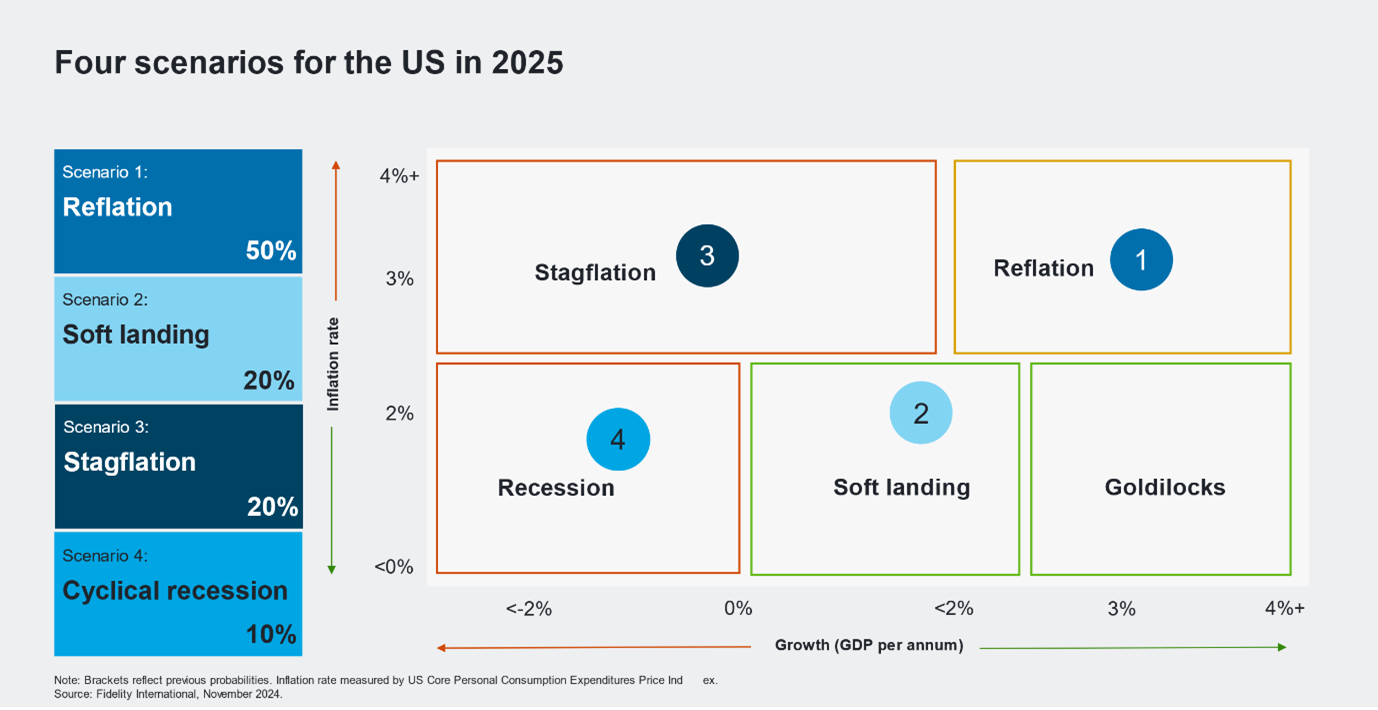

A resounding victory for the Republicans in November’s US election has shifted the economic outlook for 2025 meaningfully. The US soft-landing scenario that we confidently held as our base case for most of 2024 should give way to reflation as we move deeper into 2025, but an economy whose exceptional growth propped up the rest of the world in recent years may also now turn inward and become more protectionist.

Growth-supportive policies propped up by more fiscal easing should push inflation higher, reducing the risk of a US recession and recalibrating our assessment of the current business cycle to mid-to-late stage. But other major economies, and in particular Europe and China, will have to navigate a shift in US trade and industrial policy that is likely to weaken their own growth prospects and put downward pressure on domestic inflation as external demand slows.

Put together, these divergences will support US growth in 2025, but rising government debt burdens is the underlying, longer-term trend. We believe public finances are fast reaching their limits and that above-target inflation is likely to become the least costly option for an orderly resolution to the problem of debt sustainability.

Beyond the changing policy mix in the developed world, we should also keep a close eye on geo-political developments both in the Russia-Ukraine war and in the conflict in the Middle East, which could create headwinds for the overall global macro environment.

US exceptionalism

Expansive fiscal policy and significantly higher tariffs are likely to be the centrepieces of a second Trump presidency. The economy is in good shape: a strong consumer, solid private sector balance sheets, and a labour market that has softened but is historically strong have reduced the risk of recession. Against that backdrop, the changes the new administration has set out meaningfully increase the odds of outright rises in US inflation from the second quarter.

We assume that the much-discussed tariff rates (60 per cent for China and 20 per cent for the rest of the world) are maximalist rates aimed at negotiations that may take place if the new administration presses ahead with its protectionist goals. The rates that emerge may well be lower, but their impact on an economy that has consistently outperformed expectations over the next year would be substantial.

On the fiscal policy front, we think that the extension of President Trump’s Tax Cuts and Jobs Act (TCJA), along with additional tax cuts, may expand the deficit to an extraordinary 8 per cent of GDP. That should drive nominal GDP growth significantly above trend and aid the headline numbers next year, but its longer-term sustainability is more questionable. Especially if tariff policy is more aggressive and front-loaded than we are assuming, the risk of stagflation in the quarters that follow grows. Reduced net migration could add to these risks by dampening growth and exerting upward pressure on wages and services inflation.

That said, recession only returns as a serious risk if, in the face of an inflation shock, the US Federal Reserve pivots to a hiking cycle. The likely terminal rate for the central bank’s easing cycle is now higher than before the election. We expect we will still be in some form of an easing cycle as we enter 2025, at least until the impact of tariffs, any significant changes in immigration, or the fiscal policy expansion becomes clearer.

Europe’s structural challenge

The Eurozone economy has been almost stagnant since 2023 and it faces a range of cyclical and structural challenges. For 2025, we expect a cyclical upswing as falling inflation and lower interest rates help resurrect corporate capex and consumer confidence. Stronger real disposable income and easier financing conditions should start releasing elevated excess savings to spur consumption growth.

However, potential tariffs from the US are a downside risk, particularly for the auto sector, and the resulting trade uncertainty could reduce growth by up to half a percentage point. Germany in particular would be hit while facing additional uncertainty from snap elections that may come as early as the first quarter.

We expect the European Central Bank (ECB) to cut rates quickly to 2 per cent, followed by gradual easing to 1.5 per cent by the end of 2025. More aggressive tariffs risk provoking additional and accelerated easing, although the central bank will need to keep one eye on any currency weakness against the dollar.

Facing similar headwinds, the UK has slightly outperformed the Eurozone in 2024, and we expect this momentum to strengthen in 2025. The Labour government’s more expansive budget is likely to be boosting growth already and the UK economy, being more services-oriented, is less exposed to the risk of a trade war. With a tight labour market, improving growth, sticky wages, and now less restrictive fiscal policy, we expect the Bank of England to go slower on rates than the ECB.

China’s policy pivot

China’s quest for a slower but more sustainable model of growth focused on domestic consumption and higher-end manufacturing is advancing, but not without bumps in the road. The policy pivot by the Politburo in late 2024 signals a decisive move to resolve the issues that have depressed domestic demand, namely the property sector, local government debt, a lacklustre equity market, and poor consumer confidence. All eyes will be on the progress of the broad moves announced at the time of writing, as well as whatever the authorities follow up with over the months to come.

One big question is whether the levels of growth China needs can be delivered if the US simultaneously burdens companies’ biggest sales market with heavy tariffs. The manufacturing sector is steadily upgrading, especially in new and emerging industries, providing support for overall growth both from rising capex and external demand. Domestic consumption, however, has not yet picked up significantly. While the policy moves may help stabilise the property market, we do not expect the return of strong growth in 2025. Rather it may move to a new, lower equilibrium.

New drivers of growth are emerging and may receive more policy support. An urbanisation push should include improved infrastructure and connectivity among cities. The energy transition is a priority, with incentives for energy saving in everything from home appliances to electric vehicles. Lastly, Beijing may devote more effort and resources to resolving local government debt issues, freeing authorities to do more to support households.

As ever, we will be well into next year before the authorities publish the growth target for 2025, but the consensus of market forecasts is below 5 per cent, even after the boost from stimulus.

The spillover of the new measures may vary across different economies, with some emerging markets benefitting more than others from lower-value, higher-quality imports from China. In general, the country may continue to export deflation if the policy easing delivered to the economy remains contained and moderate. If additional US tariffs are imposed, past experience also tells us that Chinese companies are likely to prove agile in response, softening the impact on corporate earnings. Beyond that, macro stabilisation policies will be crucial in deciding China’s economic fate over the next year.

Read more articles from our 2025 Outlook