US mid-caps have solid fundamentals and attractive valuations. We believe they represent a good option for investors looking for exposure to US equities without technology mega caps, which may be running out of steam.

There has been a lot of focus on US mega caps in the last few months. We believe the US remains the best regional opportunity in developed equity markets. Strong earnings in key sectors are supporting the market, the economy looks set for a ‘soft landing’, and inflation is now sufficiently under control to allow interest rate cuts.

However, there are signs that the US mega caps rally that has dominated markets for so long might be running out of steam. Companies have found themselves struggling to beat ever-higher expectations, and many investors are now questioning if their lofty valuations are justified in the near term. There are indications that some market participants are rotating away from the very largest companies and into the rest of the market.

One area that we think presents a good opportunity is US mid-caps, which offer exposure to the US economy and have solid fundamentals and historically attractive valuations.

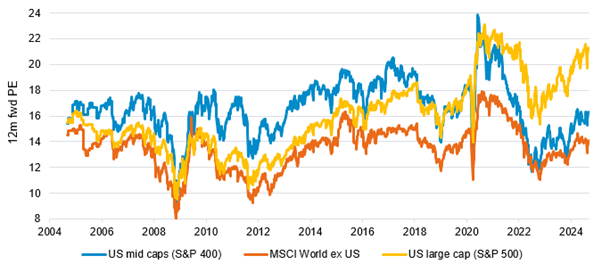

Despite being comprised of good quality US companies with a strong structural growth outlook, the mid cap index trades at nearly the same valuation as the World-ex-US stock universe. This unusual scenario presents a significant opportunity, as a reversion to the median could lead to mid-cap price/earnings (P/E) outperforming by 15-20%.

The compelling valuations of US mid-caps are also evident when compared to the overall US stock market. For decades mid-caps traded at a premium to the broader market, but this has now reversed. During the period of excitement in late 2020, US large caps and mid-caps both traded at a P/E of around 22. However, in the years that followed, mid cap valuations drifted down to their cheapest since the 2008 financial crisis. They have now recovered somewhat to 16, but still trade below their 10-year average.

Conversely, US large cap valuations have bounced back to over 20, roughly 20% above their 10-year term average, while US tech has recently hit a post-dot-com-era high of 30, which highlights the attractiveness of US mid-caps from a valuation perspective.

|

US mid-caps offer solid fundamentals at an attractive price |

|

|

The fundamentals of US mid-caps also look positive. The US economy remains on a solid footing, despite some signs that data is cooling, and the US is still the primary engine of global growth. US mid-caps are typically good quality companies - they tend to have robust sales and earnings growth and a majority of companies in the universe have a BBB/BB credit rating or stronger, and a healthy pay-out ratio to investors. This means that mid-caps should prove resilient even if growth were to wobble more significantly.

A further point to make is that there are signs that the largest US companies, which have dominated equity markets for the past decade, could be running out of steam. Allocating to US mid-caps allows investors to retain their exposure to the US economy but avoids exposure to the US tech mega caps.

Mid-caps are not immune from broader cyclicality. Their performance is linked to the US economy, so the possibility that growth slows faster than we expect is a risk. However, we believe US mid-caps represent a compelling value proposition for investors who want to retain upside participation in US equities but are mindful of stretched valuations and overly optimistic expectations surrounding US mega caps.