With interest rates at all-time lows, and set to remain there for “…years, perhaps decades…” according to Reserve Bank of Australia (RBA) Governor Philip Lowe, it is likely that Australian investors become willing and able participants in the global hunt for yield. However, Australians are late to the party, with the yield-to-worst on both international and domestic bonds around record lows.

Savers, who have seen deposit rates fall below the official rate of inflation, are also increasingly looking at other asset classes to generate a positive real return. The same is true for bond fund investors. Older bonds, on higher interest rates, have started to mature and fund managers have been forced to replace them with lower yielding bonds. Investors have been shocked as the income from these bond funds has decreased even as the capital value may have risen. Bond fund managers are increasingly adding credit, duration, or currency risk to their portfolios in order to generate higher yields. Unfortunately, because bond yields are so low, even a small increase in interest rates (when it eventually happens) could have a big impact on bond capital values and hence returns.

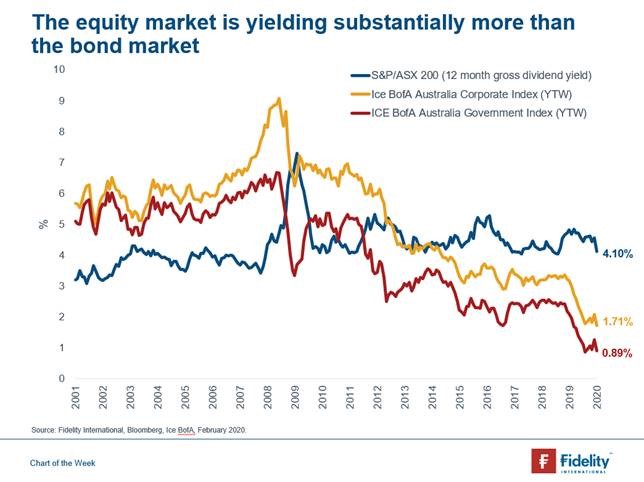

To highlight the low yields on offer in the bond market, the current yield to worst on both Australian government and corporate bonds are around historic lows, while consumer price inflation is currently 1.8%. Given our view that the RBA is likely to continue to stimulate the economy until the unemployment rate falls to at least 4.5% (currently 5.3%), it is likely that the bond market will continue to offer investors a negative real yield for the foreseeable future. Whilst lower interest rates will boost returns for bond investors in the short-term, longer term returns are likely to be depressed relative to recent history, given the RBA Cash Rate is only 0.75% and they are unlikely to fall below 0.25% (the effective lower bound).

The equity market, in contrast, continues to offer investors a dividend yield above inflation and will likely continue to attract the interest of Australian investors keen to generate positive real returns. The key for long-term returns will be actively selecting those companies that will still be able to pay an income should business conditions become more difficult. By being diversified, and taking the time to analyse financial statements, meet company management and assess the risk to profits in the near and long term, skilled active equity investors have the ability to continue to generate positive real returns for Australian investors.