Against a sober global backdrop, how is Australia faring?

Outlook and market observations

Over the last six months, the market has shifted from focusing on value styles, valuations and short-term earnings to long-term realities of business models as well as market structures. The focus we saw during reporting season will likely continue into 2023: operating margins, earnings growth, persistency of returns, cash generation, debt levels, market structures within industries, competition intensity levels, consumer confidence experience by companies, top-line sales outlook, and the visible level of certainty in management presentations.

Global news and concerns about the financial system began this month with the failures of US banks Silicon Valley Bank and Signature Bank. In Europe, Credit Suisse collapsed and was purchased by UBS. The American and European financial system regulators have prevented a major collapse of confidence in the global financial system, which has stopped the series of events that would take investors back to the 2009 global financial crisis. In Australia, we believe the banking system remains well capitalised as a result of the conservative business activities and strong regulation, which has positioned the country with relative strength.

Mergers and acquisitions (M&A) emerged for a number of companies, which signalled that companies may be struggling for growth, but also have strong balance sheets to utilise. Companies’ motivations to undergo M&A are broad and include seeking growth options in: a rising inflationary environment and a lower expected growth world, attempting to put strong balance sheets to work to optimise returns on capital, seeking to move up or down the value chain to secure supply in an increasingly competitive world, or increasing scale and leverage to lower costs. We will likely see this trend continue throughout 2023.

Australian consumer sentiment remains somewhat of a double-edged sword, with the outlook looking optimistic with concern about the second half of the year. Post-Covid, we have seen an increase in consumer spending (hotels, cafes, restaurants, shopping centres, holiday destinations, rental accommodation, business trips and preparing for family gatherings). However, this flies in the face of the data reflecting consumer confidence, which is at low levels due to the flow-through impact of housing costs (mortgages, rent cost increases) and cost of living, which is impacting the consumer psyche as spending concerns are emerging, but not yet visible in retail sales trends. With employment remaining strong, Australia is not experiencing any material economic weakness; however, the drift toward softer business investment or employment is likely to create downward pressure in the current positive economic circumstances.

Valuation of the equity market (price to earnings ratios) continues to be in a lower range compared to history due to increasing pressures on the business environment. The dispersion range between high-growth and low-growth companies has begun to expand as the scarcity of earnings growth, certainty, sustainable margins and confidence in management has narrowed.

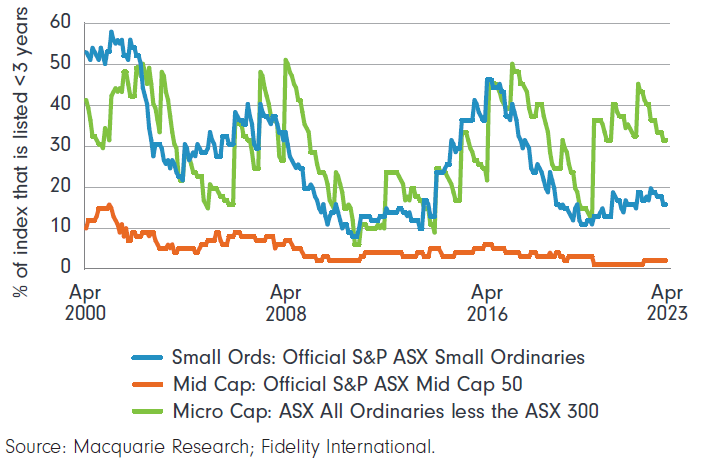

If we look at the ‘Toddler index’ (which signifies the proportion of each index where companies have been listed less than 3 years) market liquidity is getting tighter and company aging profile is increasing.

The toddler index

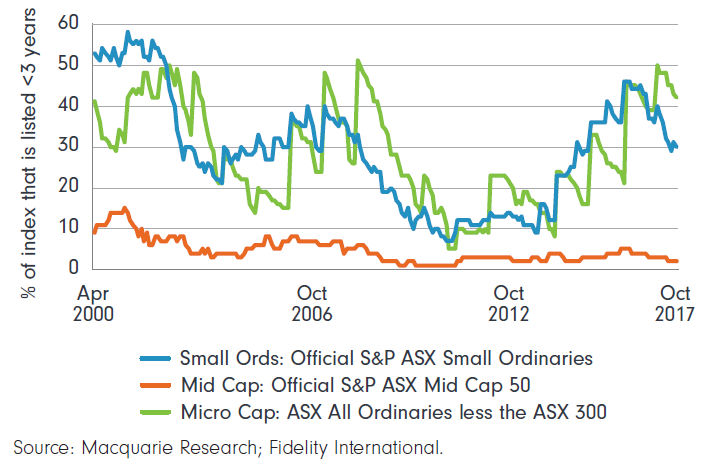

Compare this to 2017, when liquidity levels were high, so company "ageing" was declining which was also the case in 2016, 2007 and 2000.

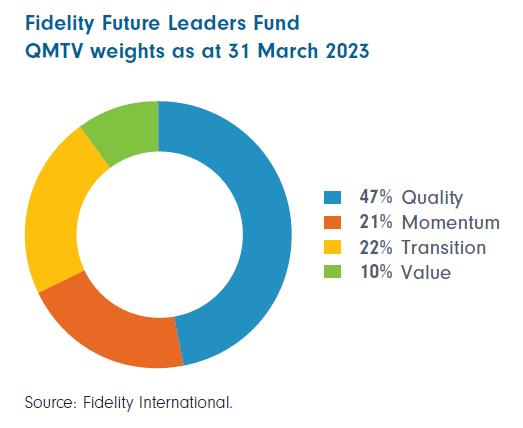

The Fund maintains a strategic tilt toward quality (software, healthcare, global consumer services, defensives, insurance brokers) and transition or value (real estate, airports, travel, global industrials, gold) with the intention of providing a higher-than-average growth outlook with a low valuation premium to navigate the beginning of 2023.

| QMTV quadrant | Sectors | Stocks held in the Fund* |

| Quality (higher returns, higher growth, long duration, quality accounts and management teams) |

Healthcare Software Insurance Brokers |

Altium Wisetech Steadfast |

|

Momentum (moderate returns with an upward trend, sentiment strong, cyclicals themes are favourable) |

Resources Industrials Gold |

Orica Evolution IGO |

| Transition (in recovery mode with some milestones or positive sentiment shift, but market still feeling uncertain about the outlook) | Travel Restaurants |

Flight Centre Auckland Airport Collins Foods |

| Value (sentiment weak, valuations near lows relative to replacement cost or attractive in the eyes of industry participants) | Real estate Petrol stations |

Vicinity Ampol |

*Information about specific securities may change. Any reference to specific securities should not be taken as a recommendation to buy, sell or hold these securities and is provided for illustrative purposes only.