When economies slow central banks have several tools to tackle these challenges. One of the most powerful of these is to cut interest rates.

When rates are lowered, companies and citizens are more inclined to borrow money – whether to invest in business expansion, buy a house, or purchase high-value goods. The net effect is that people spend more, and economic activity increases.

For investors, it is important to be aware of both the current interest rate environment and market expectations surrounding the future direction of interest rates. There is a strong relationship between rates and investment returns. Understanding that interplay can help investors navigate change, find sources of income, and maximise returns in a low-rate environment.

The positive news is that certain types of assets have historically performed well when rates drop.

Bonds – the prospect of a regular income

Rate increases have historically not been kind to bondholders. When rates rise, bond prices typically drop, and unsurprisingly, some fixed income investments struggle amid elevated borrowing costs. However, bond markets usually recover when a rate-hiking cycle ends and interest rates start to fall (or when market expectations for rate cuts gather momentum).

Existing bondholders who invest while rates are elevated and bond prices are low should continue to enjoy higher yields and regular income payments. If and when rate cuts begin, the value of those bonds will likely increase.

New investors who anticipate rates will fall might buy high-quality government or corporate bonds before rates drop to benefit from lower prices, higher yields, the prospect of regular income, rising prices, and an extended period of higher total returns.

Dividend and sector stocks – could help offset losses

Historically, stock values initially decline when a downturn strikes and economies slide into recession. This doesn’t necessarily mean that investors should retreat from the equity market.

High-quality stocks that pay dividends are popular with investors during economic slowdowns for a few reasons:

– Dividend yields (even if they decline during a recession) offer regular payments that provide income and may help offset potential losses elsewhere in an investment portfolio.

– Because they offer income and relative stability during recessions, dividend stocks tend to hold their value better, reducing portfolio volatility.

Certain sectors have performed better during periods of declining rates – such as the financial, real estate, and consumer discretionary segments – while small-cap stocks have also delivered during downturns because smaller companies typically carry more debt and benefit from the relief of lower rates.

REITs – potential appeal in recessionary times

Periods of high interest rates were difficult for real estate investment trusts (REITs), making it more expensive to borrow money for acquisitions and developments and weakening the value of existing assets.

If lower rates are on the horizon, the dividend yields from REIT investments will likely become more appealing to investors than fixed income assets. Should economies slow, then “recession-proof” real estate sectors (data centres, healthcare, logistics) may be better placed than commercial or retail property investments.

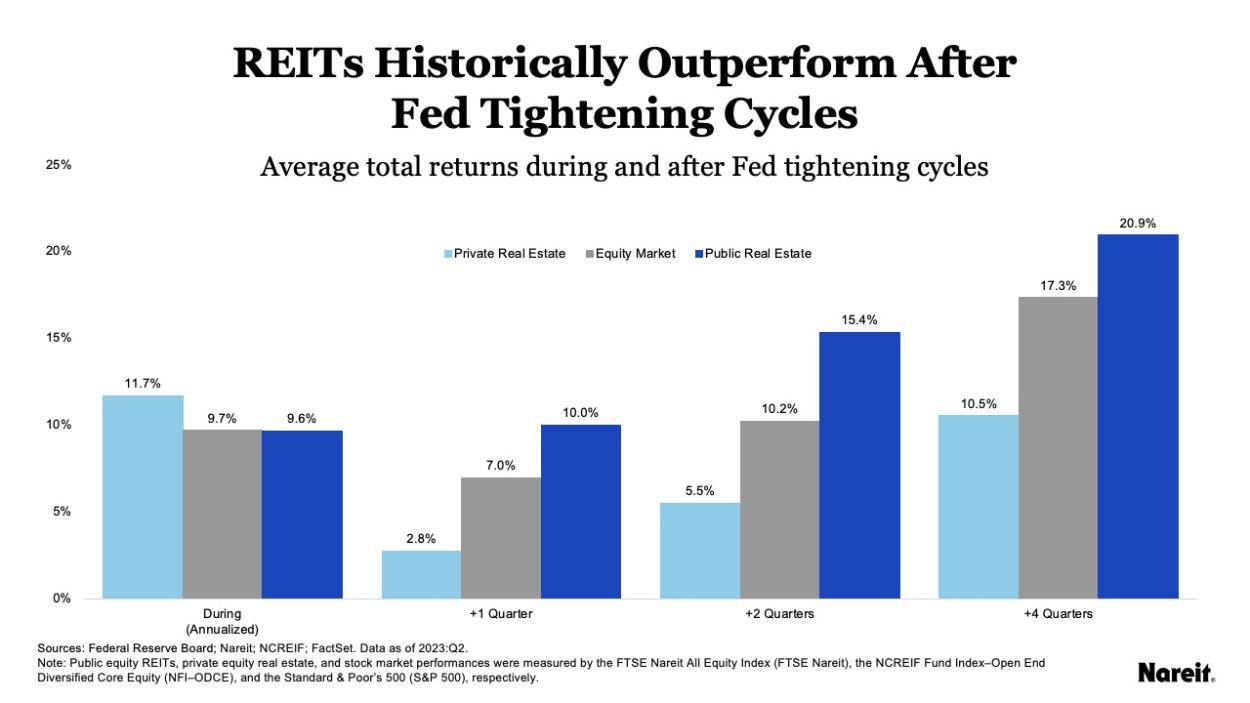

Historical data suggests that returns from publicly traded property investments outperform private real estate and stocks in the year following a period of tight monetary policy (Chart 1).

Source: Nareit 2024 REIT Outlook

Direct lending – a lower barrier to investment

Direct lending refers to commercial loans that take place without the banking sector's involvement. Private loans have grown in popularity in recent years as tighter lending standards have made it more challenging to access funding, particularly for middle-market borrowers.

For investors, direct lending offers the opportunity for higher interest payments, a variety of risk levels, and a low barrier to investment compared with other private lending channels.

Investment strategies in a low-interest rate environment

Passive investing flourished in the decade following the 2007-08 global financial crisis. Investors could allocate their money to a fund that tracked a stock index and then watch developments without much need for management or intervention.

However, when the investment landscape becomes volatile and uncertain, an active strategy managed by experienced investment teams offers investors the potential to adapt to a changing landscape, identify the best opportunities, and pivot their portfolios accordingly.

That flexibility may be crucial for investors seeking investment opportunities in a low-interest-rate environment.