Download pdf

Volatility to remain as tech-led slide topples market

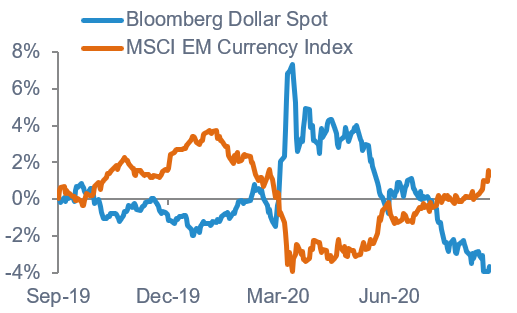

Last month we highlighted that one market dislocation to watch was the concentration of capital in tech stocks. This was further exacerbated in August as the S&P 500 reached a new record high, only to sharply reverse at the beginning of September as investors dumped big tech stocks.

While this correction is an overall healthy development, it shows that investors with broad equity exposure to an index or sector such as technology have to be prepared for gap-like moves in their portfolios. For example, the S&P 500, NASDAQ 100, S&P 500 IT sector and NYSE FANG+ indices lost 4.5%, 6.4%, 7.0% and 7.1% respectively over 3-4 September.

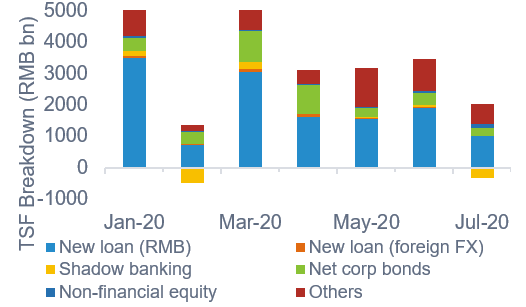

Despite the reversal, concentration in tech stocks is still substantial and equity markets remain close to record highs. The fact that this is taking place while we are in a recession, signals a developing disconnect between some asset classes and the real economy. There are some good reasons for this, including accommodative monetary policy, record fiscal stimulus, abundant levels of liquidity and structural changes in the economy favouring companies exposed to new ways of working.

But, in addition to concentration risk and toppy markets, the increasingly uncertain outcome of the US presidential election is fast approaching and geopolitical tensions between the US and China seem to only ratchet up. Investors should expect ongoing bouts of volatility as we return from summer breaks.

Romain Boscher

Global CIO, Equities

The Equities Outlook provides an overview of our investment team’s views and positioning in each of the key markets. Each of our portfolio managers has discretion over the positioning and holdings of their portfolios, and, as a result, there may at times be differences between strategies applied within a fund and the views shared in this document.

Trading desk update

US strength contrasts with European underperformance

While US equities have risen by more than 10% over the past three months, European equities have flat-lined. The percentage of S&P 500 stocks trading above the 50- and 200-day moving averages are a healthy 82% and 64%, respectively.

Strong performance by US tech companies explains much of this divergence, but broader macro dynamics have also been a headwind for Europe, with rising new Covid-19 cases relative to the US since mid-July. The euro is up 11% against the US dollar since mid-May and US growth momentum is outperforming that in the Eurozone.

Equities disconnect with the economy

Increasingly, investors are noting the disconnect between equity markets and the risk of recession. While equity price-earnings ratios relative to bond and credit yields are undemanding, in absolute terms multiples are at highs. Current investor positioning indicates a buoyant mood with short interest positions at lows. Sentiment surveys confirm this by showing investor bullishness at a multi-year high while expectations of a correction are low.

Over the past 11 US recessions, the S&P 500 declined by an average of 26%. With the index at a record high as of the end of August, equity markets at that point were theoretically pricing in a 0% chance of recession despite the fact we are technically in one.

Equities not pricing in the US recession

Source: J P Morgan, 27 August 2020.

Combined with the substantial concentration risk arising from high allocations to technology companies, we are cautious, particularly as the US presidential election approaches. Conversely, European equities have the lowest concentration risk compared to other regions as a result of the low technology weighting.

US outperformance led by tech

.PNG)

Source: IBES, Refinitiv DataStream, 3 September 2020. *Constitutes of Facebook, Apple, Amazon, Alphabet, Microsoft and Netflix.

Geopolitics remains they key issue in Asia

In Asia, the Hong Kong epidemic was largely contained, however, geopolitical issues are an overhang. US-China tensions continue with the US adding more another 38 Huawei-affiliated companies to its Entity List of parties subject to specific licences for exporting certain items.

Indian equities continued their upward momentum but saw a sharp correction on renewed tensions along the India-China border at Ladakh. India posted a daily increase of new reported cases of Covid-19 of above 80,000 - a record for any country.

In Korea, despite a lack of positive catalysts in August - flat interest rate, a resurgence of virus infections, and no new government stimulus - the KOSPI surpassed the 2,400-resistance level but cooled off towards the end of the month. In Japan, foreigners have been net buyers in August, where some investors are shifting positioning from China to Japan.

Robust retail flows increase trading costs

Retail investor flows have been strong, which historically has not been a positive sign for future market performance. Nearly 20% of all S&P 500 trading volume so far this year have come from the retail segment, which is far higher than the 15% average over the past five years. This has increased trading costs for larger orders by institutional investors.

US new issuance continued at a rapid pace, with equity issuance reaching US$308 billion so far this year. 2020 is on track to reach close to US$400 billion, which would exceed the previous record of 2013 by around US$100 billion.

US

Stocks power ahead

US equities continued their extraordinary recovery fuelled by record levels of stimulus, signs of economic recovery and progress towards a Covid-19 vaccine. Although virus cases are higher than in June they are falling and investors are watching multiple vaccines in various stages of trials. US second quarter earnings were also significantly better than expected.

Declining Covid-19 cases in the US boost investor sentiment

Source: Thomson Reuters, Refinitiv DataStream, August 2020.

Emerging from recession but market highly concentrated

The best performing sectors in August were IT, consumer discretionary and communication services, while utilities, energy and real estate ended the month negative. The US economy has emerged from a classical recession, but the narrowness of the rapidly rising market is a risk. There is an increasing dependence on the IT sector and technology-enabled names elsewhere, exposing investors to potential volatility.

Fed confirms lower-for-longer interest rates

Federal Reserve Chairman Jerome Powell announced at the Jackson Hole Symposium that the central bank will officially move to an average inflation targeting framework, allowing inflation to moderately overshoot the target, which remains at 2%, for some time to compensate for persistently low inflation in the run-up to the pandemic. This eliminates any concerns that the Fed might increase rates to combat inflation anytime soon.

US Congress is set to return from its August recess and could resume talks to end the gridlock on a phase four fiscal stimulus package. Following the failure of Senate to reach an agreement before the break, President Trump signed four executive actions as a stopgap measure.

Economy healing but more relief measures required

The economic recovery resumed in earnest after some hiccups in June and July when new virus cases surged. Activity in factories and in the services sector increased substantially, with low levels of inventory boosting manufacturing and falling infection rates supporting more demand for services. Output looks set to continue grinding higher. High-frequency data such as from Apple and Google mobility trends, restaurant headcounts and initial jobless claims all improved and we are already likely to see sequential growth in third quarter GDP even if activity does not continue to rebound materially for the next two months.

But the strength of the economic recovery may be tested if US Congress fails to deliver additional relief measures for consumers and businesses or if new coronavirus infections prompt further restrictions on activity. Household and corporate conditions have improved, with consumer spending staging a strong recovery and the labour market healing, but employment is still down significantly from pre-virus levels. Much depends on additional policy accommodation.

Activity continues to expand in August

.PNG)

Source: Markit, Refinitiv DataStream, August 2020.

Europe

Earnings beats and vaccine hopes

European equities delivered positive returns in August, driven by strong earnings and positive developments around Covid-19 vaccines and treatments. This occurred despite rising Covid-19 cases in several countries including France and Spain.

Corporate results for the second quarter were better than expected with the majority of European companies beating consensus estimates. Meanwhile, the US Federal Reserve tweaked its inflation policy, allowing higher inflation to drive growth.

Against this backdrop, cyclical sectors outperformed defensives, with consumer discretionary and industrials among the leading gainers. Value stocks surpassed growth names, and mid- and small-cap companies outshone their larger peers.

Markets eye vaccine hopes, ignore rising infections

.PNG)

Source: Thomson Reuters, Refinitiv DataStream, August 2020.

The Eurozone economy continued to grow albeit at a slower pace. The flash composite Purchasing Managers’ Index (PMI) declined to 51.6 in August, compared to 54.8 in July, indicating slowing momentum largely due to the weakness in services - tourism and hospitality remain heavily impacted by travel restrictions and social distancing. The manufacturing PMI declined marginally, but forward-looking indicators are trending higher.

UK online grocery shopping surges

An ongoing bespoke Fidelity survey to understand the pace of change in the UK grocery segment has found that online activity is surging. The total proportion of responders using online for at least half of their grocery shopping has leapt from 19% before Covid-19 to 34% during the pandemic. These figures are considerably higher for people who were familiar with online shopping prior to the outbreak. A hefty 83% of online shoppers intend to continue.

While it is still too early to make definitive conclusions on the structural changes in the UK food retail industry, the survey has found that online acceleration is one of the key changes in the market since the disruption started. Initial observations by food retailers largely confirm these findings. Online grocery retail has more stickiness for some brands, such as Tesco and Ocado, than others, while in-store shopping has consolidated around Tesco and Sainsburys. Most retailers were able to cope with this shift by adding new slots/capacity. The bulk of companies predict that there will be some roll back in the longer term from the currently high levels of online shopping, but the old in-store penetration levels will not return.

Pandemic boosts online grocery shopping

.PNG)

Source: Fidelity International, August 2020.

Japan

Positive sentiment offsets fall in GDP and Abe resignation

The market rallied in August boosted by broad-based buying following the previous month’s losses. Sentiment was supported by the fall in the yen against the US dollar, making Japanese exports more competitive, growing hopes for the development of a vaccine for Covid-19 and a decline in the number of downward earnings revisions for 2021 by leading companies. However, a record economic contraction in the second quarter and Prime Minister Shinzo Abe’s resignation capped the gains.

All sectors posted positive returns, and value stocks strongly outperformed growth names, while mid-and small-caps outpaced their larger counterparts.

Falling cabinet approval and GDP

While the resignation of Prime Minister Shinzo Abe was not a complete surprise, the timing was unexpected. A replacement for Abe is likely to be elected in September with the appointment completing what would have been Abe’s term through to September 2021. The approval rate for Abe’s Cabinet had been falling before his resignation, mainly due to dissatisfaction with the response to the pandemic.

Abe's cabinet approval rate is falling

.PNG)

Source: NHK, August 2020.

Real GDP for Q2 shrunk at its fastest ever rate, but the magnitude of the decline was largely anticipated. The economy slipped into recession earlier this year driven by a severe decrease in domestic consumption, which accounts for more than half of Japan's economy.

Japan's GDP shrinks at record pace

.PNG)

Source: Bloomberg, August 2020.

Abe successor likely to continue current economic policies

Shinzo Abe’s resignation is not positive for Japanese equities in the near term, but it may not necessarily be a drag in the longer term if his successor continues the current economic policy of aggressive fiscal stimulus and monetary support. Given the need to reinforce activity amid the ongoing fallout from Covid-19, Abe’s replacement is likely to maintain the status quo.

Monetary policy should also remain consistent. The Bank of Japan has cover to delay ‘policy normalisation’ given that global central banks’ policies are increasingly aligned with Japan’s following the virus outbreak. Governor Haruhiko Kuroda’s term is until March 2023 and there’s no reason for him to step down unless the new government reverses the policy stance. An important factor in the trajectory of Japanese equities is the strength of the currency. If the yen remains broadly around its current level without appreciating significantly, sentiment should stay positive, although volatility could rise until a successor to Abe is chosen.

Emerging markets

Recent gains are consolidated

Emerging markets delivered positive returns for a fifth consecutive month amid continuous signs of an economic recovery but underperformed developed markets. Oil traded higher on increased demand as economies continue to emerge from lockdowns and on falling supply as OPEC members implemented production cuts.

There is hope that the US will introduce another fiscal relief package and in the effort to find a vaccine for Covid-19, but there is also fear around renewed tensions between the US and China. US President Donald Trump ordered a ban on transactions with Chinese-owned online platforms TikTok and WeChat, and tighter restrictions on the telecommunication giant Huawei Technologies to limit its access to electronic components.

Chinese and Indian equities march upward

Sentiment towards Chinese equities was supported by improving economic data and new corporate listings. Indian equities continued their upward momentum as more businesses resumed operations, however, GDP experienced an unprecedented contraction. Taiwanese stocks were subdued as investors shy away from a country that is caught in a fractious relationship between its two biggest trading partners - the US and China.

Emerging Europe, Middle East and Africa (EMEA) ended August in positive territory. Russian markets traded higher as its currency strengthened and the rise in crude oil prices supported the market. Latin American stocks however posted negative returns as their currencies fell during August. With the exception of the Mexican peso, every currency in the region weakened.

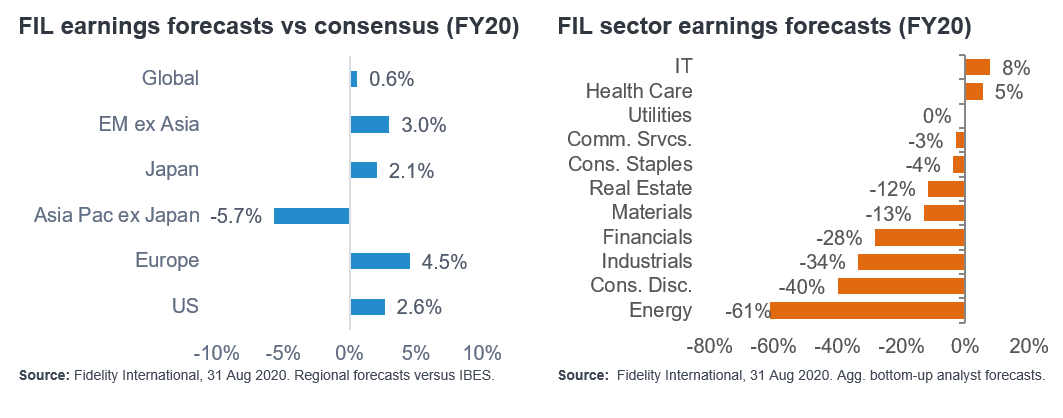

Falling US dollar could be a boon for EM

Source: NHK, August 2020.

US dollar weakness is a positive for emerging markets

Emerging market currencies continue to appreciate against the US dollar as investor risk appetite grows in parallel to the re-opening of global economies. A weakening US dollar is generally a positive sign for emerging markets as it results in a lower cost of capital for emerging countries that rely on external funding sources - usually borrowing in US dollars. A weaker US dollar also eases pressure on countries with stretched capital accounts that can negotiate from a stronger position. For example, the depreciating US dollar has prompted Argentina and Ecuador to strike deals with private sector creditors to restructure foreign debts on more suitable terms.

A major driver of US dollar strength in recent years has been the outperformance of US economic growth relative to the rest of the world. However, the pandemic has reversed that dynamic. The high number of infections and death rates in the US softened the economic outlook. In addition, better prospects for economic growth outside the US, low US interest rates, and concerns that fiscal and monetary programmes to combat the fallout from the pandemic are inflating the US fiscal deficit, are all contributing to the dollar’s weakness.

Emerging market currencies could rise a little further in coming months as the falling US dollar moderates domestic concerns about large economic imbalances stemming from the pandemic. However, there are some risks to the outlook, such as an escalation in US-China tensions, uncertainty over the US presidential election result, and rising Covid-19 cases across the emerging market complex.

Asia Pacific ex Japan

Economic recovery and positive global news offsets simmering US-China tensions

Continued signs of an economic recovery drove Asia Pacific ex Japan equities higher in August. Global cues were encouraging as further positive news emerged on the efforts to develop Covid-19 vaccines and treatments, and on signs that global monetary policies will remain accommodative. However, simmering US-China tensions weighed on sentiment.

The US blacklisted 24 Chinese state-owned companies for their roles in construction and military actions in disputed parts of the South China Sea. The US also said that it will further tighten restrictions on Chinese telecommunication giant Huawei in a bid to limit its access to electronic components.

New listings support Chinese equities

In China, a slew of new corporate listings and improving economic data boosted sentiment. ChiNext, Shenzhen's stock exchange focussed on start-ups, featured a number of successful floatations following recent capital market reforms, which included relaxing listing requirements and trading rules. The first batch of 18 Chinese IPOs started trading on the 24th August and made a stunning debut, averaging a median return of a 126% on their first day as listed companies. There is also more in the pipeline. Fintech company ANT Financial, is planning a blockbuster IPO in the coming weeks, listing US$30 billion of shares on both the STAR market and in Hong Kong to value the company around US$200 billion.

Indian activity resumes despite 3 million virus cases

In India, businesses continued to resume operations as authorities eased lockdown conditions, but stock market gains were tempered by domestic virus cases crossing the psychologically important threshold of three million. Investors welcomed Prime Minister Narendra Modi’s assurance that any approved vaccine could be mass produced and the reiteration of infrastructure spending plans totalling 110 trillion rupees (US$ 1.5 trillion).

Australian stocks edged higher due to strength in technology, however, sentiment weakened following Treasurer Josh Frydenberg’s forecast that effective unemployment would reach 13% by the end of September. In Korea, a liquidity-driven rally boosted stocks, while in Taiwan, continued trade hostility between its two key trading partners - the US and China - dampened equities.

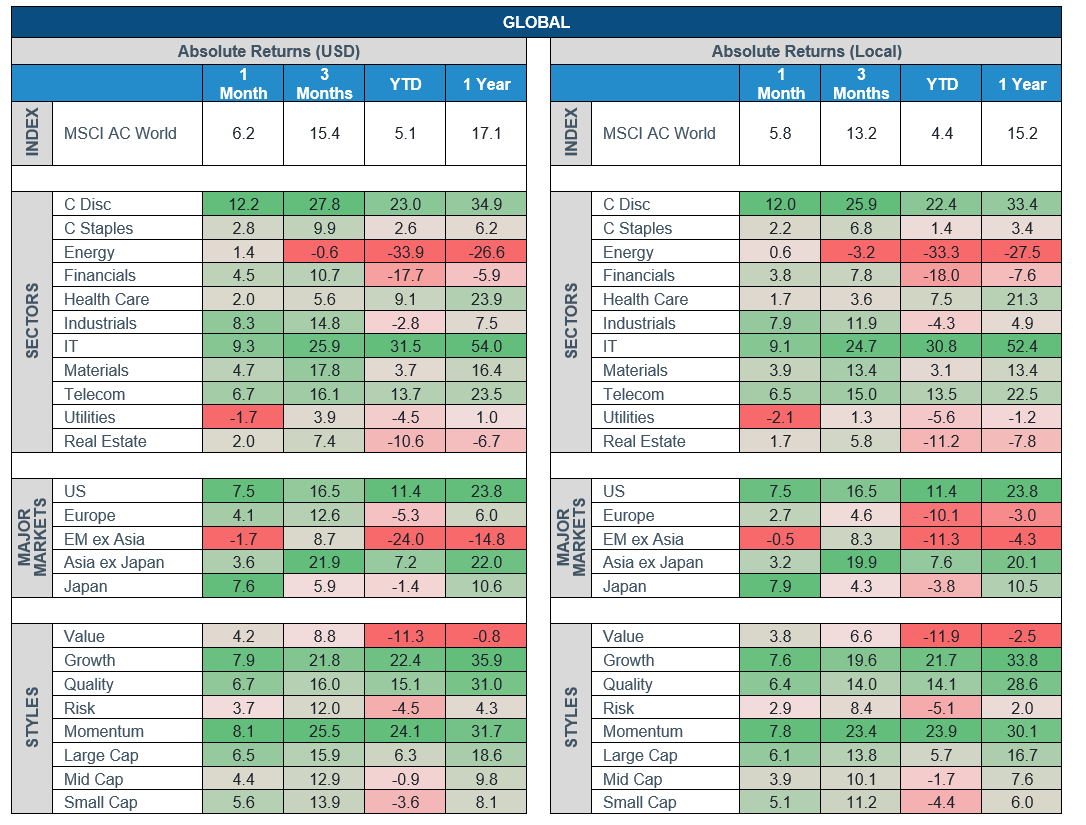

China credit growth slowing but conditions to remain supportive

China’s closely watched total social financing (TSF) data for July was well below expectations due to a sharp decline in new renminbi loans. TSF grew by 1.7 trillion renminbi in July (compared to a rise of 3.4 trillion in June) as new renminbi loans nearly halved to 1 trillion - a fraction of January’s 3.4 trillion in loans.

Total social financing is a broad measure of credit and liquidity in the real economy and includes off-balance-sheet forms of financing that exist outside the conventional bank lending system such as IPOs, loans from trust companies and bond sales. The change in TSF indicates the level of underlying support for economic activity.

Decelerating bank loans suggests that loan quotas are no longer being loosened, which could be a drag on broad credit growth. However, we expect banks will lend less into the second half of the year after rapid credit expansion in the first half due to policy stimulus. Moreover, an unexpectedly strong economic rebound in the second quarter has reduced the urgency for the PBoC to ease policy further although it should keep conditions easy to support the recovery.

China TSF slows following Q2 rebound

Source: The People's Bank of China, Bloomberg, July 2020.

Market Data

.PNG)

.PNG)