China is transitioning to a new growth model, and the recent structural reforms, particularly in the property sector, have increased macroeconomic uncertainty and contributed to a challenging period for the country’s equity markets.

The ongoing structural headwinds may keep volatility elevated for some time, however we believe an allocation to Chinese equities is still worthy of consideration for several reasons, including attractive valuations, a stabilising macroeconomic backdrop, and solid company earnings.

China’s economic strategy has changed significantly in the past few years. The country had previously relied on real estate and growing debt to fund its growth. However, policymakers have committed to a new ‘high-quality growth’ approach revolving around consumption and industrial production.

The transition has not been smooth. The Covid pandemic and global geopolitics have strained the economy, while investment in manufacturing without waiting for demand to increase has led to overproduction that has depressed prices. After a spurt of activity following the removal of Covid lockdown restrictions, China’s economic performance has been disappointing, sentiment is low, and asset prices have reflected this.

We believe the Chinese economy is in a period of ‘controlled stabilisation’, where GDP will be relatively stable at 4-5%, while the government continues to address structural issues. This is likely to include the use of counter-cyclical policy

measures in a targeted and restrained way to facilitate long-term growth objectives.

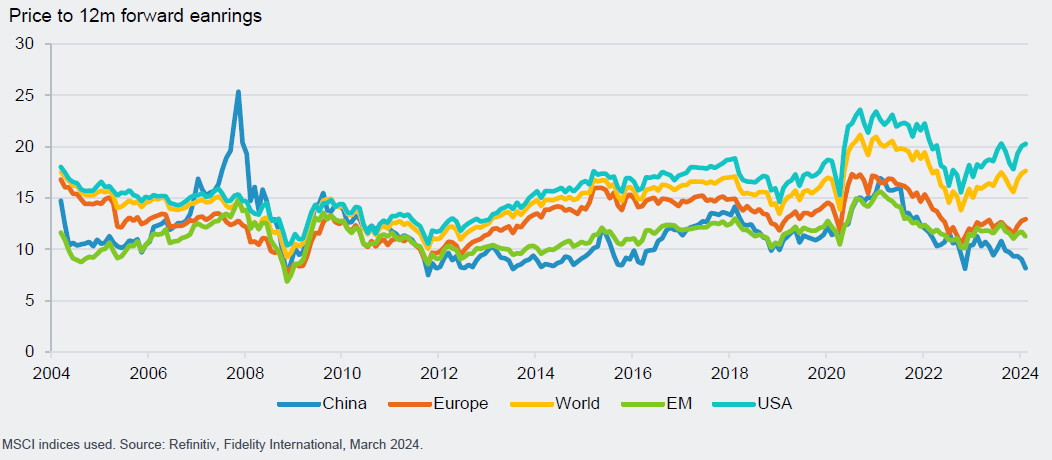

Chart 1: Chinese equity valuations are attractive compared to other regions

Cautiously optimistic about near-term outlook

Despite the well-known challenges, we are cautiously optimistic about Chinese equities for a number of reasons. First, valuations are very attractive, both compared to other regions and to the Chinese equity market’s historical average. This allows investors to gain access to future earnings at a discounted price, which tends to lead to better long-term returns.

Second, the macroeconomic backdrop in China has stabilised, but sentiment has not fully reflected this yet. Granted, many indicators are still at depressed levels, but enough are improving to suggest that conditions are unlikely to deteriorate materially and could get better. This is reenforced by our belief that both monetary and fiscal policy will be supportive at the margin. Our expected scenario of ‘controlled stabilisation’ may not involve large stimulus to juice growth, but we do believe policymakers will act to backstop economic activity if it weakens.

Third, company earnings still look solid. The recent weakness in Chinese equities was caused by investors revaluating how much they were willing to pay for earnings, rather than lower earnings overall. In fact, forecasts for company earnings over the coming 12-months have risen slightly this year. Most sectors have positive earnings momentum, baring financials, and there are tentative signs that sentiment may be improving - we’re starting to see companies that beat earnings being rewarded after many months of market indifference to positive news.

Finally, positioning among international investors is low. Global active funds currently have their lowest allocations to Chinese equities in the last decade, while hedge fund positioning has dropped from the 90th percentile to the 7th in the last 12 months. This is perhaps understandable given recent market conditions, but it does highlight the amount of money currently on the slide lines that could flow back into Chinese equities when sentiment and macroeconomic news becomes more positive in earnest.

Investing in Chinese equities is not without risks though. The property sector is a drag on an economy still struggling to get to grips with a new approach to growth. Furthermore, unemployment, especially for the young, is too high. Finally deflation is a real risk in China that we will be monitoring closely. Our stance is one of cautious optimism, and any allocations should reflect this with appropriate sizing. The potential returns on offer are attractive, but investors should be mindful that more short-term volatility is possible.

Long-term case for Chinese equities still strong

If the economic reforms have made China’s immediate future harder to predict, the long-term ambition of a manufacturing powerhouse with a thriving middle class is now clearer.

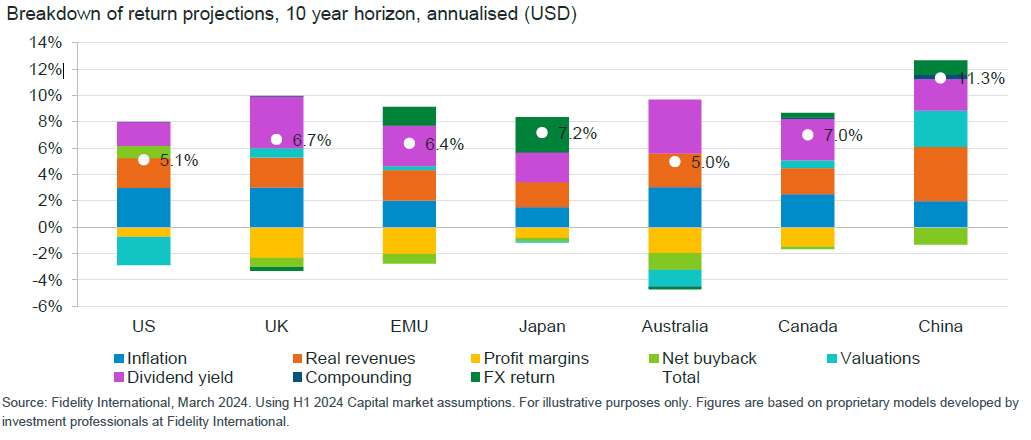

Chart 2: We expect Chinese equities to outperform other regions over the next 10 years

China’s place in the world is also shifting. Although concerns about the West and China diverging make headlines, China is in fact becoming an ever more important part of global supply chains. China is increasingly exporting components to be assembled in countries with cheaper labour, rather than finished products. Strategic investment in emerging sectors such as AI and electric vehicles should see China at the forefront of several structural trends over the coming decades.

As Chart 2 shows, we expect Chinese equities to return the most of any major region over the next 10-years by a wide margin, driven by attractive starting valuations and real revenue growth. To address concerns about potentially higher volatility and uncertainty of the Chinese equity market, we stress-tested the following scenario: government intervention is insufficient to address structural growth problems and investor confidence fails to improve.

In this scenario we assumed China’s real GDP would fall to 2.5% a year on average (from our current expectation of 4%) and valuations would only contribute 1% to returns (down from the 2.7% we currently expect). Overall, this would reduce our expectations for Chinese equities total return to 8.1% from 11.3% per year over the next 10 years. So even in this scenario, Chinese equities would still be relatively attractive to those of developed markets.

Still reasons to consider a Chinese equity allocation

China appears to be at a long-term inflection point as it transitions away from the engines of growth that have driven it for the past few decades to a more sustainable ‘high-quality growth’ model. In the short-term, a combination of stabilising fundamentals and attractive valuations give investors enough reason to consider an allocation to Chinese equities.

Over a longer horizon, we believe China will remain an important cog in the global economy. Investors should bear in mind that China’s equity market can be more volatile than other major regions and allocation decisions should reflect this. However, even in a relatively negative scenario, Chinese equities appear to offer attractive return compared to other regions over the long run.