From time to time, investment markets go through periods of uncertainty.

This could be due some poor economic news, a political crisis, something affecting a particular industry sector, or changes in government policy.

The sharp falls that can be experienced at such times are understandably unsettling for investors. They can even tempt some to change their long-term plan by selling their investments.

However, market volatility does tend to be short-lived. Here are some reasons why doing nothing may often be best during times of volatility.

1. Emotions can lead you astray

When you see a sudden change in the stock market, you might feel tempted to rush into buying or selling stocks, either to ride a wave of growth or minimise losses.

However, instinctive reactions don’t always make for sound financial decisions. By acting too quickly you’re more likely to make costly mistakes, like selling low or buying too high.

It’s important to keep a cool head when the market is volatile and avoid being distracted by your emotions.

2. A stop/start approach is a lose-lose

One of the key principles of long-term investing is to stay invested, especially during times when investing can feel like a rollercoaster ride.

When markets are going up and down, spotting an opportunity and buying more during a correction is one thing, but jumping in and out of the market should generally be avoided.

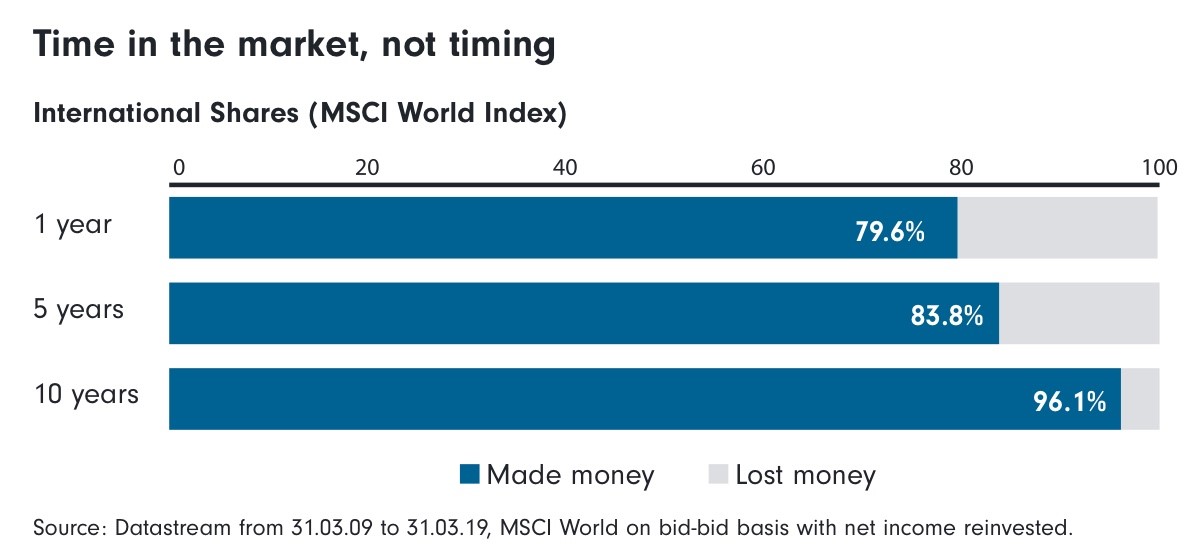

History shows that sharp falls in stock markets tend to be concentrated in short periods of time. Similarly, the biggest gains are often clustered together, and it is quite common for a large gain to follow a big fall (or vice versa).

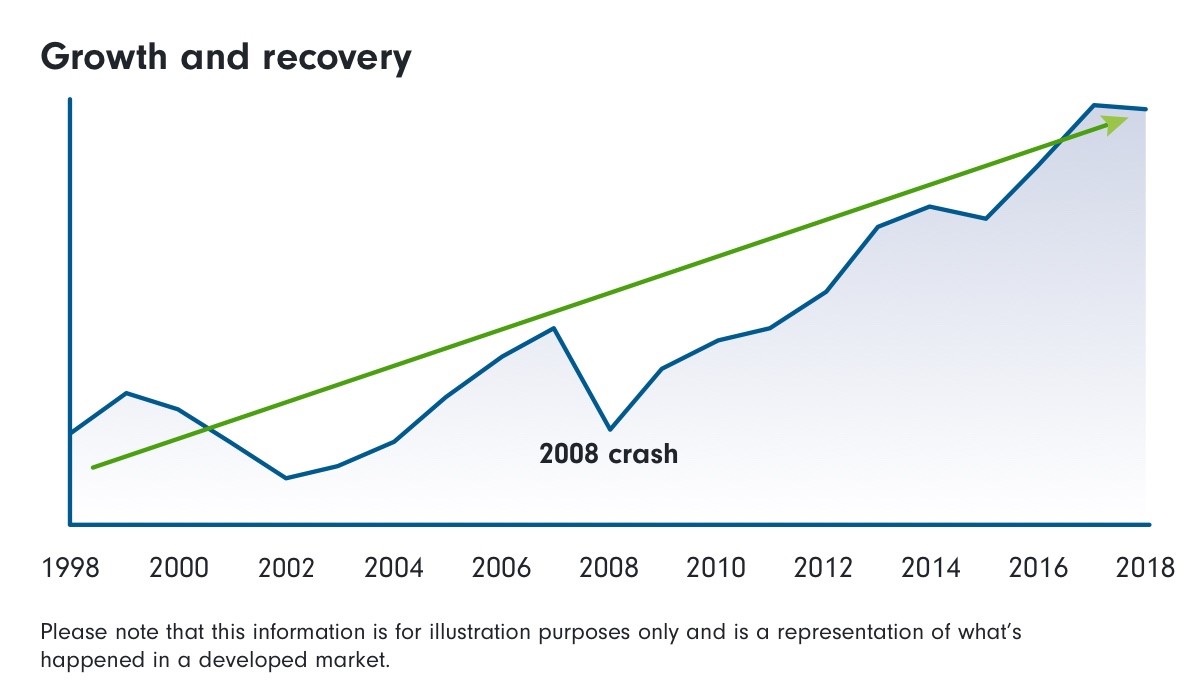

While most markets will experience periods of short-term volatility, over the long-term they generally maintain a steady, upwards path.

And those investors who remain invested will benefit the most from these long-term upward trends.

By moving too quickly to sell assets, you may run the risk of missing out on seeing your portfolio recover from falls, and even grow in value. Missing the best recovery and performance dates in the market can have a significant impact on your long-term return.

Though past performance is not a guide to the future, staying invested can be a way to capture as much growth from the market as possible.

3. Reap the benefits of dollar-cost averaging

Irrespective of your time horizon, it can make sense to invest a certain amount of money, an approach known as ‘dollar cost averaging’.

While it doesn’t promise a profit or protect against a market downturn, it does help you to reduce the risk of investing at a single point in time.

And although regular investing during a falling market may seem counter-intuitive to investors looking to limit their losses, it is precisely at this time when some of the best investments can be made, because asset prices are lower and will benefit from any market rebound.

If you would like to learn more, explore our other articles, videos and infographics about investing through volatility.