In the long run, returns on capital and earnings sustainability drive performance outcomes

In the first half of the year, there was growing concern about recession in Europe, the impact of lockdowns in China on supply chains, and the cooling housing market faced in Australia. Six months on, the world is moving forward, but unfortunately the outlook is not improving in certain markets.

On a positive note, it doesn’t feel like there is an imminent slowing in economic activity for Australia, particularly if you look at restaurants, traffic, theatres, travel, and mining activity, however, the outlook is set to change as higher interest rates and inflation begins to affect consumers more directly and slower economic growth is expected.

Economically there are many levers we must balance in our economy even if housing is weaker and consumer confidence softens into 2023. Data supports the view that Australia is still growing without some of the stresses being felt in Europe brought on from soaring energy prices and a deepening cost of living crisis. Valuation discipline is likely to remain crucial to investment success over the next 12 months as the new cost and delivery of earnings and cash will be more important than the recent past with theme, momentum or narratives taking a back seat to financial reality.

Looking at the findings to emerge from the August 2022 reporting season, we were pleased to see signs of reprieve as market multiples rallied and valuations expanded, particularly for quality and momentum names.

However, overall value as a factor was weaker as valuations in many key names needed earnings confirmation to continue to move higher. Broad themes to emerge included:

- Inflation and costs pressures

- Tight employment

- Post Covid recovery continuing

- Strong electric vehicle (EV) resources

- Continuation of the M&A activity

Earnings were strong, with positive surprises outweighing disappointments. At a stock and sector level, technology (Altium, WiseTech Global), property (Charter Hall Group), consumer (Lovisa), insurance, and some financials posted strong results. Softness or disappointment came from sectors that showed margin compression as competition and costs rises including non-EV resources, e-commerce (online retailing), apparel retailers, regional banks, and industrials that operate in competitive industries.

Outlooks were softer in some cases due to the moderation of earnings expectations as pressures build for a more challenging 12 months due to costs and competition. Those in strong market positions and those providing a unique service remain stronger and more certain due to the nature of competitive pressures.

Conviction and clarity will become more critical as economic activity is expected to slow. The focus of the Fidelity Future Leaders Fund will be to own companies with solid market structures, where pricing power and competition allow companies to hold margins and experience less of top line declines. This will allow earnings to grow or hold current levels, generate strong free cash flows, and a self-sustaining business model in the face of increasing economic pressures, higher debt, and valuation scrutiny.

Furthermore, the Fund remains balanced with a blend of strong positions in technology, electric vehicle resources, consumer names with global growth or defensive properties, and exposure in financials, energy, real estate, and global industrials. Overall, the portfolio is positioned to include higher quality and growth stocks than the index, with a modest valuation premium, and higher sustainable or earnings persistence that should manage well through the current market.

Over the next 12 months, Viability, Sustainability and Credibility remain the “pillars of success”. With this in mind, we must be careful of:

- Excessive valuation in quality and momentum

- Momentum euphoria due to desire for short term growth and certainty

- Risk spreads re-priced by markets and financial system rather than central banks

- High beta, high risk, low quality, micro-cap, loss making concept stocks

- Profit warnings expected due to costs, inflation, labour shortage, supply chain, high expectations

- Capital intensive industries or financial leveraged industries

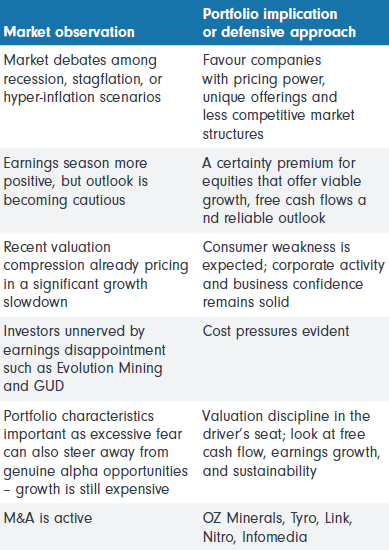

Macro settings are a key area of focus and are changing quite dramatically compared to the last decade of low inflation, low rates, and few periods of tight labour conditions. Broadly, we have summarised what these observations mean in terms of portfolio considerations: