For some time, we have held the view that a weakening growth outlook and labour market picture was yet to be priced into markets. As a result, across our global and US aggregate bond portfolios we felt that government bond yields across developed markets (DM) offered significant value and so have had a high relative exposure to USD, GBP and EUR duration. We have also been defensively positioned within credit markets with a tilt towards high-quality issuers and shorter-dated paper.

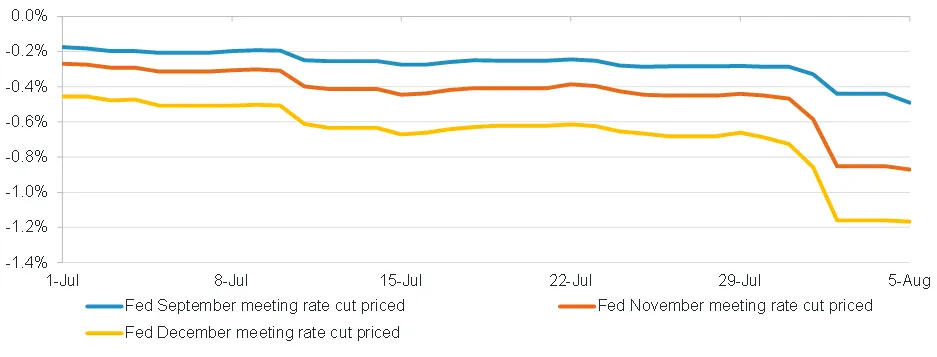

Over the last several days we have seen large moves across global markets. Though softer economic data had already prompted a slight fall in DM government bond yields in July, on the last day of the month a dovish US Federal Reserve (Fed) chair, Powell, galvanised sentiment that substantial cuts to policy rates would be coming much sooner than the market was currently pricing. A weak non-farm payrolls (NFP) print combined with an uptick in the unemployment rate accelerated this pricing further as risk-off sentiment increased across both equity and fixed income markets. While this has played out well in terms of our overall positioning, we have naturally been assessing if these moves are justified.

Markets have swiftly re-evaluated rate cut expectations on the back of weaker data

Source: Fidelity International, Bloomberg, 5 August 2024.

Views on rate market moves

Inflation is now firmly out of the picture with all eyes on the labour market and how it will influence the US Federal Reserve (Fed)’s decision making in upcoming meetings. For us, the details of the recent and future labour market data prints will be crucial, and we are looking to where we see risks to consensus views.

Economists are noting that the Sahm rule* is now indicative of a recession. Historically, the Sahm rule is triggered upon widespread job losses across a range of sectors. These losses then cause a reduction in consumption and fuel further job losses as a result. In contrast, what we have seen recently is more entrants to the labour market contributing to a spike in the unemployment rate. Initial jobless claims are still much lower and consumption much higher than previous periods where the Sahm rule has been triggered.

That being said, we are beginning to see more traditional trends emerge. Intel’s recent announcement on cutting 15% of its workforce indicates that entities might be moving away from the labour hoarding they’ve been conducting. Should this strategy become more widespread the supply-demand balance will continue to be tipped further over the edge, prompting a rise in unemployment.

Our long duration position has been built on the view that the Fed need to move 6-12 months ahead of a slowdown; leading indicators were suggesting that they need to act sooner rather than later. What has now been priced into markets is more representative of how we feel the Fed need to adjust policy rates to prevent a broader slowdown. We are therefore yet to adjust our duration positioning on the back of recent moves.

Though high conviction, we had previously kept our US duration position smaller in size, cognisant of upside risks to US Treasury yields on the back of the US election. Where Trump was once the base case and aggressive fiscal policy a concern in the event of a Trump victory, things are changing quickly in the US political sphere. Kamala Harris has moved to a much more competitive position in the polls, meaning upside risk to US long-end Treasuries has been reduced, in our view. The next initial jobless claims print will be key for us to gauge if labour market weakness is as widespread as recent payrolls and unemployment data suggests. Should it support the recent NFP print, there could be more to price in for the Fed. Conversely, a low trend value could suggest that the moves in US yields are overdone and we will likely adjust our duration positioning accordingly.

*This is when the three-month moving average of the national unemployment rate exceeds the lowest three-month moving average unemployment rate from the previous 12 months by more than 0.5%.

Views on credit market moves

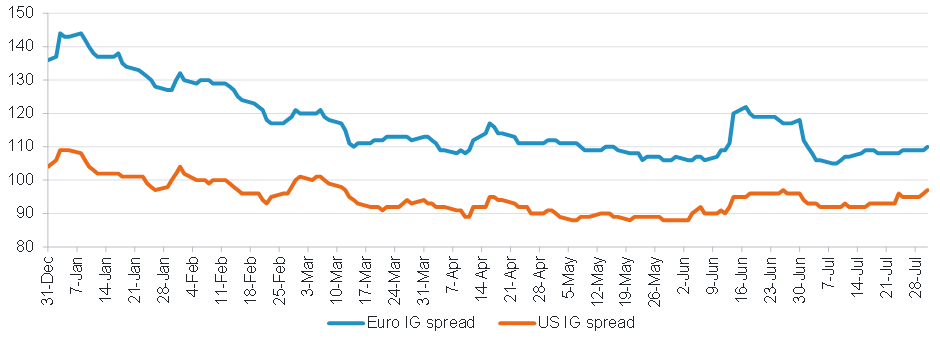

Credit spreads in both US and Euro IG have both moved wider in amidst volatility, primarily on the back of the rally in rates rather than a function of aggressive outflows from the asset class. While we have seen some value created in credit spreads, we do not feel that this is an ‘all in’ buying opportunity. To put the moves into perspective, current Euro IG spreads are still tighter than levels seen in June when the French snap election call induced widening. We are, however, selectively adding to areas of the market that have underperformed. At time of writing, in IG this underperformance has been seen in 4 key areas: emerging market sovereigns, autos, 3-5-year callable paper and names that have recently been upgraded to IG from HY. We have selectively deployed risk into the latter bucket and are looking at opportunities within callable paper and EM sovereigns. Should we see further pressure on credit spreads, we may look to add risk in larger sizes.

Credit spreads remain tight when looking at YTD ranges

Source: Fidelity International, Bloomberg, 2 August 2024.