The Market

The China–US trade dispute has clearly driven market sentiment over the last couple of weeks and looks set to be the dominant news item for markets over the coming months. Following Trump’s tweet that indicated a trade deal was not set in stone, markets have fallen, led by China A shares, with the CSI 300 index down 6% since 31 March.

There’s little doubt this dispute will lead to greater volatility if a viable solution isn’t found. Unfortunately, this is unlikely given the structural issues the US has with China; its growing economic and political influence, technological leadership in strategic areas like AI and automation, plus government support for industries – aren’t going to vanish overnight.

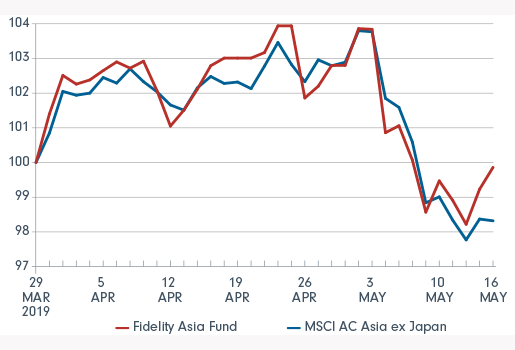

Fund performance

Given our high A-share exposure (currently 29.8%), you’d expect the fund to have had a rough ride, but the portfolio is currently up ~0.6% vs the index since the end of Q1.

Performance has surprised

Source: Fidelity International, 2019

Kweichow Moutai (liquor production and distribution) and Midea (electrical appliance manufacturer) have been the biggest contributors to performance so far in Q2 (with the caveat that Kweichow Moutai is down around 8% from its April peak). Strong earnings in April for both companies have so far managed to outweigh the recent negative sentiment towards China. Interestingly in a recent trip to Beijing we learned that Kweichow Moutai has trimmed the number of wholesale distributors they deal with by around 400-500 nationwide which could suggest a tighter management of supply and consequently a potential price increase.

On the negative side, holdings in China Petroleum & Chemical (integrated oil major and large refiner) and SK Innovation (oil refinery) have detracted from performance. Neither reported the most inspiring Q1 results and oil has been fairly volatile. But it’s more likely that an ugly outlook for first half refining margins due to a global gasoline glut has been the biggest drag on stocks. The outlook for later in the year, however, is much brighter due to International Maritime Organisation (IMO) 2020 regulations that will require ships to run on higher grade refined oil – a positive for margins.

If you’d like more detail around IMO regulations this podcast is really useful.

What changes have been made?

There haven’t been many changes to the portfolio but last week did see us initiate our first new position for over six months, bringing the number of stocks up to 24. Unfortunately, I can’t disclose the name as it’s still being traded, but I can tell you it’s another A-share we’ve had on the watchlist for some time, which took a 26% dive from its 2019 peak amid all of the trade talk – despite a huge and growing domestic market for its product.

We’ve also added to our existing holding in Zhejiang Sanhua. I’ve made some comments on this below but basically, this is a great company. They manufacture temperature valves that go into refrigerators and air conditioning units. Admittedly a fairly boring product, but they now have such scale and multiple patents that it is hard for anyone to enter the market or even contemplate spending the money to try.

Zhejiang may additionally see increased demand from the take-up of electric vehicles. Standard combustion engine cars use the engine to help power the car’s air conditioner, but electrical vehicles don’t have an engine, meaning a new cooling system is needed that requires multiple specialist temperature valves. Currently Zhejiang is the sole provider of temperature valves for electric vehicle manufacturers such as Tesla.

As always, my focus is on stocks

Below are the Top ten active positions for the Fidelity Asia Fund as at 30 April 2019 versus the benchmark*

- Kweichow Moutai, 9.6% vs 0.1%: Its highly-regarded product continues to have robust demand. The strong brand helps the company maintain its pricing power making it a structural growth opportunity in the Chinese consumption space. Valuation remains supportive.

- HDFC Bank, 9.1% vs 0.0%: This well-managed bank has strong exposure to consumer lending. It has a consistently high return on equity, a strong balance sheet and the best asset quality among Indian banks.

- AIA Group, 9.8% vs 2.6%: This regional insurance provider benefits from a resilient business model and unique competitive position in Asia. Further liberalisation of the Chinese financial sector should prove beneficial.

- China Petroleum & Chemical Corporation, 6.7% vs 0.4%: The company is held given its strong cash flow generation, supportive valuation and positive oil price outlook. It also offers encouraging prospects for unlocking value from its marketing business and through capital management.

- BOC Aviation, 5.1% vs 0.0%: This aircraft leasing manufacturer is favoured as it is a defensive play given the resilient nature of its business, high quality aircraft assets, diversified global operations and healthy dividend yields.

- Sun Hung Kai Properties, 5.5% vs 0.6%: The Hong Kong-based property developer benefits from a supply constrained Grade-A office market in HK with a likely improvement in retail rents. It enjoys strong execution capabilities, farmland conversion potential, high quality property assets and healthy earnings visibility. The stock trades at a wider than historical average discount to NAV due to concerns about rising interest rates, but its strong balance sheet means it can adopt capital management initiatives which are likely to be value accretive to shareholders.

- Han's Laser Technology, 4.6% vs 0.0%: The company is favoured for its impressive fundamentals and long-term growth prospects driven by increasing self-production of key components and product upgrades. Its strategy to reduce reliance on revenue from Apple is likely to bolster future earnings visibility.

- Midea, 3.9% vs 0.0%: The electrical appliance maker is well-positioned to benefit from market share gains in China and further penetration into the robotics and personal small appliance sectors.

- Taiwan Semiconductor Manufacturing Co, 8.2% vs 4.3%: This global foundry leader is held for its superior technology, strong position in a favourable industry structure, solid earnings visibility, good cash flow and sustainable yields.

- Zhejiang Sanhua, 3.8% vs 0.0%: The company is a manufacturer of refrigeration parts and components. Its global presence and rapid growth potential in the alternative fuel vehicle (AFV) market position it well to mitigate headwinds from falling demand for air conditioners (ACs) in China. Sanhua is the sole provider of temperature valves for electric vehicle manufacturers such as Tesla.

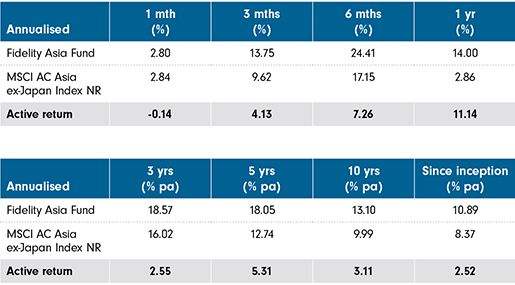

Table 1: Performance as at 30 April 2019

Source: Fidelity International

* MSCI AC Asia ex-Japan Index NR