The real estate market has a turning circle equivalent to a jumbo oil tanker. No matter what happens in the global macroeconomic or political landscape, the market can be incredibly slow to react for the simple reason that, unlike other assets such as bonds or stocks, buildings can’t be bought or sold quickly. Like the oil tanker, this is a market that is not rocked by the waves of every global event or bout of volatility.

This is not to say that real estate investors don’t pay attention to what’s going on in the wider world. Instead, we take a long-term view, and over 2024 I will be tracking various market data to understand what a core real estate portfolio could look like in three or even five years’ time. Here’s what I’ll be watching.

Interest in rates - and more

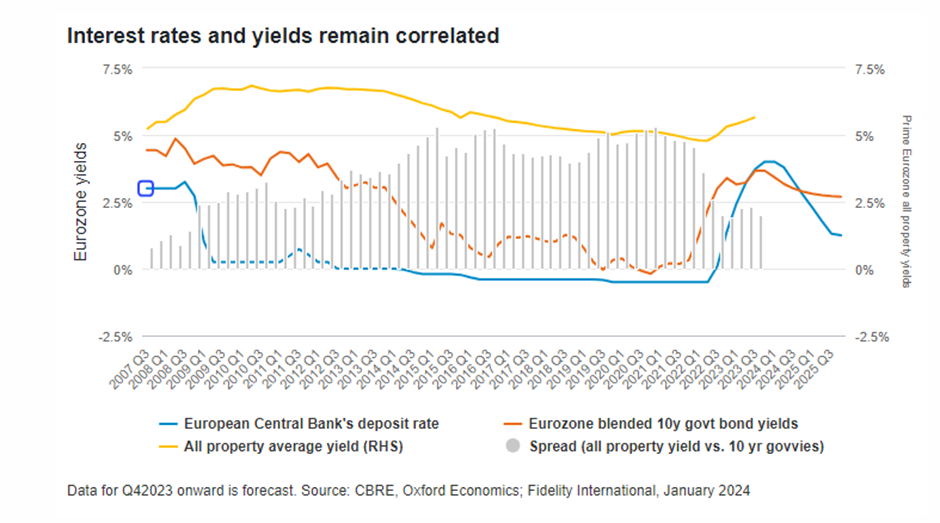

Interest rates, of course, remain one of the most important data points for the real estate market. A change in approach from central banks could trigger a change in investor attitudes. If base rates fall then yields available on real estate will become more attractive compared to cash. However, as Chart 1 shows, it can be hard to predict the lag between interest rates and real estate yields. But yields are not the end of the story anymore. Real estate served well as ‘a bond with a roof’ over the past decade, but investors now are just as interested in the market’s equity-like qualities too. That means I’m looking at the capital value that can be added by improving an asset’s sustainability criteria or its overall quality and opportunities for rental growth, as well as the yields gained from a stable rental income.

Geography matters

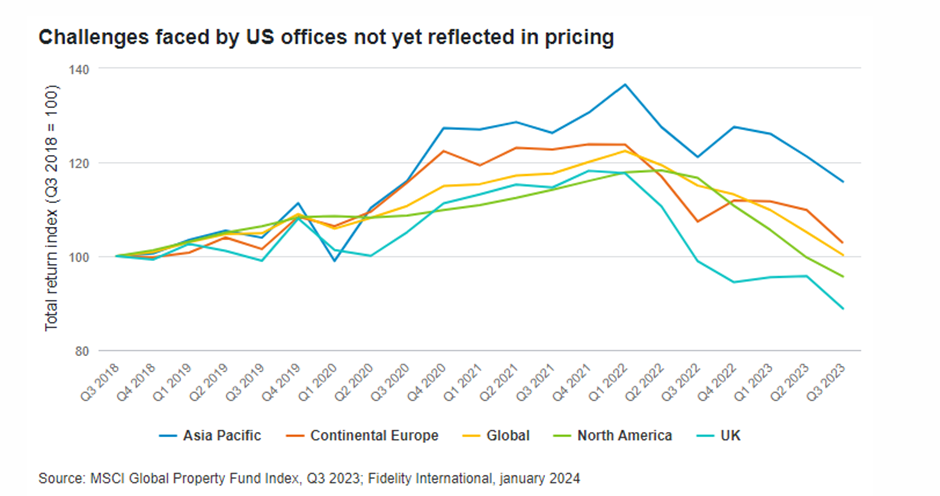

I have a high conviction that office space in Europe still looks resilient compared to the US. Workspace in the US underperformed compared to much of the rest of the world in 2023, and the market’s correction started later than elsewhere. There’s a risk that the European market could catch a cold from the US, but the problems stateside seem to be structural rather than driven by sentiment (it’s far more difficult to convert office space for other uses in the US, so vacancy rates remain high and take-up is low).

There’s still demand from occupiers in Europe, especially for sustainable buildings and for those in specific sub-markets within cities (the City of London rather than Canary Wharf, for example). Prices in the region may still be falling, but that also means there are opportunities to buy assets and add value. As we enter 2024, it’s very much a buyer’s market.

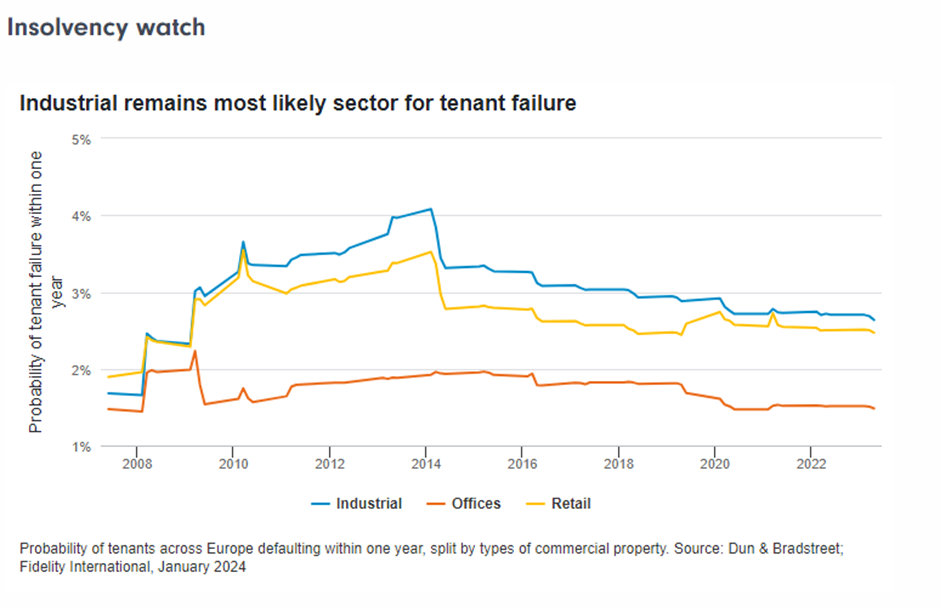

I will be keeping a close eye on corporate insolvencies over the coming cycle to uncover where the risks lie in terms of failing tenants. I’ve been working closely with Fidelity’s private credit team to help determine likely defaults, and although the default rate is low, there is an expectation that some weaker companies may fail once a recession hits. That could cause a rise in vacancies.

Despite the slightly higher risk of tenant failure, logistics - a popular sector for investors in recent years - will remain compelling. Supply chain crises have hurt transport and logistics industries, but the warehousing real estate sector has nevertheless proven remarkably resilient. In part, that’s because of a rise in demand for these assets from non-logistics operators, such as manufacturers and suppliers which have wanted to hold increased volumes of stock, replacing the ‘just in time’ supply chain management strategy with a ‘just in case’ approach. The growth in e-commerce has also been important to the logistics market, and we expect to see demand from retailers start to creep up next year once the warehouse spaces they acquired during the pandemic become fully absorbed and online sales continue to increase. It will also be interesting to see just how resilient the logistics part of the real estate market is in the event of a balance sheet recession.

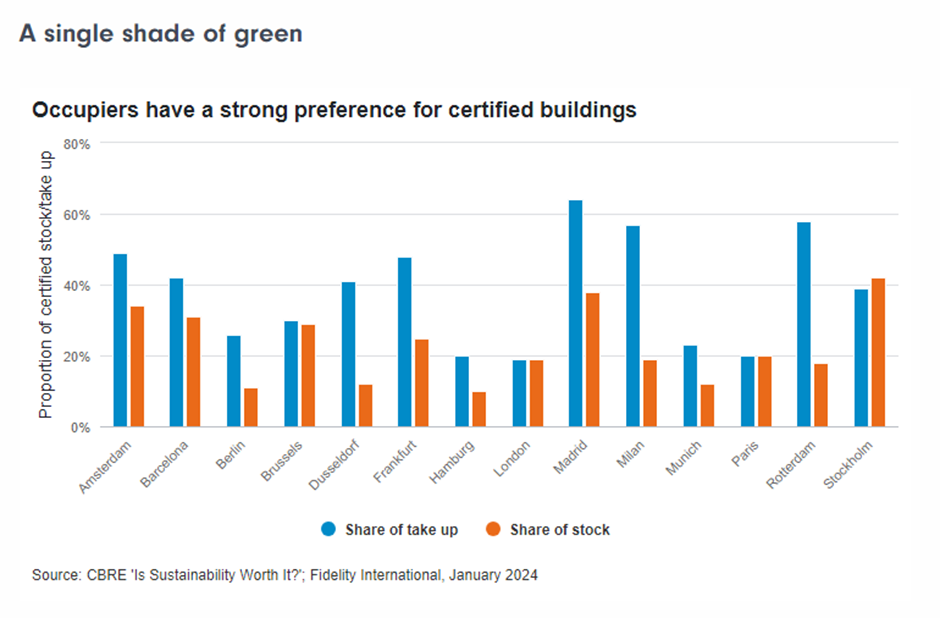

Finally, sustainability and the step-up in demand from occupiers for green buildings. The trend is clear but the market needs better definition around the various sustainability labels that tenants can apply for - some of which contradict each other (elements of the WELL Building Standard and those of the BREEAM certification, for example).

I want to see a standardised approach to sustainability metrics and a more fundamental shift in the way a buildings’ green criteria are reported. What is the long-term real-world impact investors are having through retrofitting or updating their properties, rather than just a single measure of their current state. Perhaps this process won’t be completed within the next 12 months, but 2024 is a year in which I expect to see significant progress as discussions about certification are replaced with a more meaningful focus on impact.