By Sherry Qin

Sherry is a China research analyst covering automobiles and components, based in Shanghai.

Since the Covid-19 outbreak, we have seen optimism around electric vehicles rise. Major governments around the world have made green policies and investment central to their strategies. While most of the focus has been on the US or Europe’s climate policies, China is also committed to de-carbonisation. Together with EV battery costs falling quicker than expected, China’s EV industry could grow even faster than current estimations predict. While we believe there is a long runway for Chinese EV growth, the spoils won’t be shared equally. Companies in the upstream of the value chain with better competitive positions are more likely to be winners.

The big push for de-carbonisation

The incentives in major markets towards de-carbonisation and more widespread use of electric vehicles are growing stronger. In Europe, the Green Deal intended to make the region climate neutral by 2050 is progressing fast and sustainable mobility, specifically installing EV charging ports to encourage sales of low-emissions vehicles, is a key part of the plan. In the US, President Joe Biden’s plan seeks to cut greenhouse gas emissions in half by 2035 (from 2005 levels) and reduce carbon pollution from the transportation sector by reducing tailpipe emissions and providing funding for charging infrastructure. China’s President Xi Jinping has stated it aims to be carbon neutral by 2060 and that "eco-friendly" cars should make up all auto sales by 2035.

With this backdrop, we believe EV penetration rates globally will be higher than what was expected just one year ago. In China, the penetration rate of EVs could be over 40% by 2030.

De-carbonisation and lower battery costs support China’s EV industry

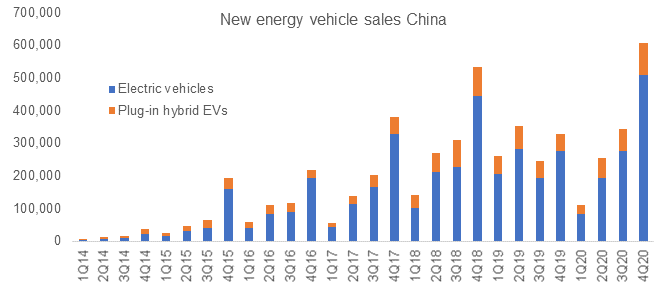

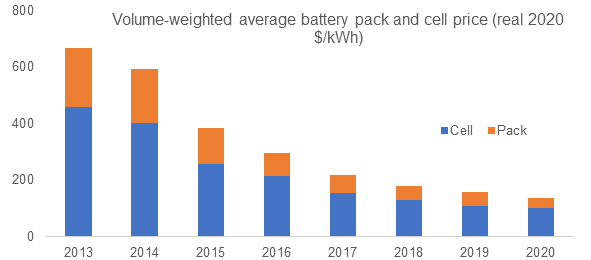

Following the outbreak of Covid, EV growth accelerated due to a spike in government support, with high subsidies in Europe including US$ 3.2 billion in the UK for charging infrastructure, EV development, and production and US$ 5 billion in Germany to help weather the coronavirus crisis and invest in electric cars. Importantly, battery prices, which are one of the biggest costs for EVs, have fallen faster than expected over 2019-2020. Prices in 2020 were 13% lower than in 2019, according to BNEF’s 2020 Battery Price Survey, as EV sales grew and more efficient battery pack designs were launched.

These twin drivers of subsidies and lower battery costs have supported China’s EV industry. In turn this has boosted enthusiasm for the sector from capital markets and we have seen new entrants and higher competition. We expect this will help the EV supply chain to cut costs yet further and make owning an electric vehicle a more attractive prospect for consumers. However, not all stakeholders will be rewarded equally. We could see the increased competition in the EV market reduce returns on capital and shareholders in some companies could lose out. Investors will have to be selective of where they invest.

|

China EV sales rise sharply through 2020

Not all EV companies will be winnersCompanies in the EV supply chain that have a greater chance of thriving are those with competitive advantages. Industries with higher entry barriers, technological leadership or costs advantages are better placed to protect their market shares and margins. Companies in the upstream of the value chain, specifically leading battery companies such as China’s Contemporary Amperex Technology, and Korea’s LG Chem could benefit from their scale, technology and leading market positions. China’s Wuxi Lead Intelligent Equipment supplies equipment to battery makers and has deep technological experience and co-operation with its customers. On the other hand, companies with pure exposure to EVs but few competitive advantages are at risk from new entrants to the sector. NIO is often mentioned in the press as China’s Tesla, but it doesn’t have the same technological knowledge or scalability and as a result, it may remain a niche player. Li Auto uses fuel-based range extender technology, which charges a vehicle’s battery as it drives. But this strategy could be disrupted if battery electric vehicles and charging facilities improve faster than expected. Long runway for EV growthThe EV sector is exciting for long-term investors because of the underlying structural trend of auto electrification - governments are explicitly committing to multi-decade de-carbonisation targets and earmarking substantial sums to make it happen. Electric vehicles are also a necessary pre-condition of auto intelligence and full autonomous driving - conventional 12V car batteries used on most of today’s gasoline-burning vehicles are not sufficient to support the computing and sensing requirements of autonomous cars, so higher-voltage electrical architectures of hybrids and battery-electric vehicles are key to autonomy. We believe EVs will take a majority of vehicle market share over time. The EV penetration in the Chinese passenger vehicle market is currently less than 6% so the long-term growth potential is substantial. |