In this period of geopolitical, fiscal, and trade uncertainty, it remains our view that there is an important role for a defensively positioned portfolio to play within a strategic asset allocation. Whilst there are admittedly valid concerns surrounding the US, which we will explore at length in this piece, we would like to start by reiterating to our clients that we believe that the US is irreplaceable as the largest, most liquid market available to investors. We expect demand for US bonds will remain resilient throughout the current uncertainties (and any further uncertainties as they arise).

From a total and excess return perspective, it is also worth emphasising that H1 has been a promising start to the year for the Fidelity Global Bond Fund. Performance has been strong in a challenging market context, with persistent volatility and numerous unknowns.

How are we viewing US IG credit? And how have we been capitalising on opportunities in this environment?

Whilst we have remained defensively positioned in H1 (and will likely continue to do so at current levels), we have been nimble and active in response to market events following ‘liberation day.’ We have been dialling up and down our long US duration and underweight credit positions, and importantly, both positions have positively contributed to alpha generation during this period.

Although US investment grade (IG) credit spreads are marginally wider year-to-date, valuations are still extreme from a historical perspective. Since 2006, spreads have only been tighter on 1% of occasions. At these levels, we think spreads do not adequately compensate for the risks ahead and are at odds with our current views on the macro landscape. We do however fully acknowledge that it is highly likely that technical factors will remain supportive in the short term, given the strong demand from all-in yield buyers (annuity providers / institutional hold-to-maturity investors) and excess cash on the sidelines as 5-year paper issued during the pandemic era matures.

Combined with the valuation and technical landscape for US IG credit, from a risk-reward perspective, we are comfortable remaining underweight credit at a portfolio level. We are continuing to focus on delivering alpha from the bottom-up, as we have been doing so far this year, with the support of our credit analyst team.

To better animate this, if we go back to the ‘liberation day’ selloffs, spreads indiscriminately widened across the market, despite some sectors being more exposed to tariff and geopolitical risks than others. In the context of this widening, we increased our positions in select, high-quality banks at attractive levels in the primary markets, as we believed they would benefit from heightened market volatility through increased trading volumes. When the market stabilised and spreads looked set to retrace their moves, we then took profits and reduced these positions.

We similarly increased exposure to select domestic energy names during the selloff, focusing on the midstream (pipelines) energy subsector, where issuers are high-quality, generally more stable and are materially sheltered from tariff risks and oil price fluctuations. We increased positions in names where we felt spread widening was driven by market sentiment rather than a deterioration in fundamentals and was therefore likely to tighten again. When spreads retraced back to our estimate of fair value, we took profits and reduced our overweight in these names.

Taking opportunities in the autos sector is another theme that we have been playing this year in our credit positioning. Over the longer term, we believe European autos Original Equipment Manufacturers (OEMs) are under increasing threat from the more compelling models and prices of Chinese electric vehicle (EV) manufacturers. For some time, we have had a material underweight to even the USD bonds issued by European autos manufacturers, but we have recently tactically increased our exposure to these companies. Valuations have widened enough to be attractive over the last few months, so we are taking the opportunity in the short term to play this market dislocation, while maintaining our structural underweight in the long term.

What are our expectations for H2?

During 2024, our expectation was for a material softening in the labour market. While this played out in some sectors, the strength of healthcare and government employment ultimately led to job creation in the US appearing much more robust than it actually was. While we were early on this call, in our view the underlying fragilities of the labour market have further increased this year, given the uncertainty surrounding tariffs.

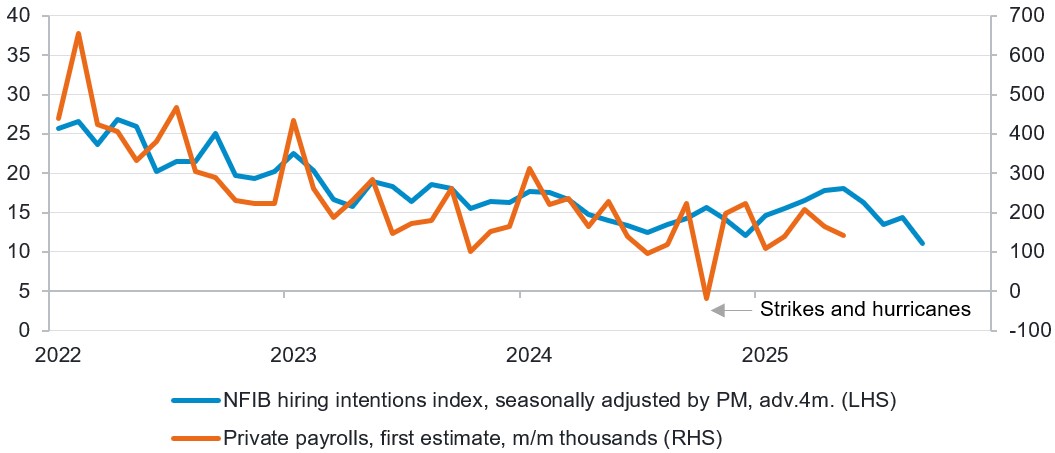

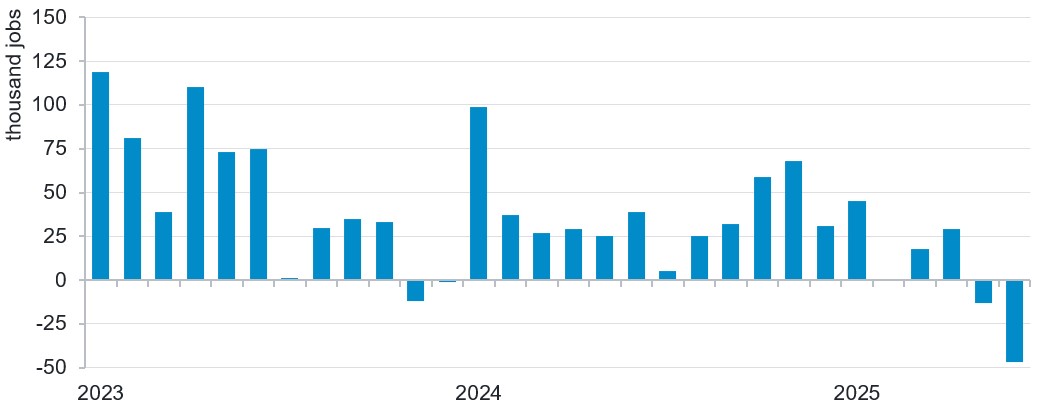

Admittedly, headline data has at times this year continued to paint a more positive picture of the labour market, and we can say with confidence that data points will continue to be ‘noisy’ going forward. One of the key factors driving our view around the labour market, which does not immediately play out in the headline data prints, is the strain on small businesses (given that these businesses typically report later than larger firms). These smaller businesses currently face high financing costs, paralysing uncertainties around trade policies, and growing economic weakness in their customers, all of which will weigh on their demand for labour going forward. This is significant given that they employ the majority of the American workforce. When digging a little further into the underlying data, our view is supported by soft data; hiring intentions have declined in this context and the change in private-sector employment for firms employing fewer than 50 workers has recently turned negative.

In this period of geopolitical, fiscal, and trade uncertainty, it remains our view that there is an important role for a defensively positioned portfolio to play within a strategic asset allocation. Whilst there are admittedly valid concerns surrounding the US, which we will explore at length in this piece, we would like to start by reiterating to our clients that we believe that the US is irreplaceable as the largest, most liquid market available to investors. We expect demand for US bonds will remain resilient throughout the current uncertainties (and any further uncertainties as they arise).

From a total and excess return perspective, it is also worth emphasising that H1 has been a promising start to the year for the fund. Performance has been strong in a challenging market context, with persistent volatility and numerous unknowns.

How are we viewing US IG credit? And how have we been capitalising on opportunities in this environment?

Whilst we have remained defensively positioned in H1 (and will likely continue to do so at current levels), we have been nimble and active in response to market events following ‘liberation day.’ We have been dialling up and down our long US duration and underweight credit positions, and importantly, both positions have positively contributed to alpha generation during this period.

Although US investment grade (IG) credit spreads are marginally wider year-to-date, valuations are still extreme from a historical perspective. Since 2006, spreads have only been tighter on 1% of occasions. At these levels, we think spreads do not adequately compensate for the risks ahead and are at odds with our current views on the macro landscape. We do however fully acknowledge that it is highly likely that technical factors will remain supportive in the short term, given the strong demand from all-in yield buyers (annuity providers / institutional hold-to-maturity investors) and excess cash on the sidelines as 5-year paper issued during the pandemic era matures.

Combined with the valuation and technical landscape for US IG credit, from a risk-reward perspective, we are comfortable remaining underweight credit at a portfolio level. We are continuing to focus on delivering alpha from the bottom-up, as we have been doing so far this year, with the support of our credit analyst team.

To better animate this, if we go back to the ‘liberation day’ selloffs, spreads indiscriminately widened across the market, despite some sectors being more exposed to tariff and geopolitical risks than others. In the context of this widening, we increased our positions in select, high-quality banks at attractive levels in the primary markets, as we believed they would benefit from heightened market volatility through increased trading volumes. When the market stabilised and spreads looked set to retrace their moves, we then took profits and reduced these positions.

We similarly increased exposure to select domestic energy names during the selloff, focusing on the midstream (pipelines) energy subsector, where issuers are high-quality, generally more stable and are materially sheltered from tariff risks and oil price fluctuations. We increased positions in names where we felt spread widening was driven by market sentiment rather than a deterioration in fundamentals and was therefore likely to tighten again. When spreads retraced back to our estimate of fair value, we took profits and reduced our overweight in these names.

Taking opportunities in the autos sector is another theme that we have been playing this year in our credit positioning. Over the longer term, we believe European autos Original Equipment Manufacturers (OEMs) are under increasing threat from the more compelling models and prices of Chinese electric vehicle (EV) manufacturers. For some time, we have had a material underweight to even the USD bonds issued by European autos manufacturers, but we have recently tactically increased our exposure to these companies. Valuations have widened enough to be attractive over the last few months, so we are taking the opportunity in the short term to play this market dislocation, while maintaining our structural underweight in the long term.

What are our expectations for H2?

During 2024, our expectation was for a material softening in the labour market. While this played out in some sectors, the strength of healthcare and government employment ultimately led to job creation in the US appearing much more robust than it actually was. While we were early on this call, in our view the underlying fragilities of the labour market have further increased this year, given the uncertainty surrounding tariffs.

Admittedly, headline data has at times this year continued to paint a more positive picture of the labour market, and we can say with confidence that data points will continue to be ‘noisy’ going forward. One of the key factors driving our view around the labour market, which does not immediately play out in the headline data prints, is the strain on small businesses (given that these businesses typically report later than larger firms). These smaller businesses currently face high financing costs, paralysing uncertainties around trade policies, and growing economic weakness in their customers, all of which will weigh on their demand for labour going forward. This is significant given that they employ the majority of the American workforce. When digging a little further into the underlying data, our view is supported by soft data; hiring intentions have declined in this context and the change in private-sector employment for firms employing fewer than 50 workers has recently turned negative.

Small businesses are slamming the brakes on new hiring

Source: Fidelity International, Pantheon Macroeconomics. June 2025.

There has been a marked fall in the monthly change in private-sector employment for firms employing fewer than 50 workers

Source: Fidelity International, Wall Street Journal. June 2025.

We have held the view for some time that we would see a slowdown in growth led by the underlying weakness from a US consumer who had already depleted their excess pandemic savings to maintain consumption in response to inflation. This is significant given that US consumer spending accounts for around 70% of US GDP and therefore any slowdown naturally weighs on growth at home and globally. This weakness has largely played out in the lower income cohorts, but we were surprised by the continued strength of the wealthiest 20%. They have continued to consume, driven by a wealth effect from broadly buoyant stock markets and house prices, and are likely to remain robust. This contributes to the perception that the US economy is on solid footing, but our more bearish outlook is marginally driven by the increasingly weakening 40th-80th income percentile of the US consumer. We are closely monitoring their excess savings rates, which are now falling below pre-pandemic levels. Recent market volatility is not likely to have benefited the consumer; market and consumer confidence has been materially dented by the uncertainty in the economic outlook, which should lead to a slowdown in spending and therefore in growth.

Our base case scenario is 75 basis points (bps) of cuts this year from the Federal Reserve. A tail risk scenario that we are actively monitoring however, and one that in our view is underappreciated by the market, is the full extent to which rates would need to be cut in the event of a material slowdown or recession. Whilst a slowdown of this magnitude is not our base case, if this does play out, given the structure of the US mortgage market where 75% of households have a mortgage at rates below 5% (after a refinancing wave during the pandemic), we believe a few 25bp cuts would have almost no impact. Current 30-year mortgage rates are in excess of ~7% (i.e. the 100bps of cuts late last year has done little to help households). In this recessionary scenario, cuts would need to be in the magnitude of 150-200bps to support the economy via a refinancing wave. Given our slight long US duration position, we are well positioned in the event of such an economic slowdown. Our defensive exposure to credit also ensures we have the liquidity and flexibility to add risk into market dislocation scenarios, where valuations are more attractive. A deterioration in hard economic data and more aggressive rate cuts than expected would likely dampen the strong demand technical which has been supportive of credit spreads for some time.

Have US Treasuries lost their safe-haven status?

To put it bluntly, we fundamentally do not agree with this statement. Understandably, the valid concerns that our clients have typically centre around the recent US credit downgrade from Moody’s, the size of the US fiscal deficit, and questions around overseas demand for Treasuries, which we will explore further below.

To begin with the first point, the US had been on ‘negative watch’ from Moody’s for around 18 months prior to the downgrade over concerns around the fiscal landscape so this was not necessarily unexpected. In addition to this, Moody’s has recently highlighted the ‘exceptional credit strengths’ the US still has, including ‘the size, resilience and dynamism of its economy and the role of the US dollar as the global reserve currency.’ The size, liquidity and strength of the US market is unparallelled and irreplaceable and we therefore expect US Treasuries and credit to remain a key allocation globally. It is also worth noting that despite ongoing noise, there are still compelling arguments for US exceptionalism which we believe will be challenging for investors looking to materially diversity away from the US.

Regarding the fiscal deficit, while we are concerned about the increase here given projections of a deficit of ~7% over the next few years, it is important to break this number down. In the most simplistic terms, this ~7% forecast can be halved into ~3.5% from interest payments on Treasury debt and ~3.5% from fiscal spending. As we move closer to (possibly a series of) Fed cuts, interest expenses will fall, therefore reducing the size of the deficit. This would limit concerns from bond markets about the debt to GDP ratio. What concerns us more and has done for quite some time, is that in a scenario where the US economy weakens, any fiscal support is now likely to be much smaller and less forthcoming than in previous crises, as the government will simply have less fiscal headroom to spend.

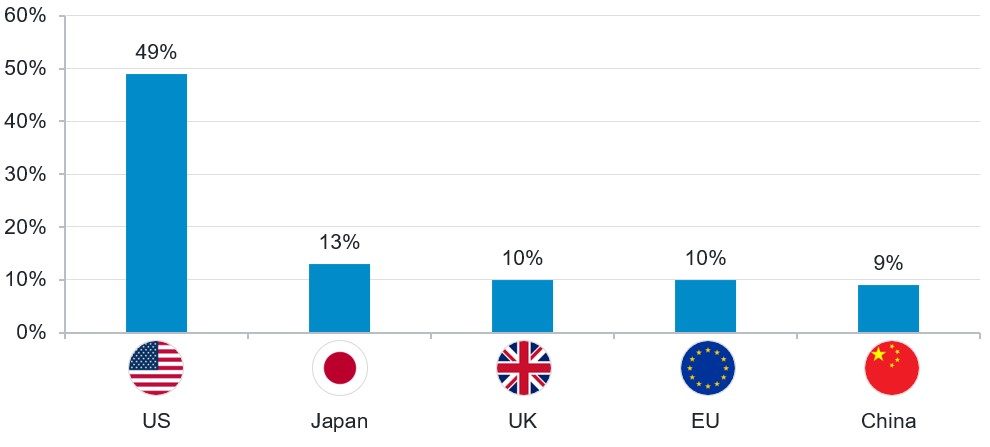

With deficit projection this high, it is no secret that the US will need to issue heavily in the bond market. Understandably, there has been some concern that recent geopolitical events have limited overseas demand for US Treasuries. As a starting point, we would highlight that the trend of Japanese and Chinese institutional investors slightly reducing their allocation to the US has already been taking place for some years now, with a limited impact on overall demand.

To further build on the above, what provides us with a high degree of comfort in the resilience of demand for US Treasuries going forward is the composition of domestic wealth. For instance, compared to the rest of the world, US households have a much higher allocation to equities, so there is material capacity for US domestic investors to increase their allocation to fixed income. To put this in perspective, a 1% increase in US domestic allocations to fixed income would likely fund the increased US Treasury issuance for the next 2-3 years. There are numerous ways this small asset allocation shift could happen. An organic increase is likely, with attractive yields on US Treasuries inducing pensions, insurance and multi manager accounts to increase their allocations, limiting the need for individual investors to actively switch, or there may be some form of tax incentive from the US government.

US households' allocation to equities is very high relative to other countries

Source: Fidelity International, Goldman Sachs Global Investment Research. June 2025.

To conclude, whilst there are many unknowns ahead, and concerns around the US are just, we remain convinced that should the US economy weaken enough to trigger a flight to quality, US Treasuries are well positioned relative to risk assets to deliver a positive total return. We would reiterate that there are no viable alternatives to Treasuries, so we expect a very limited change in demand in the long term.