This article first appeared in Livewire Markets on 6 January 2023

Falling apples tell us a lot about market valuations as rates increase

There are currently two broad schools of thought on the Australian economic outlook. One more bearish focused on interest rates, housing, global slowdown effects, consumer cost of living crisis, inflation, and potential recession in 2023. The alternative scenario is a mild case of a consumer adjustment, softer housing declines, peaking in interest rate hikes and peak inflation leading to a slowing down in Australia for 2023.

Regardless of your position on growth in 2023, it is likely that there will be strong valuation discipline running through all equity assets and business investment in Australia that will likely hold throughout the year.

There’s an unusual culmination in equity market valuations we’ve not seen for many years. Discount factors such as high inflation (labour, commodities, food and transport), economic downturn concerns, and higher interest rates are all leading to a period of very low valuation multiples across the Australian small and mid-cap market. It reminds me of Warren Buffet’s observation “Interest rates are to asset prices what gravity is to the apple. When there are low interest rates, there is a very low gravitational pull on asset prices.”

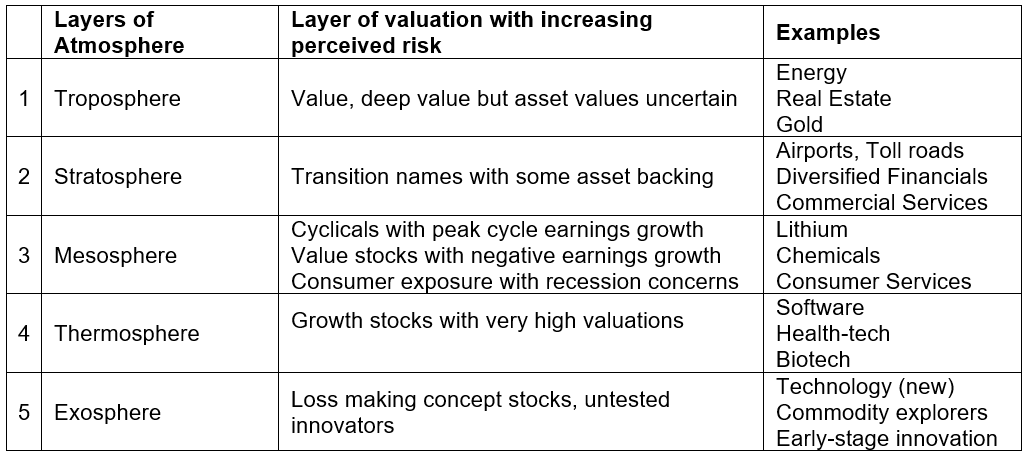

Buffet’s concept of gravity can help compare many market observations and shifts over the last 12 months versus the past ten years. If we compare these forces to earth and its atmospheric layers, the valuation reality by which equity markets have been dragged down by can be viewed in the following construct:

The current valuation discipline is likely to stay in place for the next 12 months if inflation and interest rates remain elevated. Those higher on this risk spectrum, and further away from providing investors with comfort of cash flows, earnings certainty, dividends, returns on capital or a poor ability to provide outlook statements will likely be challenged to perform in the current market.

During the recent reporting season, there were numerous profit warnings in consumer services, retail, energy producers, commodity producers, health services and bio-tech. Most were due to increasing costs that couldn’t be passed on through the value chain or to consumers due to competition, timing of product costing and delivery, or competitive market structures. This economic environment is likely to persist for the next 6-12 months. For investors, this will require a prudent approach to valuation parameters and a stronger focus on market structures or pricing power.

Revenue is Vanity, Profit is Sanity, but Cash is King

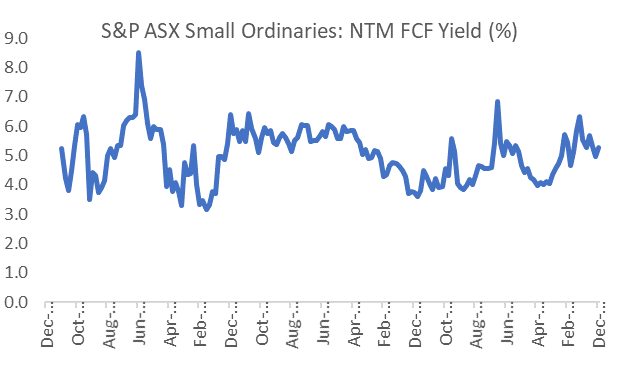

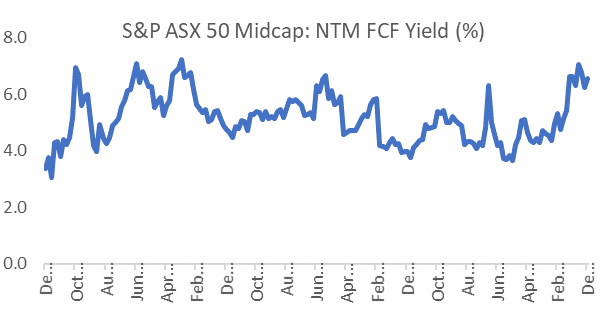

The increasing scope of earnings uncertainty in Australian small and mid-cap universe has led to valuation levels that have only been seen four or five times in the last 15 years. Current free cash flow (FCF) yields for Australian small-caps are in line with 15-year averages at around 5%. FCF yields for Australian mid-caps are higher, sitting around 6%. These levels provide some comfort that small to mid-caps remain attractive at an index level. Despite this, stock picking will likely be critical in the current period as earnings and valuation risks remain heightened and a longer-term mindset is expected to be required to look through the current period of high volatility.

Source: As at 12 December 2022, FactSet

Source: As at 12 December 2022, FactSet

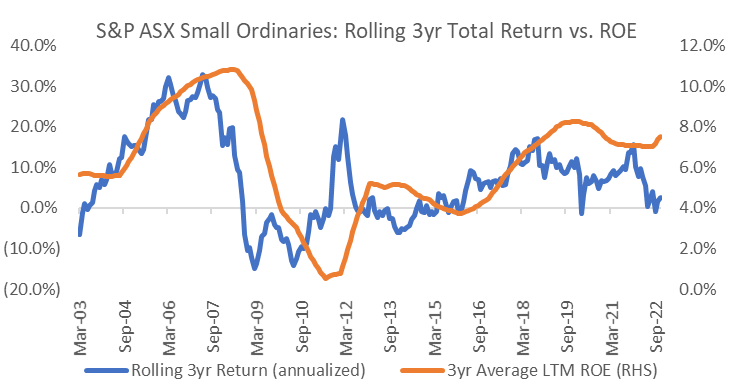

If we look at the correlation between the 3-year rolling return on equity (ROE) over the last 15 years for Australian small and mid-caps below, mid-caps look attractive given the higher level of return on equity as well as the higher free cash flow yield as illustrated above.

Source: As at 12 December 2022, FactSet

Source: As at 12 December 2022, FactSet

Over the last five years in small to mid-caps, we’ve witnessed some rapid shifts in sentiment and styles from quality growth, momentum themes and value. Leadership has traditionally been led by technology, healthcare, consumer and industrials but, in contrast, over the last six months it’s been led by materials (electric vehicle resources), energy (coal) and selective healthcare and software.

Looking ahead, the next 12 months will be led by companies that demonstrate earnings growth, cash flow delivery and confident and visible outlooks. It is considered essential to find long-term winners rather than getting swayed by market momentum, which shifts season to season and often fails to deliver in a demanding environment.