|

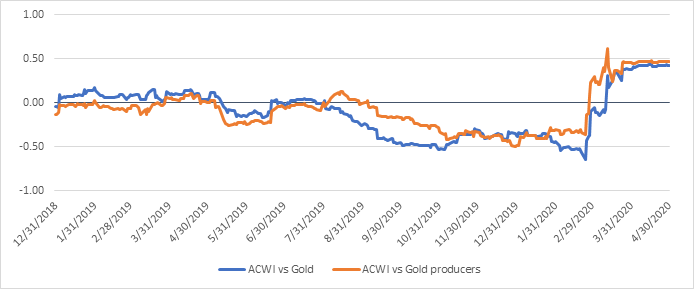

The gold price has risen 12% over 4 months, making the precious metal one of the best performing asset classes so far this year. Perhaps more interestingly, the correlation between gold and equities has turned positive for the first time since mid 2019, calling into question its diversification benefit in multi asset portfolios. However, we still like gold as a hedge against potential currency debasement in a world of expanding fiscal deficits and money supply. There is typically an inverse relationship between gold and equities, as gold is viewed as a safe-haven asset when equity markets fall. However, our chart of the week shows that correlation of the two asset’s returns has turned positive since the March selloff. The gold price fell in mid March together with the equity market, as liquidity in the financial system dried up and investors rushed for cash. In April, the gold price rallied together with equities as global central banks injected significant liquidity and pledged a ”whatever it takes” approach to maintaining healthy funding conditions across the economy. Gold and equities are usually positively correlated in market regimes driven by liquidity and changing real yields, which reflects the current environment to some extent. A positive correlation also means that the diversification benefit of holding gold might be lower. Having said that, we still hold a positive view on gold over the medium term as it can hedge against the potential risk of currency debasement given the significant scale of fiscal and monetary stimulus. It is also worth noting that returns from gold producers lagged those of physical gold in March, but recorded a sharp catch-up in April. This means they have now delivered a similar return as physical gold year-to-date. We stay invested in gold and gold producers in many of our multi asset portfolios.

Correlation of equity versus gold and gold producers - Rolling 60-day correlation |

|

|

|

Source: Fidelity International, Refinitive DataStream. 30 April 2020. Equity market is proxied with MSCI ACWI index. Gold is represented by gold bulion price. Gold producer is proxied with S&P Commodity Producers Gold index.

|

All information is current as at its published date unless otherwise stated. Not for use by or distribution to retail investors. Only available to a person who is a "wholesale client" under section 761G of the Corporations Act 2001 (Commonwealth of Australia) ("Corporations Act“).

This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL No. 409340 (‘Fidelity Australia’). Fidelity Australia is a member of the FIL Limited group of companies commonly known as Fidelity International. Prior to making any investment decision, investors should consider seeking independent legal, taxation, financial or other relevant professional advice. This document is intended as general information only and has been prepared without taking into account any person’s objectives, financial situation or needs. You should also consider the relevant Product Disclosure Statements (‘PDS’) for any Fidelity Australia product mentioned in this document before making any decision about whether to acquire the product. The PDS can be obtained by contacting Fidelity Australia on 1800 044 922 or by downloading it from our website at www.fidelity.com.au. The relevant Target Market Determination (TMD) is available via www.fidelity.com.au. This document may include general commentary on market activity, sector trends or other broad-based economic or political conditions that should not be taken as investment advice. Information stated about specific securities may change. Any reference to specific securities should not be taken as a recommendation to buy, sell or hold these securities. You should consider these matters and seeking professional advice before acting on any information. Any forward-looking statements, opinions, projections and estimates in this document may be based on market conditions, beliefs, expectations, assumptions, interpretations, circumstances and contingencies which can change without notice, and may not be correct. Any forward-looking statements are provided as a general guide only and there can be no assurance that actual results or outcomes will not be unfavourable, worse than or materially different to those indicated by these forward-looking statements. Any graphs, examples or case studies included are for illustrative purposes only and may be specific to the context and circumstances and based on specific factual and other assumptions. They are not and do not represent forecasts or guides regarding future returns or any other future matters and are not intended to be considered in a broader context. While the information contained in this document has been prepared with reasonable care, to the maximum extent permitted by law, no responsibility or liability is accepted for any errors or omissions or misstatements however caused. Past performance information provided in this document is not a reliable indicator of future performance. The document may not be reproduced, transmitted or otherwise made available without the prior written permission of Fidelity Australia. The issuer of Fidelity’s managed investment schemes is Fidelity Australia.

© 2025 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited.