What’s in a label? Fidelity used specialist reaction-time testing to gauge fashion consumers’ underlying attitudes. The results suggest clearer and standardised signalling on sustainability could play a role in turning the tide on purchasing behaviour.

A lifelong vegetarian and now design industry grandee, Stella McCartney says she was called an “eco weirdo” when she launched her eponymous clothing label in 2001 with the promise to use sustainable materials. Fast forward two decades and many fashion companies are still getting away with inaction on the environment. With an estimated US$2 trillion in sales annually, the fashion industry will use up a quarter of the world’s annual carbon budget by 2050 unless changes are made.

Thankfully, it is not just trailblazers like McCartney who are starting to act. From our ongoing engagement with producers and retailers, we see efforts to improve supply chain traceability and source materials more sustainably. These credentials are increasingly important and while there are many years of work still in front of companies, better options are beginning to be presented to consumers.

Unsustainable purchasing habits still persist, however, so it seems important for those retailers aiming to design a more sustainable model - and draw shoppers to it - to understand why this is, and what might turn the tide. Price is clearly the biggest factor - but if the world is so concerned with sustainability, what else is stopping people from allowing these concerns to guide their consumption behaviour?

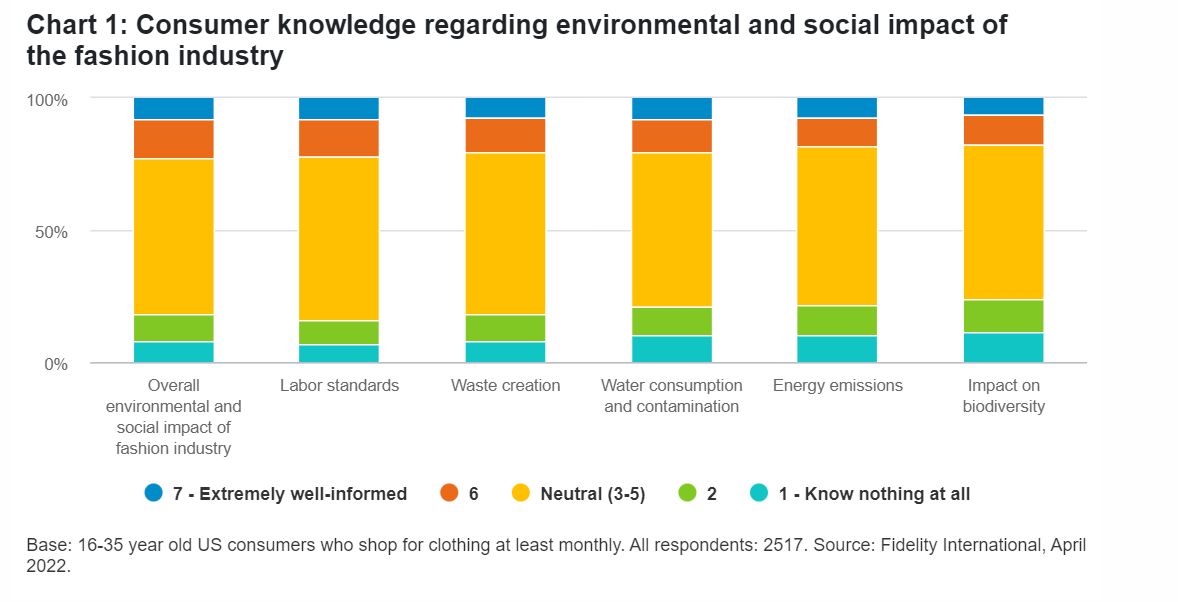

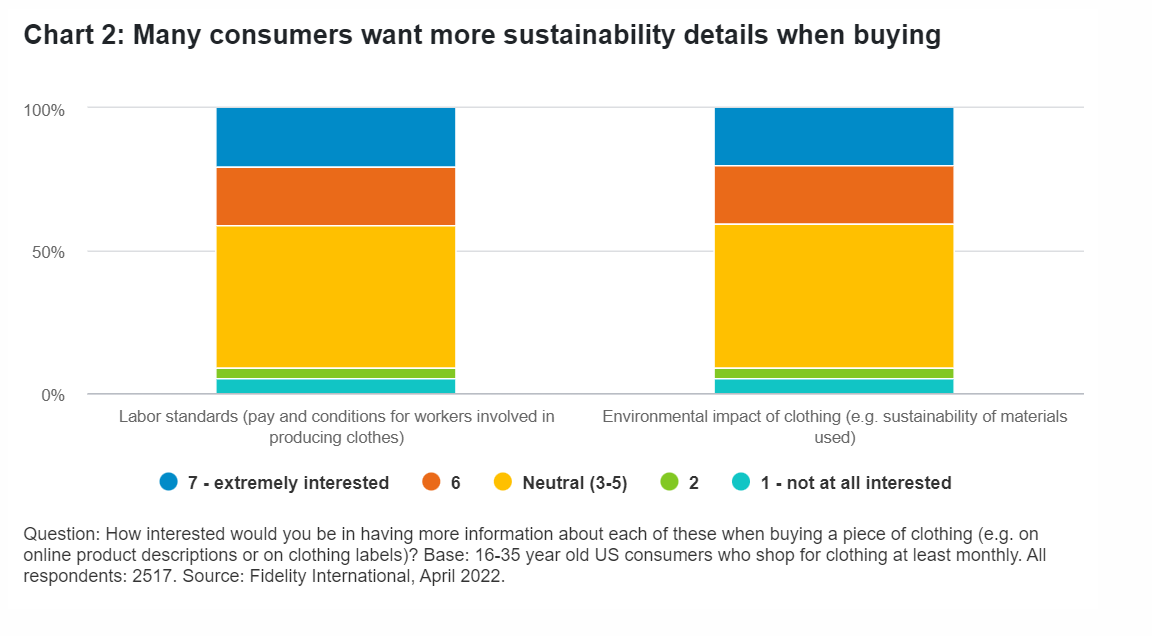

We may have some answers. Fidelity International conducted a survey of US consumers aged 16-35 at the end of last year, and the results reveal the extent to which a lack of standardisation or transparency on sustainability in fashion leaves most consumers feeling poorly informed about the environmental and social impact of the fashion industry. Indeed, some 40 per cent of respondents said they are highly interested in having more information on both labour standards and environmental impact when buying clothing.

Say-Do Gap

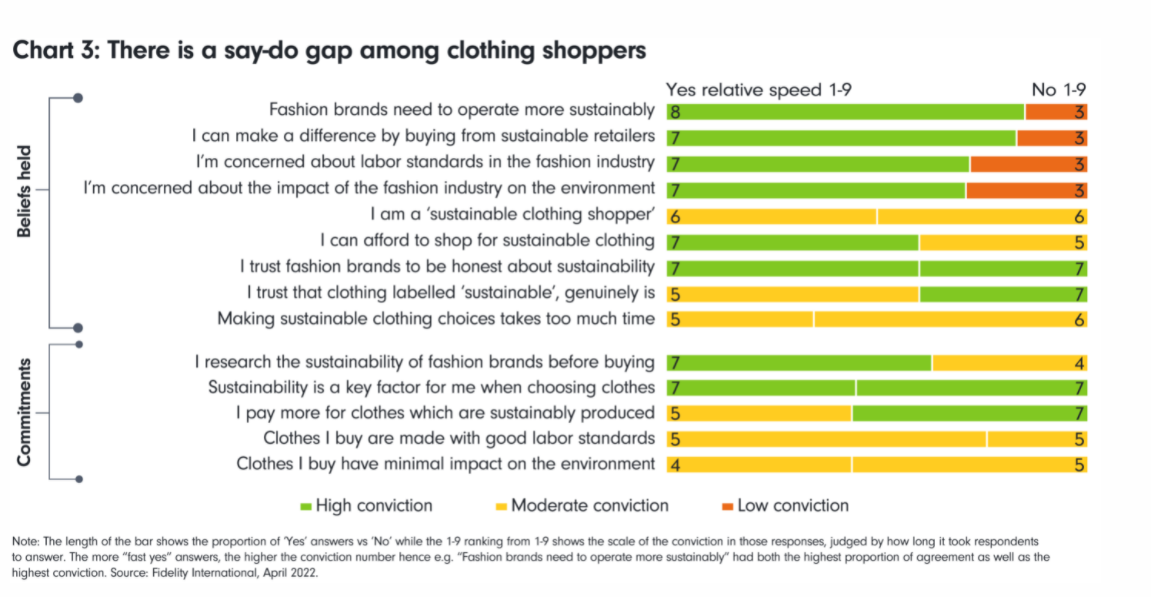

The survey shows that there is genuine concern among shoppers about sustainability issues within the industry - even if most ultimately prioritise factors such as price, style and quality over Environmental, Social and Governance (ESG) concerns when buying. While there are many who are disconnected from sustainability issues, very few are actively unconcerned.

Some 40 per cent of respondents say they are highly interested in having more information on both labour standards and environmental impact when buying clothing. Even among those who do not currently look for any such information, 3 in 10 would be very or extremely interested in more information. Almost 20 per cent seek information on the labour standards involved in producing an item of clothing before they buy, and the same proportion look into environmental impacts.

Testing conviction

People can hold conflicting viewpoints (or views they know are not socially desirable) when faced with a complex issue like sustainability, so by measuring the strength of mental associations and the speed in which they are accessed, we gained insight into what drives buying decisions. Reaction-time testing of implicit beliefs - assessing the conviction of people’s answers based on the speed of responses - suggests there is a large group who feel strongly about the need for better practices in the fashion industry.

We also see a very clear correlation in our data between feeling well-informed and being engaged in shopping sustainably.

For all these reasons, our survey suggests that with more information about the social and environmental costs of their clothing, consumers may make different choices. Labelling is by no means the whole answer, but if retailers were to educate consumers by displaying more information on clothing labels and product descriptions, it could have an impact on shopping behaviour.

Findings like these raise the stakes for the European Union’s (EU) Sustainable Product Initiative, which aims to make products sold across the bloc more sustainable and is due to take off this year. Whether or not the initiative provides a major regulatory boost, there is an opportunity here for retailers and producers to benefit. Customers want to know more than most clothing labels currently tell them when they are buying, and improving such disclosure should build trust and loyalty for brands.

Pressure groups have highlighted the problems inherent in earlier approaches to sustainability labelling, which prioritised water conservation and reductions in emissions over the need to keep plastic out of the biosphere, for example. It should be possible to improve the certification on these issues, if not to completely resolve that tension. If standardised, a larger and more informative label that lays out easily understandable facts about the sustainability of a product and its supply chain would be a substantial step forward.

Getting on the right track

Better disclosure is only one consideration. Environmental activists say the vast majority of fashion producers and retailers are still far off taking real action. The fast fashion industry has been built on the ability to drive costs and prices down and as a result generate strong volume growth, but the winning model of the future will be about pricing power afforded by higher quality of garments, sustainable sourcing as well as enabling of recycling, repair or resale. Less will prove to be more.

Our survey shows that messages like these are slowly hitting home and increasing awareness of the scale of the challenge ahead. Investors have a role to play, and Fidelity analysts are engaging with companies to push for more action on climate and other ESG goals. Change clearly must come from several directions: from the big corporate players, where we as investors can help; from regulation, where governments must do more; and from innovation in materials and circularity, be it from existing or new businesses.

But for most consumers to start buying sustainably, as they wander through the mall on a Saturday afternoon, they first need to know what that means, and whether the clothes they are buying fit the bill.