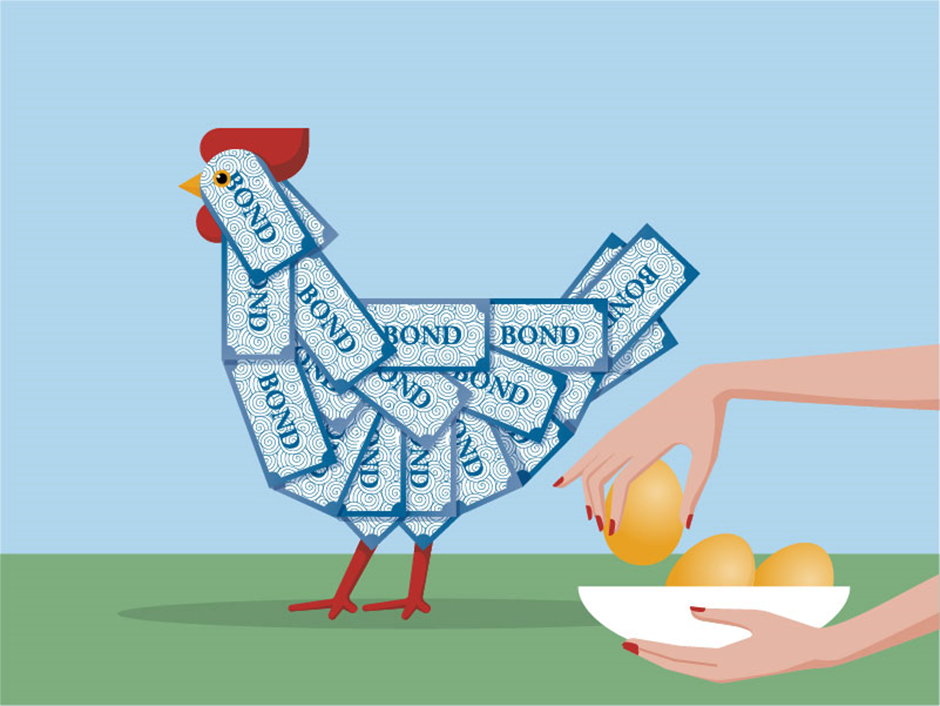

Bonds – also known as fixed income – are a well-established staple of the investment world. Deemed more stable and steady than equities, they also yield a regular income. In this article, we explore the myriad benefits bonds can provide.

A regular income

There are many reasons why bonds are so popular with investors. Firstly, there are the regular interest payments – which coined the phrase ‘fixed income’. These payments (called ‘coupons’) are commonly made twice a year. Bond coupons are often highly attractive to investors who want the stability of a steady income.

As you might know, shares can also provide an income, in the form of dividends. However, paying dividends is at the company’s discretion. The company is wholly within its rights to re-invest the profits in the business, instead of paying them out to shareholders. Crucially, a company cannot take the same approach to paying bond coupons. Paying the coupon on a bond is part of the legal agreement between the issuer of a bond and the bondholder. Failing to pay constitutes a ‘default’, meaning the issuer (whether a company or a government) could find it more expensive to borrow money in the future. For bondholders, this legal framework is good news. It is also why many investors prefer to rely on bonds, not shares, for their income.

An element of capital protection

The second reason bonds are popular with investors is their promise to return their capital. Although bond markets can (and do) fluctuate, the issuer of the bond has contractually agreed to repay the bond when it matures. Compare that with the stock market, where the investor enjoys no such assurance. And, while savings accounts also offer security, the income generated by bonds is typically higher than current savings rates.

Although the issuer has promised to repay the bond, it’s always possible that they run into financial difficulties, which could stop that happening. How can an investor be sure that their investment will ultimately be repaid? Well, a good guide to creditworthiness is the bond’s credit rating. In the case of both corporate and government bonds, specialist organisations called credit rating agencies assess a whole host of factors before assigning a credit rating to the bond. A bond’s score reflects its overall credit risk – in other words, how likely the issuer is to default on the debt or interest payments and let the investor down.

Steady as she goes

The third key benefit bonds provide is their stability. As we saw during the financial crisis, stock markets can gyrate wildly, with extreme price movements. Moreover, while bonds are affected by the same factors that can unnerve investors (namely interest rates and inflation), their price movements are not as extreme as equities.

Bonds are also deemed steadier and less risky than equities. For example, if an investor was interested in a company, they could choose between the firm’s bonds and its shares. Let’s suppose the investor decided to buy the bonds, and the firm entered bankruptcy. As a bondholder, the investor would take priority over the shareholders – meaning they would have a better chance of getting some of their investment back. This steady aspect of bonds is particularly valuable when held in a diversified portfolio, as it offsets the effect of more volatile investments, such as shares.

Selecting the most suitable fixed income fund

Gauging credit risks and building a portfolio of bonds is tricky business. This is where asset management firms come in – these are companies with the skill and resources necessary to create a portfolio of bonds, then monitor its ongoing performance. Such portfolios are often tailored by sub-asset classes within fixed income, such as corporate bonds and global government bonds, for example. The portfolio manager monitors both the macroeconomic environment and the bonds themselves and adjusts the portfolio accordingly.

The most resilient funds are often made up of a mixture of bonds from various issuers. This approach spreads the fund’s risk and reflects the adage ‘don’t put all your eggs in one basket’. If a fixed income fund contains bonds from 60 different issuers, and one of these issuers is unlucky enough to default on its debt, diversification will cushion the blow. It is the role of a portfolio manager to assess the bonds available in the fixed income universe and create the most dynamic mix. So, if an investor is thinking: “What’s the best fixed income investment for my portfolio?” – it’s crucial to find a trusted portfolio manager, who has the skills and experience to help them achieve their goals.

Want more to read and watch?

Explore our other fixed income articles