Ultra-long bonds - with a maturity of more than 10 years - used to be one of the dullest securities in China’s debt market, purchased simply to be owned until maturity. But in 2024, investing in 30-year government bonds has become a hot trade in the secondary market.

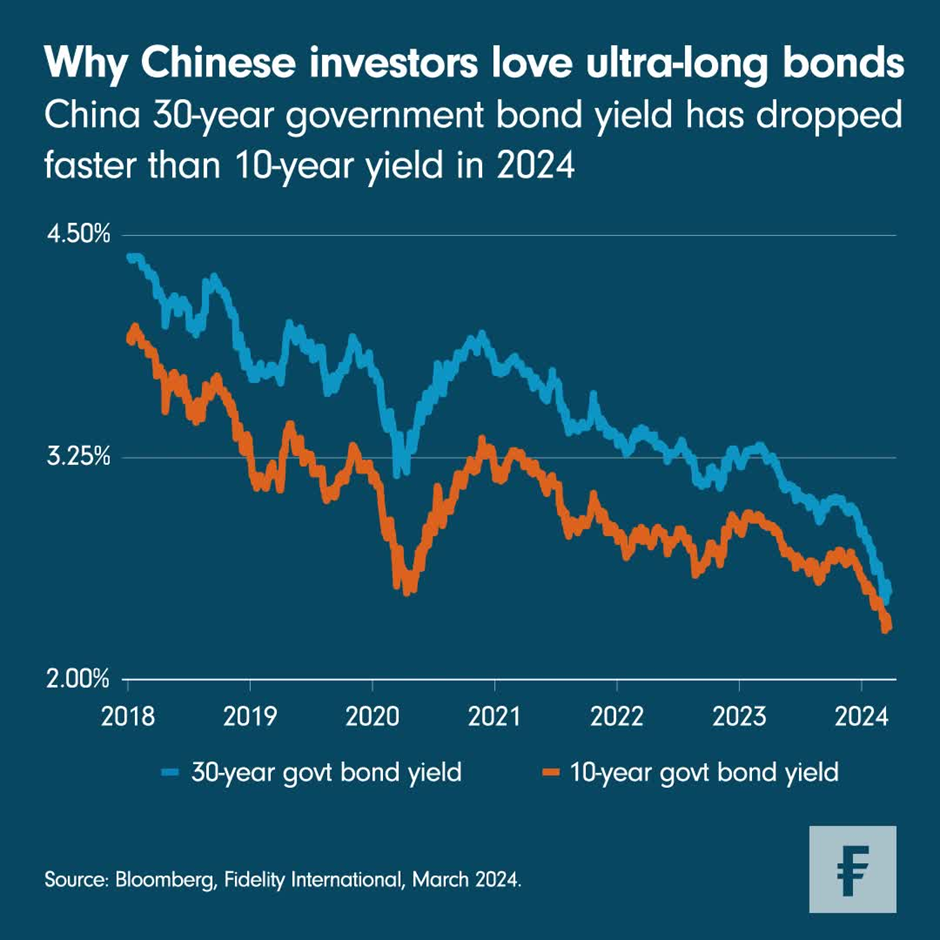

This week’s Chart Room shows robust demand is driving the yield on 30-year bonds to fall to its lowest level in 19 years. The yield gap between 10-year and 30-year government bonds narrowed to just 12 basis points at the start of March.

The rally is in large part a result of investors’ hunt for relatively higher returns as bond yields across the curve have plummeted. The weak demand for loans and the steady growth in deposits are seeing banks, the biggest investors in China’s debt market, pour money into bonds. On the other hand, the property market (traditionally the asset class of choice for Chinese investors) is yet to stabilise, the stock market remains volatile, and cross-border capital restrictions stop domestic investors from looking elsewhere for better returns.

The flattening of the curve also reflects investors’ expectations that China’s recovery will take some time as the government refrains from resorting to large-scale stimulus. Chinese policymakers may need aggressive monetary stimulus to achieve the ambitious 5 per cent growth target for 2024.

With expectations that China’s central bank will cut interest rates - likely after the Federal Reserve pivots - there is a desire also to lock in higher yields. The wide US-China interest rate differential limits the PBoC’s scope for easing, but it will have more room to manoeuvre after the Fed starts cutting.

As China plans to issue 1trn RMB (US$139bn) of ultra-long government bonds this year, there may be short-term fluctuations on the longer end of the yield curve. But since the country’s economic recovery may be slow and bumpy, the bond boom is likely to continue.