Sandeep Kothari, Portfolio Advisor for the Fidelity India Fund, thinks that in a low-growth global environment India’s economic revival, on a relative basis, will look attractive and, despite increased volatility, stock-picking opportunities will support equities.

March 2016

How do you view India in a global context and what will be its key drivers this year?

India is attractively placed in a slow-growth world due to its relatively strong economic fundamentals and domestic-driven structural growth trends. India is the only major emerging market where the economy is expanding at around 7%. The outlook is positive because interest rates are falling as inflation slows. As a result, consumption, capital expenditure and foreign investment are likely to improve. Another boost for India is that being the world’s third-largest oil importer, the weakness in oil prices is an unambiguous plus. Thirdly, corporate earnings are likely to pick up from current levels. While India’s earnings growth has decelerated in the past two years, it is expected to rise as the economy accelerates and more reforms are implemented. Finally, the reform process is progressing in the right direction, although its pace has been slower than expected.

Valuations look reasonable – the stock market trades at 16 times its 12-month forward earnings, which is in line with their historic average. Stock-picking opportunities are abundant due to wide disparities in valuations, earnings prospects and the quality of balance sheets. This is a promising backdrop for bottom-up investors.

What is your take on reforms in India?

Investors have largely focused on the slow-moving big ticket reforms such as a national goods and services tax and the Land Acquisition Act, which aims to make it easier for the government and business to buy private land. But we are encouraged by the strong resolve the government has shown by implementing reform in other areas aimed at creating a structure for long-term sustainable growth. I think these are critical to improving the investment climate in the country.

Examples of such reforms include cleaning up of government-owned bank balance sheets. While this slows credit growth in the short term, this improvement will provide a solid platform for better capital allocation to sustain growth for a longer term. The government is simplifying approval processes, reducing bureaucratic hurdles, scrapping outdated laws and speeding up investment clearances, which makes it easier to do business. Also, there are reforms being made within the power sector, to labour laws and with regards to infrastructure development.

Could you elaborate on the earnings cycle and valuations?

The recovery in earnings was delayed by about six to nine months because the materials sector was hit by low commodity prices, rural demand slowed due to two consecutive weak monsoons and companies held back their capital expenditure due to tighter lending standards.

However, there are now signs that earnings may be bottoming out on an absolute basis. They are likely to pick up from the current low levels as the economy accelerates and more reforms are implemented.

History shows that the equity market usually underestimates earnings capacity during cyclical upturns. Given that earnings growth expectations are at low levels, there is a high probability of upward revisions as earnings growth accelerates.

How do you assess recent performance and where are you finding investment opportunities?

The fund has been able to outperform the MSCI India Index in 2015, primarily driven by stock selection. The strategy to stay with high-quality growth stocks, characterised by their a higher returns on equity and free cash flows and lower debt, has helped the fund as these stocks did better than high beta, leveraged stocks.

For instance, our holdings in the high-quality private sector banks and discretionary companies and our strategy to avoid stressed balance sheets and capital-starved cyclical businesses have helped us strongly outperform the index.

However, our limited exposure to medium- and smaller-sized companies has held back the fund’s absolute returns. Notably, the small caps have continued to extend their outperformance over the large caps for the second year in a row. For instance, while our holding in the larger and stronger private sector banks has enhanced relative returns, some of the smaller private banks have done even better.

Our stock-selection process takes into account the upside and downside risk profile and we will continue to look for long-term value-creating businesses that are available at reasonable value. At the sector level, the private sector banks look more attractive as they take market share from the public sector. The under-penetrated industries, such as consumer companies, look attractive due to their long runway of growth. In addition, I am finding opportunities in sectors that benefit from a rise in capital expenditure.

Can you give us some stocks examples?

Within the banking sector, the fund has a high-conviction stake in HDFC Bank. It has an excellent management team, a strong balance sheet, the lowest cost of funds and best-in-industry asset quality. The bank has invested in expanding its retail branch network and in upgrading its technology platform to boost its online presence. Moreover, it is comfortably capitalised to fund future growth.

The fund recently initiated a position in India’s second-largest electrical-goods company, Havells India. The company has a strong brand and extensive distribution network in India that helps reap the benefits from rising demand. After the sale of its lower-margin business, what remains is a high-quality portfolio business that yields high returns on capital and generates strong free cash flows.

Elsewhere, the fund holds a high-conviction stake in Power Grid, India’s central transmission utility. Being government-owned, it is a regulated monopoly business with high assured returns and low operation risks. Power Grid has a strong record of implementing projects well and it continues to win government projects.

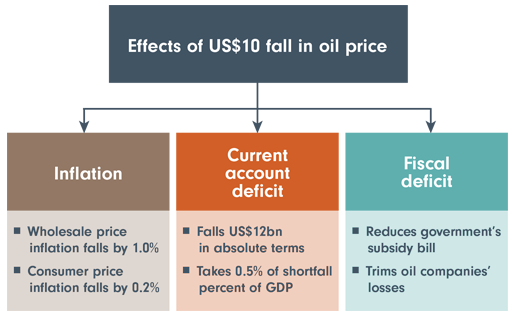

Benefits of lower oil prices on India's economy

Source: Motilal Oswal Research. January 2016

Financial information comes from Bloomberg unless stated otherwise.

Important information

References to specific securities should not be taken as recommendations.

Investments in small and emerging markets can be more volatile than investments in developed markets.

Investments in overseas markets can be affected by currency exchange and this may affect the value of your investment.