In an inflationary economic environment, investors will be thinking about how to protect their purchasing power as the cost of living rises. There are many ways investors can capture growth by investing internationally.

The Covid pandemic accelerated growth across existing themes and sectors such as digital transformation, online retail and cloud technology but there are also underlying structural growth themes globally, such as demographics and environmental, social and governance (ESG) obligations, underpinning the success of select companies and the countries and regions where they operate.

Demographics point to an age of prosperity for Asia

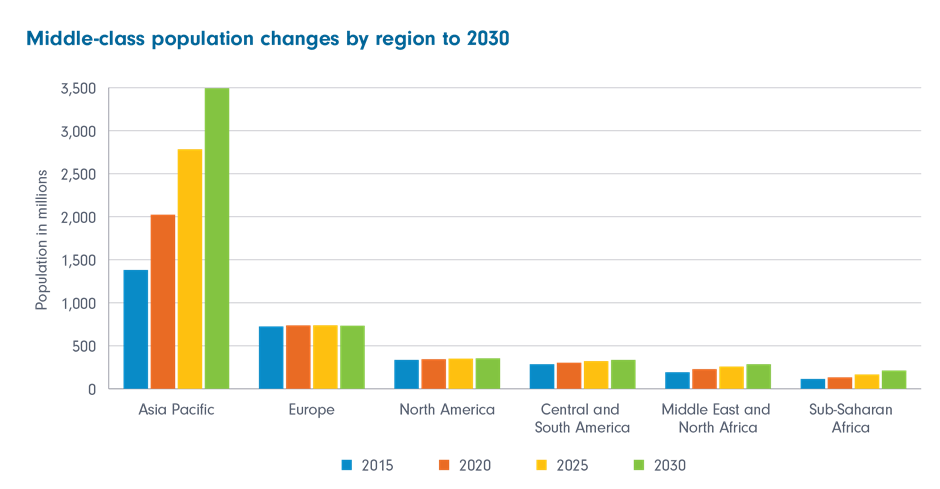

A macroeconomic growth factor unchecked by Covid is the changing demographics of our world as a whole and regions within it. As the Figure below shows, the middle class in Asia has been growing rapidly over the past six years and is expected to grow well over three times the size of any other region by 2030.

Source: Statista, 2021 https://www.statista.com/statistics/255591/forecast-on-the-worldwide-middle-class-population-by-region/

A skew towards ageing populations is expected to drive the expansion of the healthcare sector in some countries. Rising demand for retail and leisure from a growing middle class and greater urbanisation can be expected in others.

We believe that investment opportunities arising from these transitions can be captured in a portfolio targeting companies with products and services that address these shifts in income, labour markets, consumption and more.

Emerging markets are the powerhouse for global growth

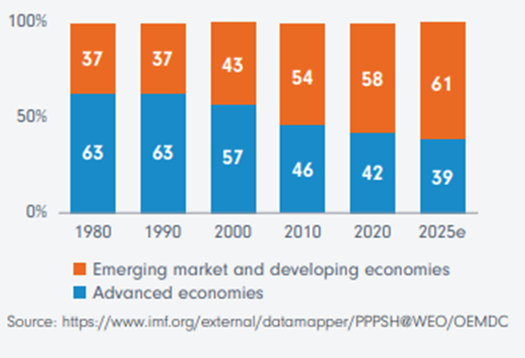

Today, emerging market (EM) economies account for a much higher percentage of global GDP than they have in the past. The IMF World Economic Outlook Database showed that in 1980, these nations had a combined GDP of less than half that of advanced economies. By 2010, the two were close to level. However, by 2025, it’s estimated that emerging economies will have an output that is larger than the developed world.

EM is a significant contributor to global GDP, yet is under-represented in global indices

In other words, it is anticipated that in the space of 45 years, EMs will have gone from a peripheral position in the world economy to a central one. Despite this, they still account for just a fraction of most Australian investment portfolios.

The road to transition

Another significant growth trend with a long tail, but a less predictable trajectory, is the transition to more sustainable and environmentally responsible economies and business models. Pressure on companies to better manage emissions and waste is coming from both consumers and governments.

In the European Union (EU), for example, legislation was introduced in 2018 aiming to recycle 70% of municipal waste and 80% of packaging waste by 2030. More recently, President Joe Biden signed The Inflation Reduction Act, his flagship climate and tax bill into law in August 2022. The Act is expected to raise US$737 billion, of which US$369 billion will be spent over the next decade on climate and energy programmes. It will extend tax credits for wind and solar and introduce new ones for nuclear power, energy storage, and hydrogen. It also includes tax credits for buying electric vehicles.

All this is welcome for climate investors; the legislation is expected to increase demand for quality investments in wind turbines, solar panels, power transmission, batteries and carbon capture storage. The growth in these technologies will also help create a virtuous cycle where scale and research and development should rise, leading to even better and more competitive solutions, and encourage more demand.

While many potential opportunities in sustainability will found here in Australia, the opportunity set outside Australia is vast and deep, particularly in the typically under-researched global small to mid- cap sector, companies that are often at the leading edge of innovation and growth.