Historically, a tightening in financial conditions like the one that we have seen over the last year invariably led to a US recession. Gauging the potential severity, however, is a more complex affair.

In recent months, some investors have shifted from asking whether the US Federal Reserve’s rate hiking will lead to a hard landing to asking how hard the landing will be. And while many look to previous tightening episodes for clues about the current situation, this week’s Chart Room suggests that economic history tends not to repeat itself so much as rhyme.

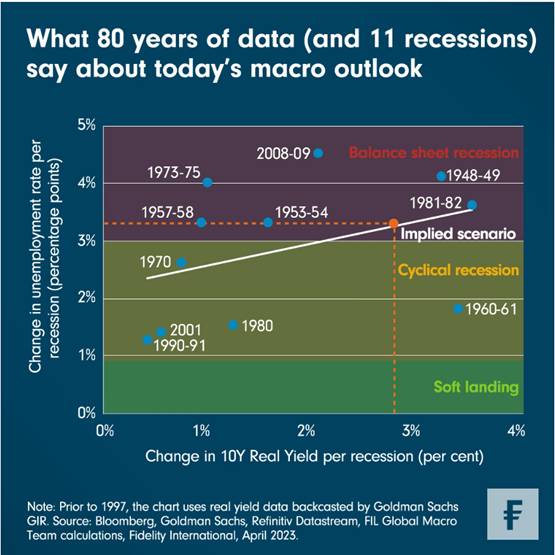

By looking at the trough-to-peak changes in the US 10-year real yield over the 12 months building up to every US recession since World War II, we find that the greater the tightening, by and large, the higher the rise in unemployment in the ensuing downturn. That simple linear relationship implies that the current unemployment rate could increase by more than 3 percentage points based on the maximum change in 10-year real yields seen to date (282 bps). This would imply something on the softer end of the spectrum of ‘balance sheet’ recessions is in store - a deep recession that is often exacerbated by households and/or corporates deleveraging their balance sheets.

But, of course, past performance is no guarantee of future results. We know that tightening financial conditions are not the only variable at play. The chart shows historical instances where similar levels of tightening have had significantly different effects. The 1960-61 recession, for example, was relatively short-lived, and preceded what stands as the third longest period of economic expansion in US history. Skip ahead to the early 1980s, and we had the archetypal policy-induced recession, the result of Paul Volcker’s rapid and sustained hiking of interest rates.

While we still believe that today’s tightening financial conditions will almost certainly lead to a US recession, we expect the downturn will probably be less severe than the historical relationship suggests. One reason is that the balance sheet of US households is, on the whole, fairly healthy. Debt as a percent of disposable income has only recently moved above its pre-Covid level, which itself is significantly below the pre-Global Financial Crisis highs. As a result, we estimate an 80 per cent probability of a ‘cyclical’ recession, in which the unemployment rate increases by around 1.5-2 percentage points.

But as the recent turmoil in the banking sector has demonstrated, the amount of debt in the system means fragilities lurk which could yet alter the balance of risks. Investors may be best served keeping their eyes on the present while looking for clues in the past.