When Warren Buffet thinks about investing his approach is to “Only buy something that you’d be perfectly happy to hold if the market shut down for ten years”. If you take this advice you would only have your buy price on day one and your sell price some ten years down the track. This would mean you would completely miss all the market noise: the gyrations and the fads and fashions of a market moving between fear and greed. This famous quote came to mind recently when Oracle made public its takeover offer for Aconex.

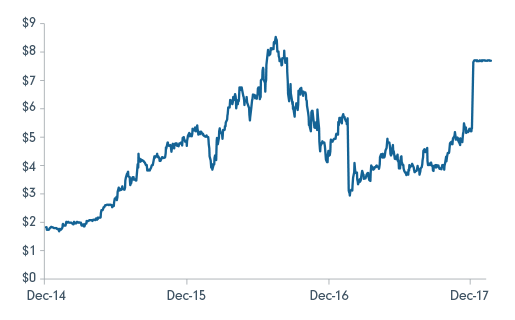

Aconex has experienced a rollercoaster ride on the ASX; from depression to excitement to depression and back again. But at the end of the day the stock has gone from an IPO price of $1.90 to a takeover bid of $7.80 in just over three years - a return of 410%. While the gyrations in between have been all about sentiment and fads and fashions the difference between the IPO price and takeover offer is all about fundamentals and that’s what drives long-term investing.

Chart 1: Aconex share price

Source: Thomson Reuters Datastream, 2 February 2018

Founded in 2000, Aconex provides cloud based collaboration software to manage project information, correspondence and processes. The architectural, design and project drawings and plans for construction projects are kept in the cloud rather than on paper which allows the contractors, builders, designers and project managers to access via the cloud rather than view paper documents. This solution is relatively low cost but offers substantial productivity gains for everyone involved in the project and construction chain. Large construction firms which trialed the software were quick to implement it more broadly.

At Fidelity we purchased approximately 10% of Aconex at and shortly after the initial public offer (IPO). We were very attracted to the long term fundamentals and believed that the software had a great opportunity to gain a large share of the global construction industry. Relatively low cost coupled with high productivity gains meant that customers simply couldn’t afford not to adopt it in such a highly competitive industry.

Interestingly the IPO had to be scaled back due to limited investor interest with the stock traded down to a low of around $1.65. The impacts of sentiment and ‘fashion’ were felt as early as day one! As investors became familiar with the structural growth story and opportunities for Aconex however the stock price slowly gained momentum and delivered good first year returns.

After this strong start, the company started to miss what were very high market consensus estimates due to a cyclical downturn in the overall global construction industry. This brought concerns around valuation, cash flows and earnings growth. When investing for the long-term we are continually asking ourselves the question whether it is cyclical or structural forces that are driving companies’ sales and earnings. The cyclical downturn in the industry would have no impact on the long-term value of the business and we maintained an approximate 10% holding in Aconex up to the $7.80 takeover bid by Oracle. By not worrying about cyclical issues and focusing on the structural growth, investors in the Fidelity Australian Equities Fund have benefited from this longer-term approach.

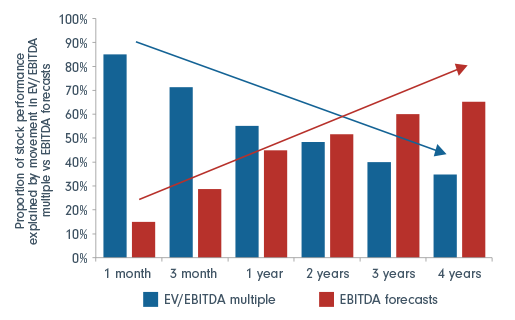

Research has shown (refer to chart 2) that in the first two years its largely sentiment or ‘fashion”, that drives stock prices through valuation changes but over a longer period it’s fundamentals and primarily earnings growth that drives stock prices. Long term investing is the ability to leave these fads, fashions and market noise aside and focus on fundamentals and long term earnings growth.

Chart 2: Changes of valuations vs changes in earnings

Source: Goldman Sachs. Proportion of shareholder return for explained by changes in valuation multiple (EV/EBITDA) vs. Change in earnings (EBITDA) forecasts. Based on the top 600 largest listed companies globally since 2010. Figures do not sum to 100. Holding period returns are the average of multiple holding periods between 2010 and 2015. As at January 2016.

The Fidelity Australian Equities Fund has a five year investment horizon. I’m continually asking not only is this cyclical or structural but is this going to be a better more valuable business in five years’ time? The Fund also has around a 20% turnover ratio, which means I’m doing what I say I’m going to do and have a holding period of five years for my investments. We’re not trading but rather making long term investments based on fundamentals - investing in companies that have structural growth opportunities at attractive valuations and supporting these companies over time to see higher earnings growth realised. This keeps turnover low, trading costs low and makes the fund more tax efficient.

We all know that we need to focus on the fundamentals and the long term but that’s often easier said than done when you’re surrounded by the market noise trying to force you to trade. By taking Warren Buffet’s advice and only focusing on companies that we’d be happy to hold if the market were to close for ten years we insulate ourselves from fads and fashions and reap the benefit of staying on course.