Fidelity Australian Equities Fund Update

The Fidelity Australian Equities Fund has delivered an average annualised return of 12.04% after fees, since its inception on 30 June 2003. The Fund has outperformed the S&P ASX 200 Accumulation Index on average by 2.76% per annum over this period.*

Key take outs

- Short term underperformance driven by a style rotation out of quality stocks in Q4 2016 and Q1 2017 driven by ‘Trump Trade’ one-off.

- These 'fads and fashions' in the market will not out over the long-term.

- The market has started to focus back on high-quality companies and longer-term earnings growth reflecting a return to fundamentals and the Fund has performed broadly in line with the market.

- Size of the Fund does not impact how we manage the portfolio. We seek long-term winners and aim to add as we gain more conviction.

- Strong personal alignment including 100% of super invested in the Fund ensures a focus on the long-term not shorter-term outcomes.

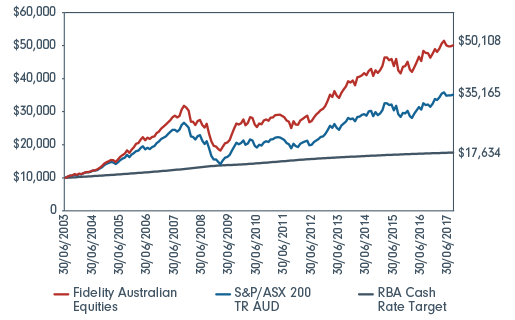

Over 14 years of strong long-term performance

The Fidelity Australian Equities Fund was established on 30 June, 2003 and has now been in operation for over 14 years. I have managed the Fund since its inception and I have been extremely proud that the Fidelity Australian Equities Fund has delivered an average annualised return of 12.04% after fees and has outperformed the Australian market on average by 2.76% per year over this entire period.*

This means that an amount of $10,000 invested at the inception of the Fund would be worth $50,108 as at the end of August 2017. The same amount invested in the S&P ASX 200 Accumulation Index or held in cash over the same time period would be worth $35,165 and $17,634, respectively.

Past 12 months performance

While the Fund has out-performed the market over the medium and longer term after fees it has had a more difficult period in the last 12 months. Over the past year the Fund has delivered a 4.82% return after fees, underperforming the market’s return of 9.79%. This under-performance essentially occurred in Q4, 2016 and Q1, 2017 and was primarily caused by a strong style rotation in the market towards lower quality companies.

The style rotation caused by the “Trump Trade” saw the market change its expectations towards higher inflation, higher interest rates and higher global growth. Higher global growth was expected to lift all companies’ earnings especially those lower quality companies that are structurally challenged and on lower valuation metrics. Higher-quality companies with strong earnings growth were sold off as the higher inflation and interest rate expectations meant that their future earnings were discounted back to today at higher rates meaning their earnings multiples were compressed.

We believe that this “Trump Trade” was one-off in nature and that the Australian market would head back towards fundamentals over the longer term. We have already seen the market normalise since the end of Q1, 2017 as the market starts to focus back on high-quality companies and longer-term earnings growth. Over the last six months and during reporting season the Fidelity Australian Equities Fund has performed broadly in line with the market reflecting the return to fundamentals.

The Fund faced a similar tough period during 2005/06 when private equity investors aggressively entered the market buying low-quality businesses and re-leveraging up their balance sheets. The market at this time was similarly not driven by fundamentals but rather by financial engineering. Our view at this time was that we needed to stick with our long-term investment approach and that the fads and fashions being created by private equity’s financial engineering would eventually unwind and the market would return to long term fundamentals. We saw this financial engineering unwind in 2008/09 with a return of strong performance for the Fund.

In 2017, the “Trump Trade’ has created the fads and fashions in the market and we similarly believe the market will return to focus on long-term fundamentals as it appears is now happening.

Investment Process

It is important to note that through this entire period we remained true to our tried and tested investment process. Our investment process is focused on bottom-up stock selection that identifies companies that will be better more valuable businesses in five years time. In the shorter term, fads and fashions dominate and fundamentals do not always out over 3, 6 or even 12 month periods but we believe that fundamentals will always out over 5 year timeframes.

From the outset I have sought to identify companies which will be more valuable in five years’ time, research and monitor these companies and build on my investment in them over time. This means that even though the Fund has grown in size, how I manage the portfolio and make my investment decisions has not changed. I don’t have a short-term time trading focus but rather remain resolute in the five year investment horizon for the Fund. This is evidenced by the low turnover of the Fund which has been approximately 20% since inception.

This five year investment horizon also means that the Fund has relatively low turnover, is low cost and tax efficient which benefits investors in the Fund.

The Fund will own between 30-50 stocks. In my view, this is another key and important metric as below 30 stocks is not really a diversified portfolio and elements of luck will enter performance and above 50 starts to get too close to the market. Staying within 30-50 stocks ensures the Fund is concentrated enough to deliver good outperformance but also managing the returns in a risk controlled way.

As most investors in the Fund may know, I have allocated 100% of my personal superannuation fund in to the Fidelity Australian Equities Fund. I believe this provides strong alignment between the manager of the Fund (me) and the investors in the Fund (you) and ensures that I take the ups and the downs with our investors.

Like all Fidelity portfolio managers, my remuneration is also based on the performance of the Fund and providing active returns to investors in the Fund. I’m vested in this fund at every level with our investors.

Investing is a marathon not a sprint and my alignment ensures that I am focused on the longer term and not shorter-term outcomes. The Fund has delivered on average over 12% per year for greater than 14 years, which has delivered strong returns for my superannuation fund and more importantly those of our investors.

Reporting Season

Key take outs

- Company results were mixed but overall were relatively solid.

- Resources sector was the standout positive sector driven by operating efficiency improvements and higher commodity prices.

- Banks and property were low growth but in line with expectations.

- Individual company results varied widely with some stand out results coming from WiseTech Global, Treasury Wine Estates, Rio Tinto, Star Entertainment, Sydney Airport.

The Australian market responded positively to the reporting season rising 0.71% through the month of August. Company results were mixed, as always, but overall were relatively solid. Approximately 40% of companies reported in-line results to 30 June, with 30% beating expectations and 30% missing expectations.

The resource sector was the standout positive sector with overall sector earnings upgraded by approximately 6%. Resource sector earnings upgrades were driven by both operating efficiency improvements as well as higher commodity prices. Banks and the property sector were low growth but broadly in line with market expectations.

Industrials saw the greatest downgrades with the overall sector earnings expectations downgraded from approximately 11% Earnings Per Share (EPS) growth to 7% eps growth for the coming year. Housing activity remained solid but infrastructure spend (mining, utilities and general infrastructure) and commercial construction drove better performance. Dividends grew faster than earnings as dividend payout ratios increased.

Individual company results varied widely with some stand out results coming from WiseTech Global, Treasury Wine Estates, Rio Tinto, Star Entertainment, Sydney Airport as well as most engineering, construction and building companies. The telecommunications sector saw the largest downgrades but the insurance sector also disappointed. Companies that delivered poor results included Telstra, Vocus, QBE, Woolworths, Bluescope Steel, Healthscope as well as Domino's. Given the Fund’s holding in Domino's it is important to explore this in more detail.

Domino's

Key take outs

- Domino's disappointed based on short-term distractions but we believe will have no impact on significant long-term opportunities.

- Digital delivery of food and beverage is one of fastest growing markets expected to double in Australia over next 3 years.

- Competitors in the market such as UberEat and Deliveroo will benefit from the growth but will struggle with delivery time and efficiency.

- Vertical structure of Domino's is vastly superior.

- Other areas of growth for Dominos' include Domino's Anywhere and GPS tracker

- We continue to believe in the long-term growth prospects for Domino's.

For the period to 30 June 2017, Domino's delivered 28% eps growth. Unfortunately market expectations were for 32% eps growth. The downgrade was related to short-term issues with the point of sale system in the French subsidiary. These issues have now been rectified. Sentiment towards Domino's has also been negatively impacted due to a few of the Domino's franchisees underpaying some staff. These two issues has weighed on the share price and seen both earnings downgrades and earning multiple compression. We view both these issues as short term distractions that are being rectified and will have limited to no impact on the very significant long-term earnings growth opportunities.

Digital delivery of food and beverage is one of the most exciting growth areas within the entire market. Digital delivery of food and beverage is expected to approximately double in Australia over the next three years and increase seven times in the US over the next decade. This potential growth has obviously attracted a number of companies and several aggregators have established themselves in the space in the hope of benefiting from this very significant growth.

Aggregators like UberEATS, Deliveroo and Menulog among others are hoping to capture this growth. While we believe all will benefit from the growth, we feel that the vertical delivery system of Domino's is vastly superior to that of the aggregators. The aggregators continue to struggle with the delivery time and efficiency of combining multiple organisations and operations. Aggregators have tried to improve delivery times by optimising delivery routes with artificial intelligence as well as having pre-cooked meals already in delivery vans waiting for orders.

While this has improved delivery times it is still vastly inferior to the vertical approach of Domino's. Domino's has a target of 3/10, which means 3 minutes to cook and 10 minutes for delivery to customers. Having a fresh, piping hot pizza delivered in 10 minutes from ordering is obviously an extremely positive customer experience and one far superior to the aggregators. Domino's have been able to set this target from improved faster cooking ovens, better delivery options and performance, GPS tracker, technology and due to considerably more stores, closer proximity to customers.

Domino's are also introducing ‘Domino's Anywhere’, so that customers can order their pizza, pay for their pizza then get it delivered anywhere (beach, park etc). Domino's Anywhere utilises the drop pin technology to identify the exact location of customers. This is part of the reason why the digital delivery of food and drinks will increase so rapidly over the next decade. The technology behind the Domino's app is also allowing the cooking of the food to be linked perfectly to the location of the customer. A customer can order a pizza to be started cooking when they are within 10 minutes from the store. The app can identify the location of the customer and when they are 10 minutes from the store.

In line with our investment process we expect Domino's earnings to grow very rapidly over the next five years and expect it to be a better much more valuable business over that five-year timeframe.

Outlook

Key take outs

- After a strong performance in 2016/17 the Australian stock market is well positioned for continued good returns in 2017/18.

- Over the past 12 months, the market was driven by an improving resources sector, a resilient banking sector and continued specific growth in the industrials space.

- Additional headwinds expected ahead - such as the impact of Amazon on the retail sector, additional government taxes on the banking sector and a tougher consumer environment.

- Australian corporates remain in a strong position with quality balance sheets and good underpinning fundamentals.

- Earnings growth expected to come from a number of sectors including resources, infrastructure and services.

After a strong performance in 2016/17 the Australian stock market is well positioned for continued good returns in 2017/18. The ASX200 Accumulation index delivered 14.1% over the 12 month period ended 30 June, 2017 in the face of major macroeconomic headwinds like rising US interest rates, political instability at home and abroad and geopolitical tensions.

The Australian market was driven by an improving resources sector, a resilient banking sector and continued specific growth in the industrials space. While there are some additional headwinds expected in 2017/18, like the impact of Amazon on the domestic retail sector, additional government taxes on the banking sector and a tougher consumer environment, Australian corporates remain in a strong position with quality balance sheets and good underpinning fundamentals.

The Australian stock market has been the best performing market in the world over the long term driven by strong population growth, an excellent and low cost natural resource base, a strong corporate governance environment, a high dividend yield and high, real dividend growth. These key fundamentals are expected to continue in 2017/18.

In terms of valuation the Australian market is trading at approximately long- term averages, but with high-quality earnings, strong balance sheets and low interest rates, there is an argument that the market should be trading in excess of these long-run averages. Australian equities also continue to be very attractively valued against other asset classes like bonds and property and remain the standout asset class for the longer term.

Earnings growth in 2017/18 is expected to come from a reviving resources sector, infrastructure, a strong services sector, including strong performance from the tourism sector as well as specific industrial and technology companies.

While it may be hard to match the strong market performance of 2016/17, all the key ingredients are still very much in place to deliver investors relatively good returns from the Australian stock market in 2017/18.

*Past performance is not a reliable indicator of future performance. Total returns (net) shown are as at 31 August 2017 and are calculated using mid-prices and are net of Fidelity management costs, transactional and operational costs and assume reinvestment of distributions. No allowance has been made for tax or the buy/sell spread. Returns of more than one year are annualised. The return of capital is not guaranteed. Inception date: 30 June 2003

All information is current as at its published date unless otherwise stated. Not for use by or distribution to retail investors. Only available to a person who is a "wholesale client" under section 761G of the Corporations Act 2001 (Commonwealth of Australia) ("Corporations Act“).

This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL No. 409340 (‘Fidelity Australia’). Fidelity Australia is a member of the FIL Limited group of companies commonly known as Fidelity International. Prior to making any investment decision, investors should consider seeking independent legal, taxation, financial or other relevant professional advice. This document is intended as general information only and has been prepared without taking into account any person’s objectives, financial situation or needs. You should also consider the relevant Product Disclosure Statements (‘PDS’) for any Fidelity Australia product mentioned in this document before making any decision about whether to acquire the product. The PDS can be obtained by contacting Fidelity Australia on 1800 044 922 or by downloading it from our website at www.fidelity.com.au. The relevant Target Market Determination (TMD) is available via www.fidelity.com.au. This document may include general commentary on market activity, sector trends or other broad-based economic or political conditions that should not be taken as investment advice. Information stated about specific securities may change. Any reference to specific securities should not be taken as a recommendation to buy, sell or hold these securities. You should consider these matters and seeking professional advice before acting on any information. Any forward-looking statements, opinions, projections and estimates in this document may be based on market conditions, beliefs, expectations, assumptions, interpretations, circumstances and contingencies which can change without notice, and may not be correct. Any forward-looking statements are provided as a general guide only and there can be no assurance that actual results or outcomes will not be unfavourable, worse than or materially different to those indicated by these forward-looking statements. Any graphs, examples or case studies included are for illustrative purposes only and may be specific to the context and circumstances and based on specific factual and other assumptions. They are not and do not represent forecasts or guides regarding future returns or any other future matters and are not intended to be considered in a broader context. While the information contained in this document has been prepared with reasonable care, to the maximum extent permitted by law, no responsibility or liability is accepted for any errors or omissions or misstatements however caused. Past performance information provided in this document is not a reliable indicator of future performance. The document may not be reproduced, transmitted or otherwise made available without the prior written permission of Fidelity Australia. The issuer of Fidelity’s managed investment schemes is Fidelity Australia.

© 2025 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited.