According to Bloomberg, global oil prices have risen by the most on record after a strike on a Saudi Arabian oil facility. West Texas Intermediate (WTI, the benchmark in oil pricing) crude oil prices rose 11% to around US$60 a barrel, the highest price since May. Safe-haven assets like gold and US treasuries appreciated after the news broke, while the currencies of oil-linked nations like Canada and Norway also rose.

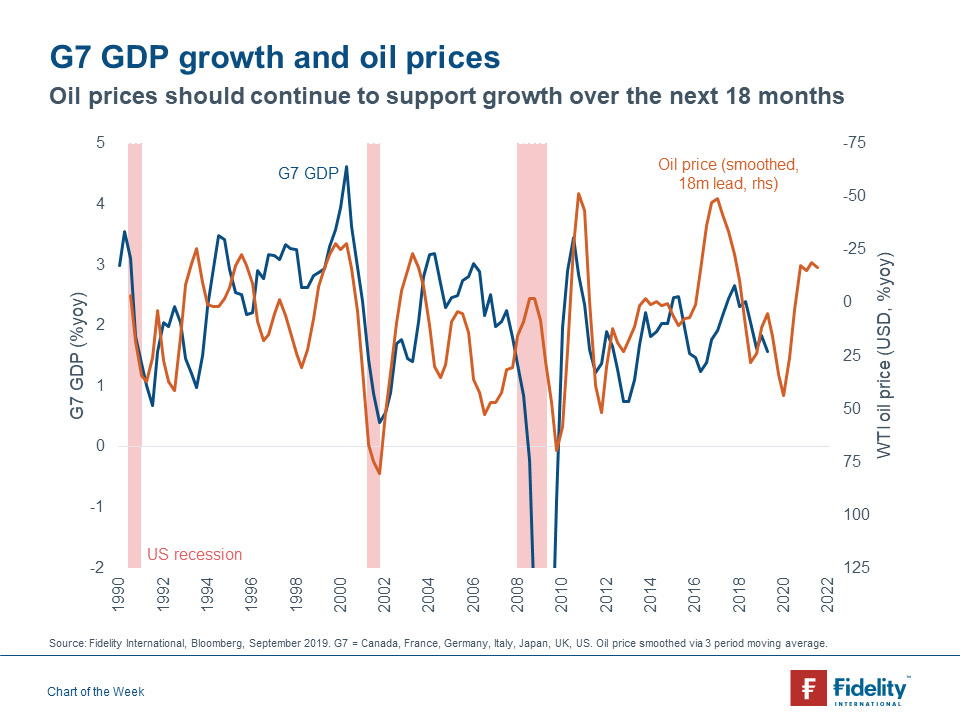

Historically, there is a good relationship between lower oil prices and G7 GDP growth rates. Big oil price increases have usually preceded recessions, as households respond to higher petrol prices by tightening their belts. In addition, central banks tend to raise interest rates to stem rising inflation. Conversely, GDP growth usually responds to lower oil prices after about 18 months, as consumers are spending less on their fuel bills and are free to spend more of their income on goods and services. For central banks, inflation is less of an issue in a falling oil price environment, meaning monetary policy can be run at a more accommodative level. In this context, it is important to remember that despite today’s increase, WTI crude oil futures remain 13% lower than this time last year.

It is still unclear how long it will take to restore Saudi Arabian oil production. The oil price will likely continue to be volatile while market attempts to quantify the extent of the supply disruption. Any price increase and the implication for global economic growth should be viewed in a long-term context, and despite the rapid price increase, oil prices continue to suggest the consensus is too bearish on the prospects for global growth.