In this market environment where headlines are rampant and political developments continue to emerge, one macroeconomic event stands out from the others; the US Federal Reserve (Fed) has restarted its easing cycle. In this article we discuss why this was expected, what it means for fixed income globally, and how we are positioning to take full advantage of market moves.

Key points

- The Fed has restarted easing, cutting rates to 4–4.25% amid a weakening labour market and a consumer squeeze; given the mortgage market’s structure, single 25 bp cuts have limited impact, so more easing is likely needed.

- Markets see additional cuts this year; the authors expect at least three to materially support growth, especially as small businesses face high borrowing costs and private credit could retreat in a slowdown.

- A US slowdown typically drags global growth with a 3–6 month lag; while the ECB may diverge, significant Fed cuts could constrain it, and lower US rates/softer dollar may ease global financial conditions and support EMs.

- Fixed income stance: long US duration and overweight European duration; expect lower Treasury yields, stay selective and defensive in credit with spreads at post‑GFC tights, and keep liquidity to deploy if spreads widen.

Why did the Fed cut US interest rates?

In mid-September, the Fed announced that it would cut rates from 4-4.25%. This was the first rate cut since December last year and was primarily driven by concerns about a weakening US labour market, in response to weaker than expected jobs data. By cutting rates, the Fed hopes to stimulate the economy and encourage investment, by reducing borrowing costs.

This decision comes amid signs of broader economic challenges. Policy disruptions, including ongoing tariff negotiations are impacting the US labour market. Companies are finding it more difficult to pass on higher costs from tariffs to consumers, inspiring more cautious hiring practices, contributing to the Fed's concerns about "downside risks to employment."

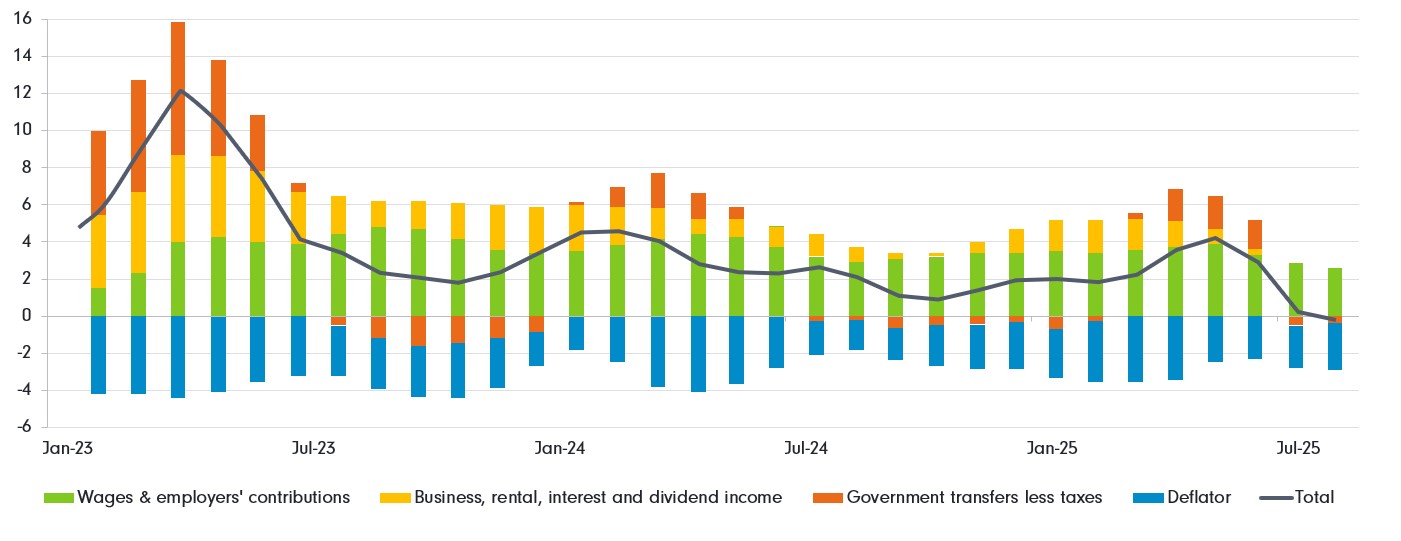

We have held the view for some time that we would see a slowdown in growth led by the underlying weakness from a US consumer who had already depleted their excess pandemic savings to maintain consumption in response to inflation. Given that US consumer spending drives around 70% of US GDP growth, the outlook here is a key determinant of the direction of the US economy. We are currently seeing an unusual situation where the middle-income consumer is facing a real income squeeze, with wage growth tracking lower than inflation. This has not been seen for over 10 years, excluding the 2021 pandemic-era inflation surge.

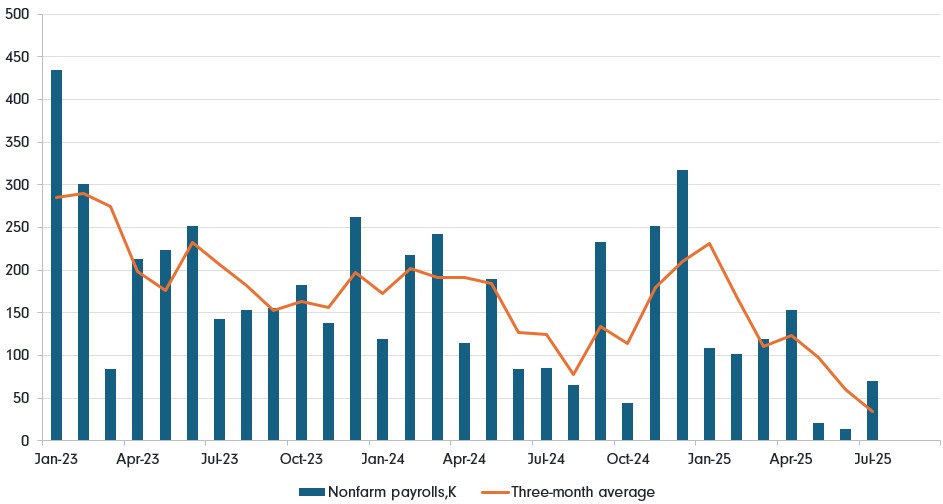

The pressure we have begun to see in the labour market, with a series of payroll prints falling below expectations and significant revisions to prior prints, will only exacerbate this burden on the consumer. Other evidence for this weakness in the labour market includes a marked fall in the monthly change in private-sector employment for firms employing fewer than 50 workers, and a downward trend in the rate of US workers leaving their jobs, highlighting that American worker confidence in finding new employment is low.

Will this rate cutting cycle continue?

The market is pricing in a further two rate cuts by the end of this year, and economic projections released alongside the rate cut decision showed that most of the central bank's top leaders anticipate at least two further quarter-point reductions by the end of 2025. This is more cuts than in previous forecasts earlier in the year.

Our base case is that at least three cuts will be needed to have a materially stimulatory effect on the US economy however, dependant on upcoming jobs data from the US. This is due to the unique structure of the US housing market. A key way this monetary policy impacts the real economy is through the housing market, lowering mortgage costs so people have more disposable income. However, in the US there is a unique structure where the current rate on new mortgages, typically with a 30-year term, is around 2% greater than the effective rate on existing mortgages, so a 0.25% cut may not provide any support.

Payroll growth has slowed sharply in the US

Source: Fidelity International, Pantheon Macro. August 2025

The small business sector in the US is also a crucial part of the economy, which currently faces high rates on business loans. This has been supported to an extent by the growth of private credit lending which would also most likely pull back in a slowdown scenario, requiring support in the form of a larger number of interest rate cuts.

Real after-tax income, 3m/3m% annualised

Source: Fidelity International, Pantheon Macro. August 2025

What does this mean for the rest of the world?

Today, the US remains the engine of global growth, so a slowdown there inevitably carries implications worldwide. When they ‘catch a cold’, the pull down in growth inevitably spreads globally, typically with a 3-6 month lag. A softer US economy could also dampen demand for exports from major trading partners.

Whilst the European Central Bank’s (ECB) deposit rate trajectory is likely to diverge from that of the Fed, it is likely that meaningful cuts from the Fed would tie the ECB’s hands.

However, lower US rates may also ease financial conditions globally. Emerging markets and other economies that have struggled with higher borrowing costs could see relief, while an even weaker US dollar may provide support for global trade.

How can fixed income perform in this environment?

We have a range of globally diversified positions in the Fidelity Global Bond Fund, including a long to US duration, as well as an overweight position on European duration. As Fed cuts continue, we expect US Treasury yields to continue the broad path downwards they have been on since the beginning of this year, as investors look for safe haven assets, and additional Fed cuts are priced in.

Given current market conditions and heightened geopolitical risk, we also think that global credit spreads, at post GFC tights, do not offer a particularly attractive risk/reward trade off. We are continuing to be highly selective about the fundamental strength of the credits we invest in, focusing on high quality and defensive name. In the event of spread widening, which is likely to coincide with a potential downturn in the US economy, we hold a significant portion of our holdings in highly liquid assets like cash and commercial paper, so we can pivot and take the opportunity to add to credit holdings at more attractive valuations.

Global IG spreads have fully retraced April’s widening

Source: Fidelity International, Bloomberg, September 2025. Indices used are G0BC, C0A0, UR00, ER00 and ADIG.

In this period of geopolitical, fiscal, and trade uncertainty, there is a very important role for a globally diversified and defensively positioned portfolio to play within a strategic asset allocation.