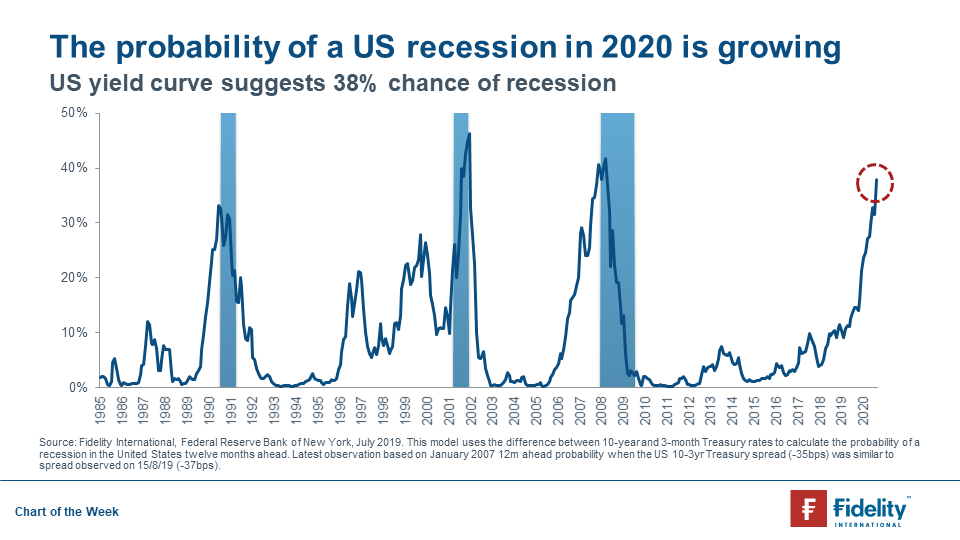

For those wondering why there is so much focus on the US yield curve this morning, an inverted yield curve has historically been one of the best recession indicators. Economists at the Federal Reserve Bank of New York found that it can be a very valuable forecasting tool, with the slope of the yield curve - the spread between long and short-term interest rates - inverting before every recession in the last 50 years. What has rattled investors overnight is the fact that the 10-2 year yield curve inverted for the first time since 2007 following weaker than expected economic data out of China and Germany. This has resulted in heighted risk aversion amongst investors, and risk assets like equities have suffered the brunt of the pain, while traditional safe haven currencies like the Japanese yen and Swiss franc have appreciated overnight.

While we don’t expect an imminent recession, the case for further rate cuts in the US is getting stronger, with the Federal Open Market Committee (FOMC) having little option but to ease rates, thus keeping US government bond from rising materially. We continue to expect the Fed to cut at least once more this year, and potentially twice, in line with market expectations. While late-stage expansions are typically characterised by heightened volatility and greater uncertainty, it can be a rewarding time for investors. Those investors that can maintain their discipline during periods of heightened market nervousness can often find that it pays to remain invested over the long run.