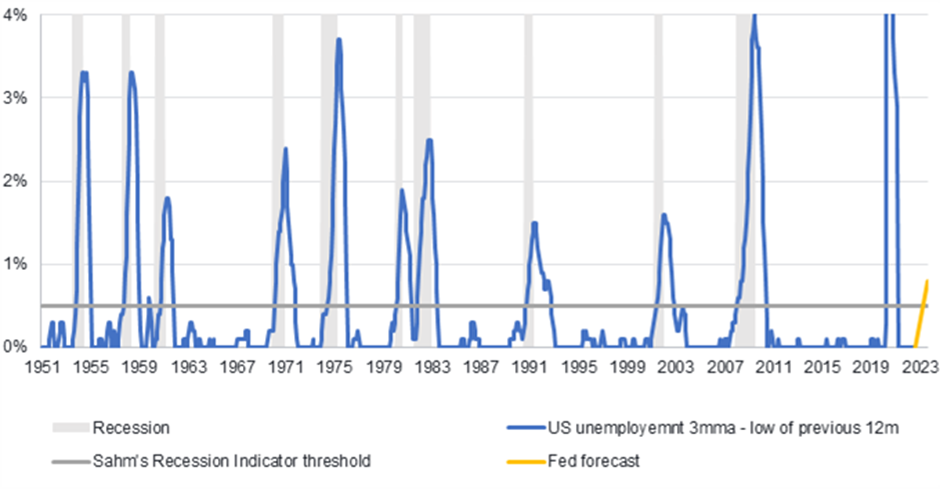

The US Federal Reserve (Fed) has revised up its unemployment estimates, bringing them closer into line with our own. It now expects US unemployment to rise by 0.7% next year. Every time unemployment has risen that fast in the last 70 years, the US has entered a recession.

Source: Bloomberg, St. Louis Fed, Fidelity International, September 2022

Last week, the Fed once again hiked US interest rates by 75bps to combat the highest inflation rate in 40 years and looks set to hike until the economy shows visible signs of weakening. Fed officials also released a series of gloomy economic forecasts predicting higher inflation, higher rates and higher unemployment than previously thought.

For now, the US labour market is still strong. But the latest Fed estimates for US unemployment are finally moving closer to our own, calibrated using our activity trackers. If our US activity trackers remain where they are now, it implies an unemployment rate of 4% by mid-2023, compared to the new median Federal Open Market Committee (FOMC) prediction of 4.4% by the end of 2023 and a current rate of 3.7%. Although 4.4% would still be fairly low by historical standards, the speed of change would be dramatic. In fact, since 1950, every time the 3-month moving average unemployment rate rose by more than 0.5% from the previous 12 months low, the US entered a recession. This relationship is known as ’Sahm’s Recession Indicator’.

So, the Fed’s own forecasts, if correct, now match ours by indicating a high likelihood of a US recession. This has been one of key reasons why a hard landing in the US has been our base case since June.

Despite this, risk assets do not appear to be accurately reflecting this growing risk, which suggests there could be more downside to come. The outlook might be shaky for the US, but the situation in Europe and the UK looks even more precarious.