Recent volatility in the tech sector and declining equity market breadth have dominated market narratives of late. Year-to-date, the S&P 500 tech sector has outperformed consumer cyclicals by around 20% and consumer staples by 27%. The artificial intelligence (AI) capital expenditure (capex) super cycle is masking what is really going on under the surface in the real economy. We examine how this has begun to play out in credit markets alongside some of the risks, implications and the increasing bifurcation we are seeing between this and the real economy.

Tech sector turns to bond markets to fund capex plans

As fixed income investors, we have to ask: how much debt will fund the huge AI related capex planned by tech companies? We've started to see issuance ramp up, and while demand has been strong, any macro hiccup could pressure spreads wider, especially if rates remain elevated. Let's start with some concrete examples from the tech space, Meta being a prime illustration. In recent weeks, they priced a US$30 billion deal that attracted close to US$120 billion in orders, a very good sign of investor appetite.

This follows their US$27.3 billion off-balance sheet deal with Blue Owl, backed by the rental payments on the datacentres they are building together. The company is projected to generate around US$25 billion in free cash flow next year, but that's juxtaposed against a whopping US$100 billion in planned investments, much of it tied to AI infrastructure. Oracle and Google pulled off similar deals recently, issuing US$18 billion and US$17.5 billion, respectively, also to healthy investor demand.

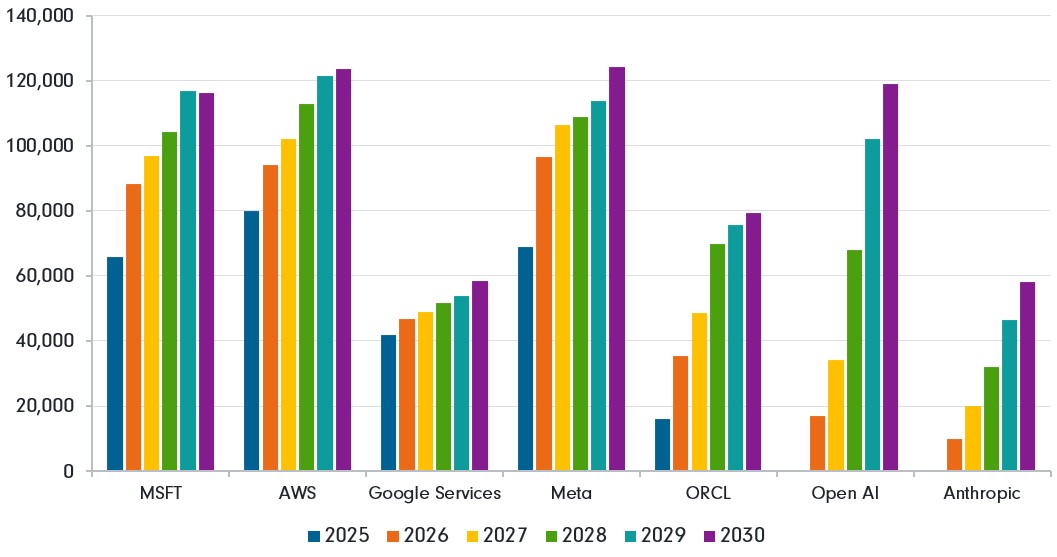

Figure 1: Consensus capex forecasts for selected hyperscalers and AI companies (US$m)

Source: Fidelity International, Bloomberg. November 2025.

With a likely continuation of this explosion in AI datacentre spending and an increase in debt financing, we could see meaningful growth in the percentage of AI related debt in investment grade credit markets. Whilst this is not an immediate cause for concern, given the largest issuers are generally high quality, there are a number of potential risks we are watching.

Are these risks fully priced?

- Open-source Large Language Models (LLMs) from China are growing in usage and the Chinese AI sector appears to be playing to its comparative advantage in manufacturing. Whilst the DeepSeek related market volatility earlier in the year was short lived, through the tactic of commoditising LLMs, the balance in AI related trade wars could shift to the manufacturing side. This would be similar to what we have seen in the autos sector, where Chinese manufacturers have been able to scale at much better rates than incumbents. If a similar dynamic were to unfold with AI, hyperscaler valuations could face significant challenges.

- We are also seeing the bottleneck for data centre investment moving from a shortage of chips to energy requirements. Recent comments from Microsoft’s CEO mentioned the thousands of H100 chips they have collecting dust, waiting to be deployed without enough energy to power them. This is further evidenced by GPU rental prices, down 30% this year. Energy demands seem currently unable to keep up with data centre investment.

- The rates of LLM improvement and adoption also remain up for debate and show signs of potential stagnation. Considering the magnitude of investment into AI, the timeline on monetisation continues to remain unclear. With increasing instances of circular investment deals between the likes of Microsoft and OpenAI, valuations remain vulnerable with optimism baked in

Looking at more examples in practice, Amazon provides another lens. Their free cash flow was down 60% year-over-year, compounded by a recent outage on AWS that disrupted services. Yet, their latest earnings beat expectations, largely driven by a mark-to-market gain on their investment in Anthropic. Without that accounting boost of US$9.5 billion from their stake in the AI firm (Anthropic is valued at around US$180bn), EPS and net income would have declined 8.5%, or stayed flat if you add back severance costs. This mirrors Microsoft's dynamic with OpenAI, Microsoft's cloud revenue gets a lift from embedding OpenAI models, but strip away the partnership synergies, and the core numbers look softer.

Back to reality…

As credit investors we remain focussed on the fundamentals. Whilst we remain broadly cautious to downside risks associated with AI capex market euphoria, the tech companies which have recently turned to bond markets for AI related funding continue to remain high quality issuers. They broadly have robust cash positions, stable cashflows and conservative levels of existing leverage in comparison to other investment grade sectors.

As such, AI related issuance with an attractive enough new issue concession and sound underlying credit fundamentals remains an area we are willing to participate in. Given the credit quality of these issuers, it is also less likely the bonds will underperform more highly leveraged investment grade sectors in a risk-off move. Where we would exercise more caution, however, is if issuance were to start growing significantly from more speculative areas of the AI linked tech sector, where capex is based on future cashflow expectations rather than supported by strong current cashflow.

Below the surface, an increasing split between tech euphoria and the real economy

Shifting to the consumer side, we're seeing a stark contrast to the tech rally. Many consumer stocks aren't participating in the broader market upswing, hammered by weak sentiment among low- and middle-income households. Taking recent comments from Chipotle's CEO as a barometer: "Earlier this year, as consumer sentiment declined sharply, we saw a broad-based pullback in frequency across all income cohorts. Since then, the gap has widened, with low- to middle-income guests further reducing frequency. We believe that this guest, with household income below US$100,000, represents about 40% of our total sales, and based on our data, is dining out less often due to concerns about the economy and inflation. A particularly challenged cohort is the 25- to 35-year-old age group. We believe that this trend is not unique to Chipotle and is occurring across all restaurants, as well as many discretionary categories." Their stock plunged 16% post-earnings, and it's emblematic of the bifurcation we're seeing.

Another anecdote about the consumer is the massive drop in traffic to Las Vegas this year, tracking to be about 2 million shorter this year and with 90,000 vacant rooms by some estimates. Here there is also some pretty evident bifurcation with the upscale resort owner Wynn Resorts stock up around 40% YTD and the more budget operator Caesars Entertainment down around 40%.

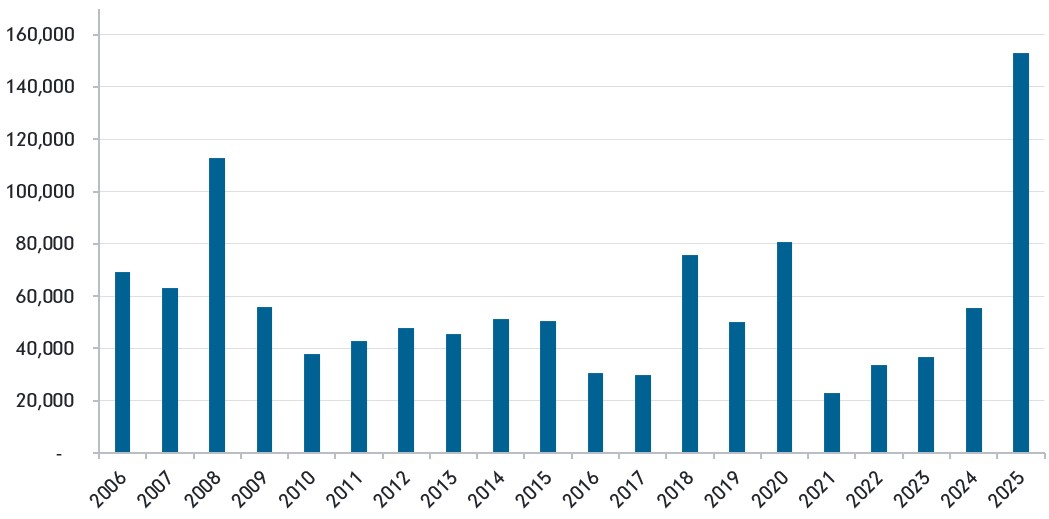

This consumer weakness isn't helped by the wave layoffs across industries, from Amazon to Target and Starbucks, jobs are being lost. Companies are increasingly capitalising on AI to automate functions, or using expected AI automation gains as a reason to cut costs and proceed with job cut plans. The latest data from outplacement firm Challenger, Gray & Christmas (Figure 2) shows job-cuts for October have been the highest for any October since pre-2008. Whilst the US labour market had been in a dynamic of relatively low levels of hiring and firing, this appears to be at a turning point where firings are increasing whilst companies are maintaining hiring restraint.

Figure 2: Annual October Challenger job-cut announcements highest since the financial crisis

Source: Fidelity International, Challenger, Gray & Christmas, Inc. Bloomberg. November 2025.

Where does this leave us in terms of fund positioning? We remain underweight credit risk at current valuation levels and are reducing outperforming credit exposure into market strength. Whilst new issuance supply has been elevated, we have been selectively participating in high quality issuance where concessions are reasonable. We continue to maintain capacity to add credit risk on better valuations.