Over the past five years bond markets have undergone a tumultuous period underpinned by the rapid rise in inflation and bond yields. The level of volatility associated with the shift from a low inflation to high inflation environment experienced by bond investors has tested their resilience, sending many investors into the perceived safety of cash, term deposits or other floating rate fixed income products.

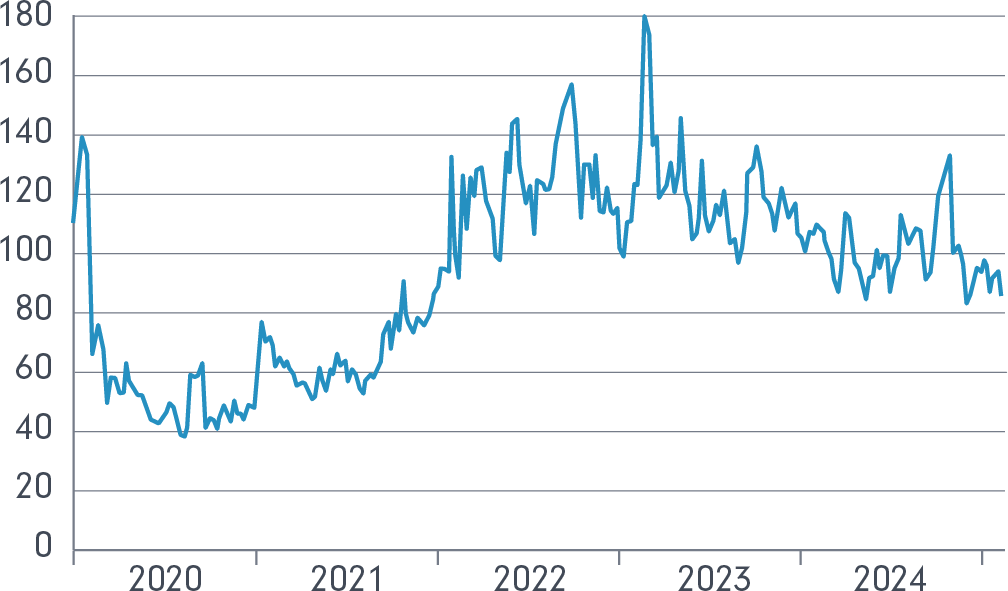

This volatility is measured by the ICE BofAML MOVE Index (MOVE Index), which measures the implied yield volatility of a basket of options over US Treasuries. It is often referred to as the VIX Index of the bond market.

As the chart below shows, from the beginning of 2020 we’ve seen bond volatility rise to a peak in 2023. With inflation moderating, the MOVE Index has also moderated, but remains elevated as bond yields have continued to bounce around, creating a choppy ride for investors.

Figure 1. Volatile Markets for Bonds Since 2020

ICE BofAML MOVE Index (2020 - 2025)

Source: Financial Times

In this volatile environment, as you’re building your defensive portfolio for your clients, it is important to include a manager who is active and nimble, with a strong focus on risk. While volatility can create anxiety for investors, for active managers such as Fidelity, market volatility can create investment opportunity as the relative attractiveness of securities within the fixed income market diverge.

A nimble, active approach

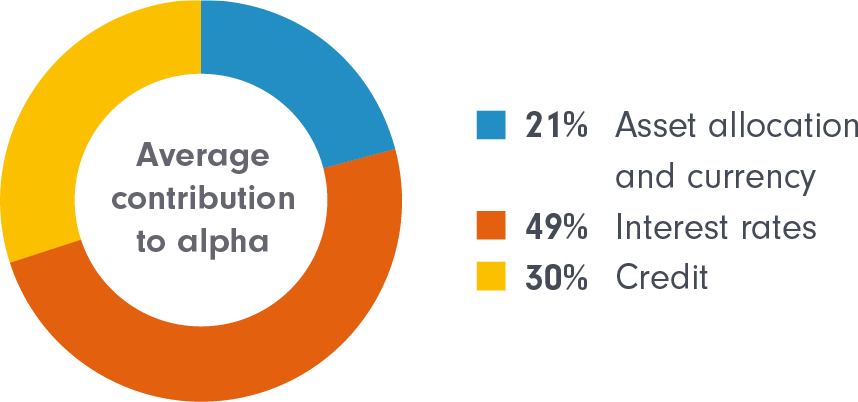

The team managing the Fidelity Global Bond Fund have had extensive experience managing bond portfolios through a variety of market cycles. The process underpinning the Fund (Fidelity’s Global Aggregate Strategy (“Strategy”)) seeks to add value through three primary alpha sources:

- Active asset allocation

- Applying active interest rate strategies

- Active credit security selection.

Historically, the Strategy has demonstrated the ability to add value from these three active alpha generators as the chart below shows, highlighting the diversity of the sources of alpha.

Figure 2. Distinct sources of alpha

Source: Fidelity International, 31 December 2024. Attribution refers to the representative Fidelity Funds (FF) - Global Bond Fund, which is managed using the Strategy. The comparative index is Bloomberg Global Aggregate Bond Index. Performance is shown gross of fees based on FF- Global Bond A-ACC-USD^ with gross income reinvested. Ongoing charges of 1.05% per year applies. The target alpha for the above strategy is 1.0% against the benchmark, over rolling three-year period. Average contribution to alpha calculated over a five-year period. The FF Global Bond Fund is not offered or available to investors in Australia.

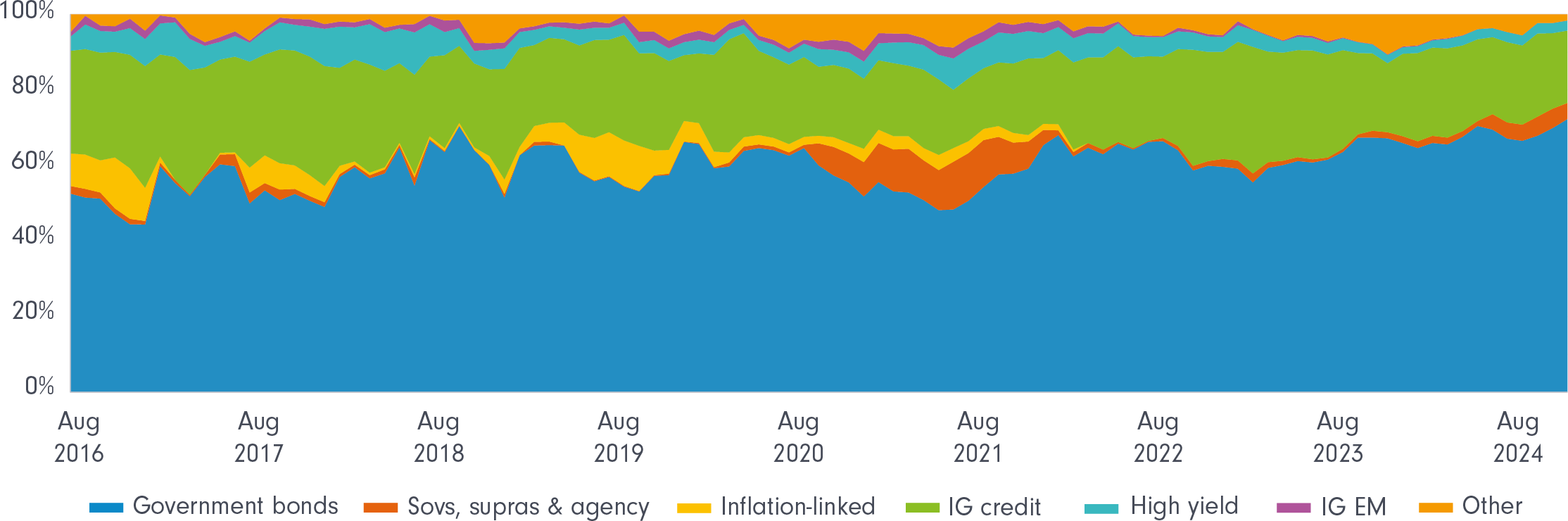

Recent examples of the Strategy’s active approach are evidenced by being overweight in investment grade credit relative to high yield bonds, and overweight government bonds versus emerging market debt.

Other tactical decisions may include taking positions in duration (interest rate risk) i.e. being overweight or underweight duration in a given bond market or taking an active position in specific credit securities. Additionally, the manager can reallocate across countries and regions to take advantage of the differences between rate and economic cycles. The ability to use a variety of levers within a bond portfolio is important in periods of volatility to optimise the portfolio in different market conditions.

The chart below highlights Fidelity’s ability to actively rotate between fixed income sectors, showing the changing allocation to different fixed interest sectors over time. The data relates to an offshore version of the global bond strategy which applies the same investment process as the Fidelity Global Bond Fund.

Figure 3. Asset allocation evolution

Source: Fidelity International, 31 December 2024. Comparative index is Bloomberg Global Aggregate Bond Index. Other includes cash, FX and derivatives. Data refers to FF - Global Bond. The FF Global Bond Fund is not offered or available to investors in Australia

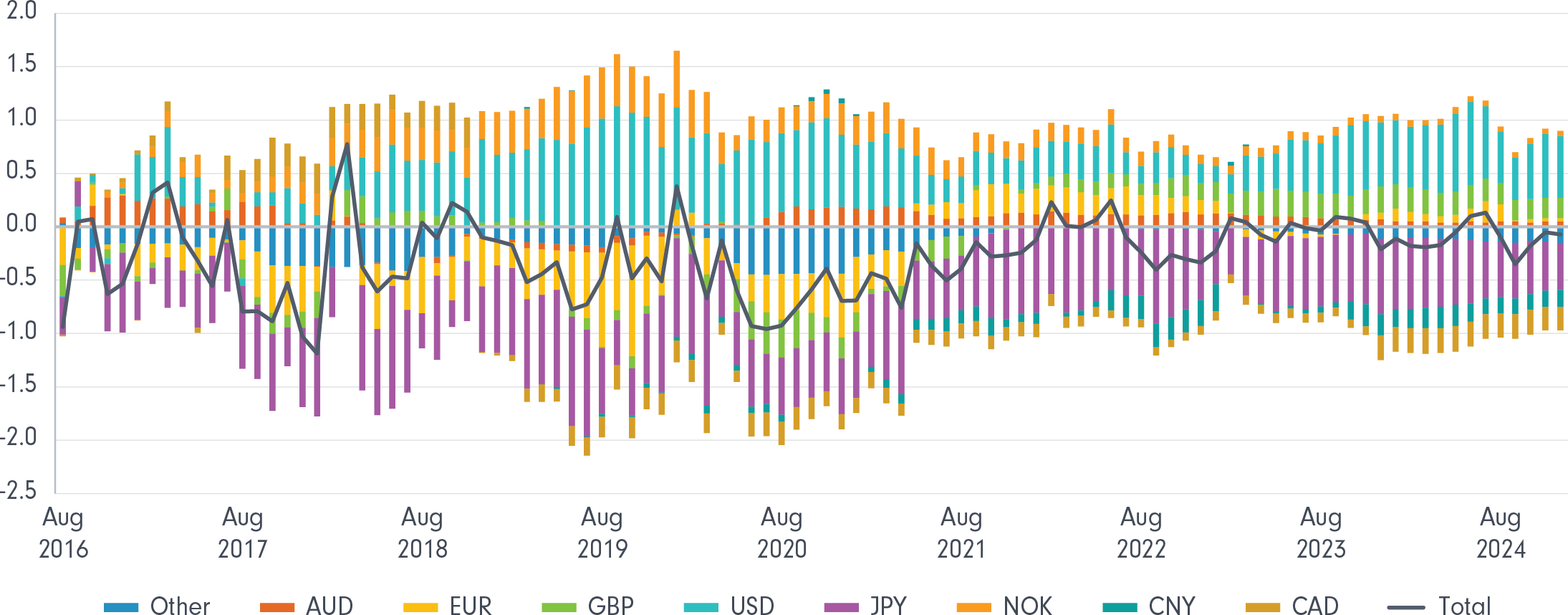

Similarly, the manager has been active in their active duration exposure taking significant active duration positions across different bond markets albeit within an aggregate portfolio duration limit of +/- 1.5 years relative to the benchmark.

Figure 4. Relative duration evolution

Source: Fidelity International, 31 December 2024. Comparative index is Bloomberg Global Aggregate Bond Index. Holdings can vary from those in the index quoted. For this reason the comparison index is used for reference only. Other: CHF, NZD, KRW, IDR etc. Data refers to FF - Global Bond. The FF Global Bond Fund is not offered or available to investors in Australia

A concentrated high-conviction portfolio

The Fund is a relatively concentrated portfolio holding 100 to 200 issuers. This enables the manager to have a high level of conviction and visibility of each of the underlying securities held within the portfolio. Supported by Fidelity’s research pedigree underpinned by deep fundamental analysis, the investment team has more than 35 years’ experience investing in global fixed income through different market cycles.

The Fund’s credit research process also benefits from its their ability to leverage the breadth of Fidelity’s equities research capability with access to a large library of proprietary company research. Additionally, the credit team can attend company meetings alongside the equity researchers to harness the strength of the research platform. This level of insight provides another lens to view credit research which can enhance our security selection process.

Furthermore, the size of Fidelity’s global bond book is in a sweet spot - being large enough to have scale while not being too big impeding the manager’s ability to be nimble in taking active tactical positions. The Fund can execute quickly as investment opportunities present themselves and require timely action. The size of the portfolio, combined with best practice portfolio execution, is another valuable source of alpha and a competitive advantage Fidelity can offer.

Risk controlled portfolio management

Finally, the Fidelity Global Bond Fund is managed in a risk-controlled fashion. The Fund can add value through active portfolio management and is also managed to ensure it is not taking on excessive risk, which we believe is aligned to investor expectations. The portfolio composition is true-to-label i.e. not overly reliant on a single factor to drive portfolio returns or investing excessively in securities outside of the index or of lower credit quality to elevate returns at the cost of greater risk.

With inflation moderating and key market yield curves shifting, from being inverted to upwardly sloped, investors are being rewarded for holding longer dated bonds via an allocation to active global bond funds.

The long-term case for bonds has improved markedly, however, we think that bond markets may continue to be exposed to bouts of market volatility. This dispersion between different sectors within the bond market will require a manager that is truly active and nimble in their approach to navigate bumps in the road while at the same time, taking advantage of the opportunities market dispersion brings.