A growing number of young Asians have been taking to social media to debate how to live more sustainably. In China, a discussion group titled “Leaving No Trace” on Douban, a social network platform popular among young Chinese, has attracted more than 40,000 members. Tips are traded on reducing carbon footprints such as turning old jeans into chic denim bags, using worms to make fertiliser out of food waste, or bringing reusable cups and straws to enjoy bubble tea – a favorite drink among young people in Asia.

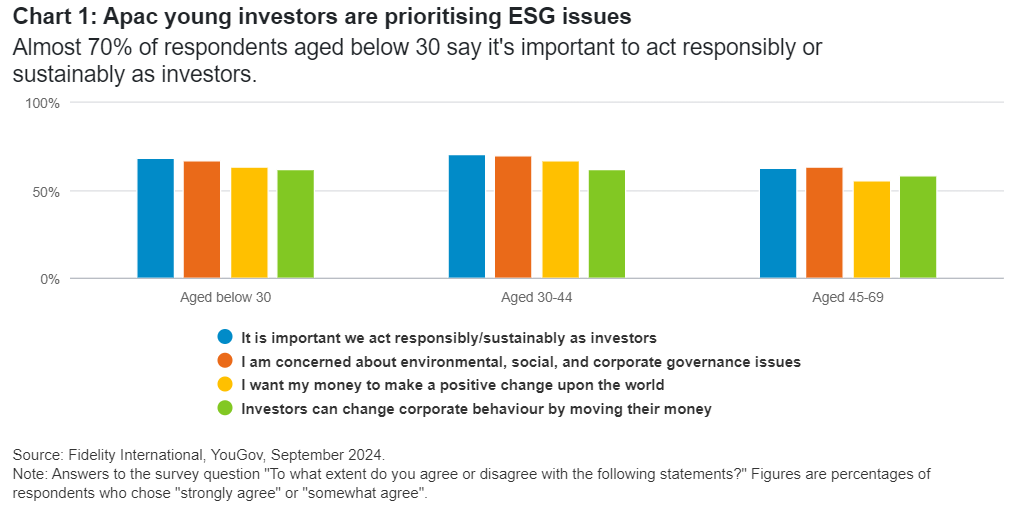

The eco-conscious youth are not only seeking to build sustainability into their daily lives. They’re demanding investment portfolios do the same too. According to a 2024 survey by Fidelity International and YouGov, close to 70 per cent of Asia Pacific youngsters aged below 30 say it’s important to act responsibly or sustainably as investors – keeping up a trend set by millennials (30-44 years).1 The survey also shows both cohorts to be equally optimistic about the power of investing to make a positive impact on the world.2

Greater transparency, clearer pathways

Most of the world’s emissions come from Asia, where robust economic growth has only increased the region’s carbon footprint. Channeling funds to local companies that take the lead in the energy transition could have enormous consequences for the fight against climate change.

Encouragingly, regulatory regimes are growing more supportive of the type of sustainable investing that drives capital to these companies – and ensures they are using the money wisely. Most notably, mandatory ESG reporting frameworks are starting to replace voluntary ones across the region. Mainland China introduced guidelines that require some 400 listed companies to publish sustainability reports by 2026.3 It will be mandatory for listed companies in Singapore and Hong Kong to make climate-related disclosures from 2025.4 Greater transparency helps paint a clearer picture for investors about what companies are doing on the ground.

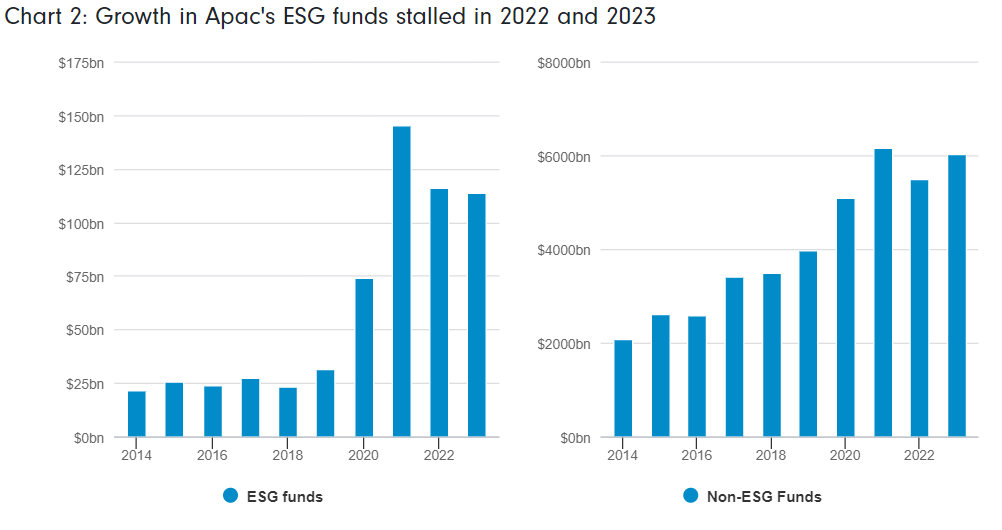

The first stages of the ESG revolution led to an almost sevenfold jump in Apac’s ESG funds between 2014 and 2021, from USD $21.4 billion to $145bn.5 That was of course still a very small proportion of investors’ overall capital, but represented a much faster expansion than that of non-ESG funds, which only tripled during the same period. Weak performance of ESG-focused portfolios, coupled with concerns about geopolitics and greenwashing, led to a 22 per cent drop in ESG funds in the two years that followed.

Source: Morningstar Direct, Fidelity International, September 2024. Note: Data includes both ETFs and mutual funds, covering seven markets, Australia, mainland China, Hong Kong, Japan, Singapore, South Korea, and Taiwan. ESG funds are defined as Morningstar Sustainable Funds.

Green gold

Despite the decline, we see strong growth potential for ESG investors in Asia over the long run. The region is home to the world’s leading manufacturers of electric vehicles, solar panels, and critical components of green technologies, with many high-emitting companies progressively replacing coal-fired power plants with clean energy sources. As investment in the energy transition builds and environmental awareness pushes changes in consumer behaviour, avenues of growth available to these companies will multiply.

Meanwhile, substantive changes in corporate governance are underway in Asia. More effective board structures and greater diversity at the most senior levels will bolster oversight and protection of a broader group of stakeholders, including minority interests. We expect Asian companies to manage ESG risks better as a result – including a prioritisation of long-term over short-term targets. Those that do are more likely to create value for investors through resilient growth. And over the medium to long term, this should improve the risk- reward equation for ESG investors.

There is still a long road ahead for sustainable investing in Asia. The total size of associated assets is tiny compared to the entire fund universe in the region. And there remains plenty of room for Asian regulators to do more to weed out greenwashing. Young Asians for one are unlikely to stand for it. After all, there’s more to protecting the planet than old jeans and bubble tea.

Asia leads in transition bondsAsian issuers dominate the nascent market in transition bonds, an investment vehicle designed to fund activities or projects that reduce greenhouse gas emissions from heavy-emitting industries, such as steel, cement, and petrochemicals. Total issuance may be a drop in the global fixed income ocean, but of the USD $32.2 billion of outstanding transition bonds worldwide, 78 per cent were sold by Japanese, Hong Kong, and mainland Chinese issuers.1 Japan issued the world’s first sovereign transition bond in February 2024 to fund projects such as exploring hydrogen technologies for steelmaking and fuel-cell batteries, and promoting production of clean-energy cars.2 The issuance was part of its plan to raise up to ¥20 trillion (USD $139bn) via transition bond sales over the next decade. Why AsiaThe rise of this debt instrument is first and foremost a result of the increasing demand for transition finance in a region that is still heavily dependent on fossil fuels but needs to achieve both economic development and decarbonisation. The average age of coal-powered plants in China and India is just 13 years, compared to 34 in Europe and 41 in the US.3 A managed early retirement of young coal plants and a transition of the energy system are critical in Asia, especially given the ongoing strong growth in power demand on the back of robust economic expansion. With ‘green’ debt instruments typically channelling capital to projects or companies that already have a low-carbon footprint, there is a gap for a funding mechanism that supports companies’ or their activities’ incremental progress towards decarbonisation. As a result, Asia has provided considerable support for transition taxonomies and government policies, all of which is aiding growth in transition bonds. What nextMore needs to be done to boost the appeal of the asset class. First, the market needs a well-established cross-border taxonomy to define the environmental outcomes that eligible projects should generate. The absence of clear, consistent, universally accepted standards for the transition is the biggest hurdle for investors. Second, issuers should communicate clearly how proceeds will be used; how a bond contributes to climate change goals and forms part of a broader transition plan. Reliable data collection and transparent reporting would help alleviate greenwashing concerns and bolster investors’ confidence in this relatively new type of debt. Finally, clear national transition plans and associated policy initiatives can help provide more certainty for long-dated capital expenditure in the move towards a low-carbon economy, which could drive further growth in transition finance. The big changes that Asia’s heavy emitters need to make require stable and long-term funding. As the pressure to decarbonise intensifies, issuance of transition bonds is likely to pick up. This small corner of the sustainable debt market will have its moment, and most likely in the not-too-distant future. Vanessa Chan, Head of Asian Fixed Income Investment Directing and Gabriel Wilson-Otto Head of Sustainable Investing Strategy. 1 According to Bloomberg data. |

1 68 per cent of respondents under 30, 70 per cent of respondents aged 30-44, and 62 per cent of respondents aged 45-69 say it’s important to act responsibly or sustainably as investors.

2 The survey was conducted by YouGov in six markets in May 2024 and published in July. A total of 6,515 respondents, aged between 18 and 69, participated in the survey.

4 More Singapore businesses will have to report sustainability information, starting with listed firms in 2025 - CNA (channelnewsasia.com)

Hong Kong Exchange to Require IFRS-based Climate Disclosure Beginning 2025 - ESG Today

5 According to Morningstar Direct data.