1. What is your investment outlook for Australian Equities in 2019?

2019 is increasingly looking like a rocky swell of negative sentiment driven by fear about the next phase in markets and high asset valuations after a solid nine years of upward market trends and record low interest rates.

In Australia, “the lucky country”, we have been blessed with 103 quarters since the last technical recession. While economic indicators remain strong, concerns about the next few years are growing. This has been fuelled by headlines reminding us of falling residential house prices and the associated negative wealth effect on the $6.9 trillion of residential property value.

Adding to concerns has been lower credit growth and softer retail sales. Higher regulation and behavioural scrutiny is occurring across many industries including finance, energy retailing and aged care. These factors are affecting many companies in the small cap universe, mainly in the slowing consumer cycle (Motorcycle holdings, Automotive holdings, Michael Hill, Myer, Autosports and Nick Scali) as well as regulation impacts (Aveo, Estia, Japara, Regis, Challenger, IOOF, Clearview and Eclipx.) Construction is also slowing down and having an effect on share prices (CSR, Fletcher Building, Dulux, Boral and Reece Plumbing).

Globally, caution is also growing from slowing growth in China and trade war headlines. This is affecting sentiment and earnings expectations of small cap resources in steel, copper, coal and consumer exporters such as infant formula names A2 milk and Bellamy. Financial markets have reacted to rising bond yields and the rising cost of risk, calling for “the end of easy money and debt fuelled carry trades”. Slower secondary raisings and small cap IPO markets are quite evident.

2. What do you think could surprise investors next year?

If governments globally trend toward an interest rate rise pause, growth stocks as well as long duration yield will likely perform well as yield and growth become scarce.

Watching markets over decades you see a pattern of scarcity and abundance of capital, risk taking, credit availability and growth. In pricing these trends there are shifts in earnings, sentiment, momentum and valuations that can swing wildly with fear and greed.

We are witnessing many late cycle signals, yet the benefit of widespread caution from companies, government and individuals is that we are unlikely to be facing a sustained economic downturn.

3. How do you plan to capture the best opportunities?

What 20 years in the market has taught me is that there is a close relationship between total returns (share price movements plus dividends) and returns on capital (return on equity used as a proxy). Keep this in mind when reflecting on market volatility and how you should construct a portfolio as well as trying to avoid the noise from headlines.

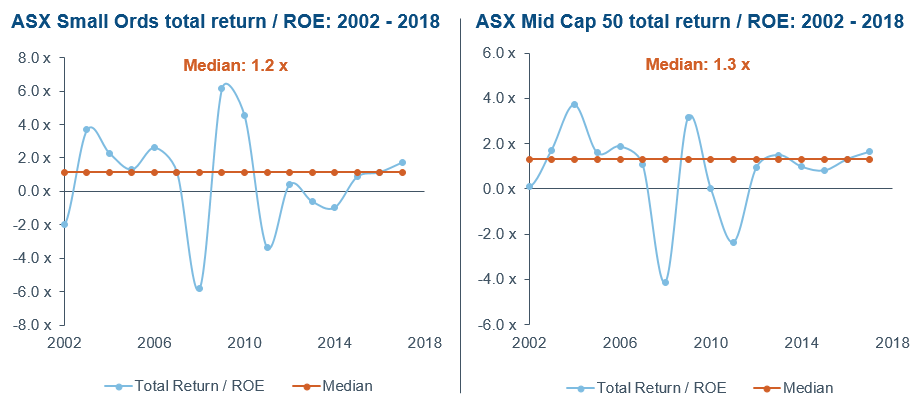

The 16-year charts of the small ordinaries and the mid cap 50 show the swing around total return to return on capital can move from 6 times to minus 6 times. However, in the long run, there is a strong correlation between total returns and returns on capital.

Source: FactSet, August 2018. ROE = Return on Equity

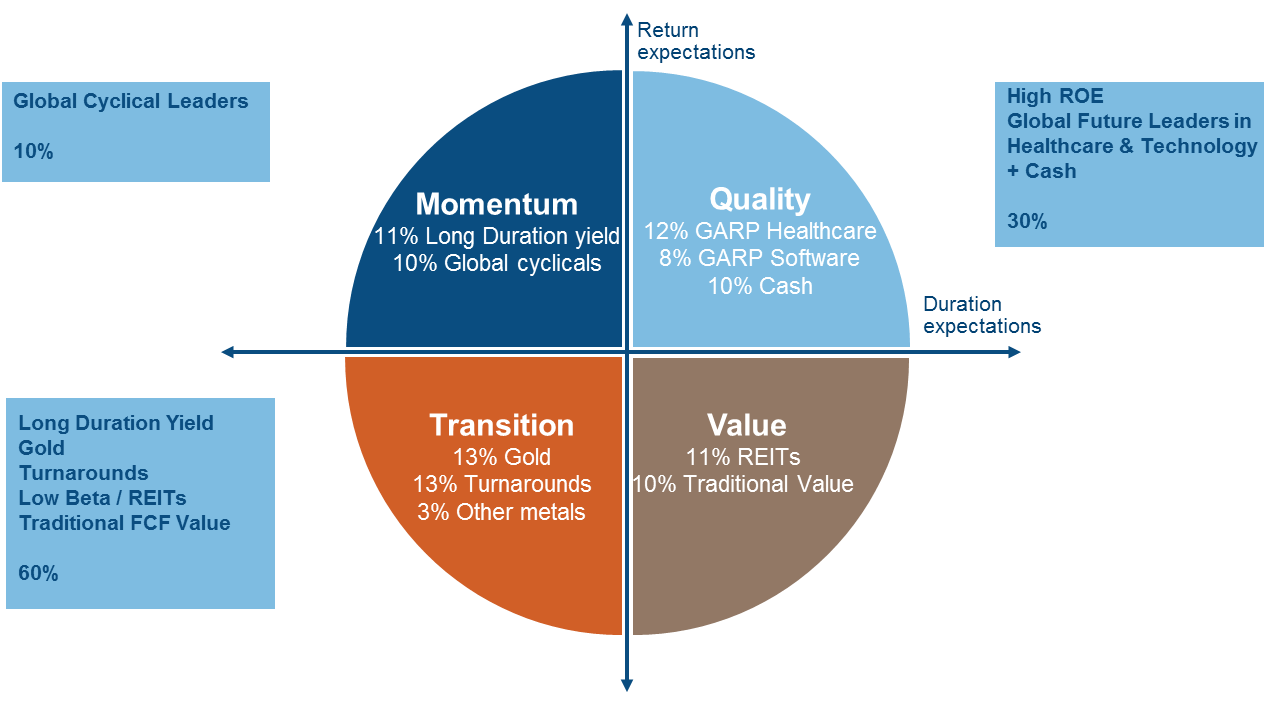

Portfolio construction for 2019 remains as always in the context of the QMTV structure.

Cash provides optionality, value (sustainable free cash flow yield businesses) and growth at reasonable price (GARP) provides valuation protection through yield or growth support; turnaround stocks or gold provides a lower leverage to the softening economic cycle while investors should be very cautious of momentum businesses that rely on equity or debt market liquidity and valuation speculation.

Source: Fidelity International. Stock categories are defined as per the Portfolio Manager’s investment philosophy.

We are witnessing many late cycle signals, yet the benefit of widespread caution from companies, government and individuals is that we are unlikely to be facing a sustained economic downturn.