|

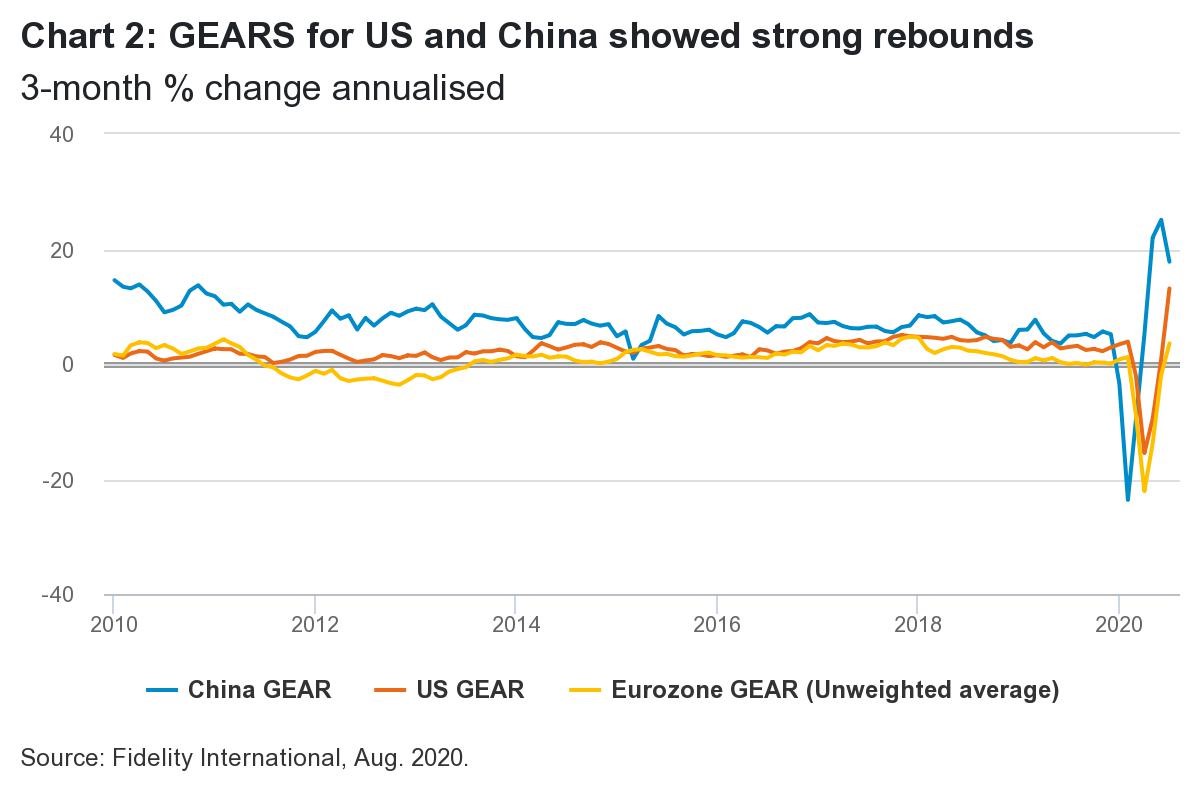

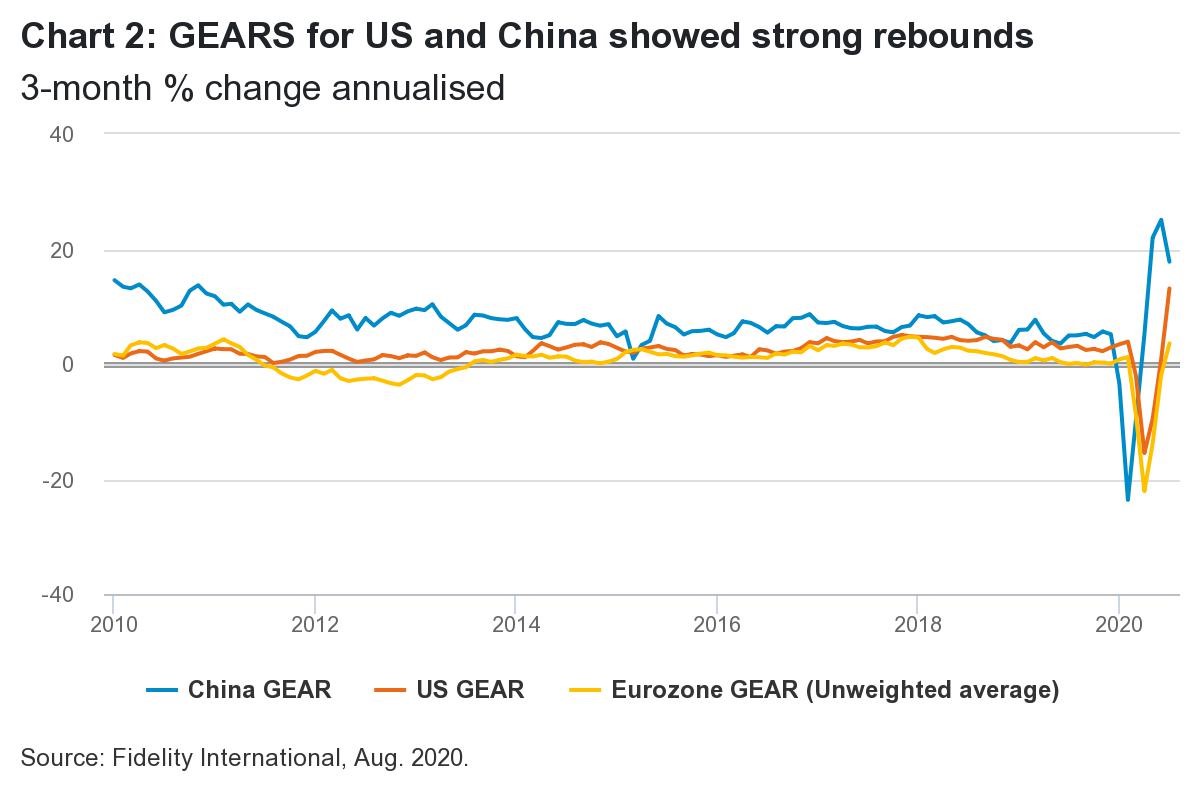

Fidelity International’s GEAR (Gauges of Economic Activity in Real Time) activity indicators continue to rebound strongly. But what is more interesting is where our GEARs imply activity is at for each country compared to pre-Covid-19 levels.

The US

The dramatic rebound in the US this month takes its activity level within 2 per cent of its previous high, albeit we are yet to see what the tapering of unemployment benefits does to this in the coming months. US GEAR (up 13.1 per cent on a three month annualised basis) is now the significant leader among developed markets, implying activity barely below pre-Covid levels.

.jpg)

On nearly all metrics available for July, the US has shown improvement, with the labour market and consumption the biggest gainers. Hours worked are improving and unemployment claims continue to fall sharply. There has also been a pickup in homebuilding activity, with housing starts increasing and homebuilder confidence now above its long-run average.

China

China is the only country so far to display a ‘true’ V-shaped recovery, with our GEARs implying that GDP is comfortably above its pre-Covid peak. With a GEAR reading of positive 17.8 per cent, it is now in double-digits for a third consecutive month. Manufacturing and services PMIs still show expansion, while real estate and investment activity are overwhelmingly positive. External trade is resurgent. Car and truck sales, however, are now more subdued following an initial spike. Retail sales continue to improve, but lag the improvements seen in industry and investment.

|

Emerging Markets

EM overall is a mixed bag. Other than China, India has shown improvement, but needs to rebound further, given the outsized depth of its lockdown contraction. South Korea saw improvements across the board, with employment, retail volume and services production seeing the strongest growth, but may be vulnerable to a renewed outbreak in Seoul this month. Latin America again contains the worst of our GEARs. Brazil has seen a remarkable rebound, driven by a recovery in hours worked and industrial production. Meanwhile, Mexico still languishes, despite improvement in confidence surveys and industrial production from a very low base.

Eurozone

Eurozone GEAR (up 3.6 per cent) has moved into positive territory but is not yet strong enough to imply a ‘V-shaped’ recovery. Services and manufacturing PMIs have surged into expansion, but other services, consumer, retail and industrial confidence surveys still show a very depressed outlook, despite having bounced from the trough. Unemployment is still rising, notable as the one Eurozone data point to have worsened. International trade and industrial orders are the largest bright spots, rebounding significantly.

Interestingly, Sweden and the Eurozone have both converged on an activity level around 5 per cent below February levels. This is despite the former taking a shallow path of limited lockdowns, and the latter going much harder before sharply reopening.

In fact, many of our GEARs imply activity congregating around this ‘5 per cent below baseline’ level, excluding the main laggards (fragile EMs and the UK). Other high-frequency indicators and forecasts have suggested that 5 per cent below normal might prove to be a socially-distanced ceiling in the West. As such, it will be pivotal to see if growth indicators start to drop back towards zero (or below) in coming months, or if further progress is possible as we get used to growing in the ‘new normal’.

|

|

|

|

.jpg)