60 per cent probability

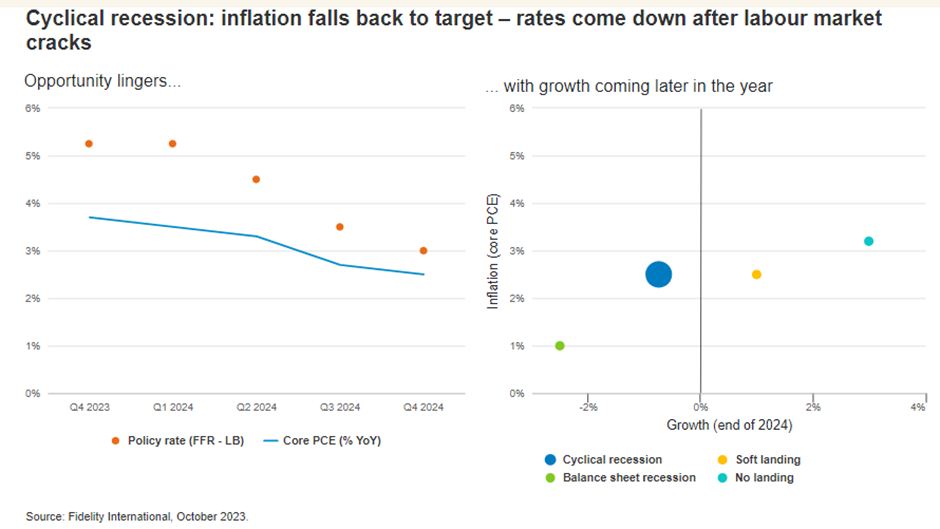

A cyclical recession would see a moderate economic contraction followed by a return to growth in late 2024 or early 2025. Inflation would be sticky for a period before returning to target, with interest rates staying higher for longer followed by central banks pivoting to cut rates. This is currently our base case.

Investment summary

In our base case scenario, a cyclical recession would bring lower economic growth that could be a worry for small-caps or companies with discretionary sales. Equities (away from low-quality or small names) would be of interest, while in fixed income the focus would remain on short-dated, high-quality credits.

- Some cautiousness around cyclical sectors and weaker geographies

- Inflation-linked bonds preferred as inflation remains sticky, although nominal bonds will benefit as rates fall

- A potential ‘Goldilocks-zone’ for real estate investment

Multi asset

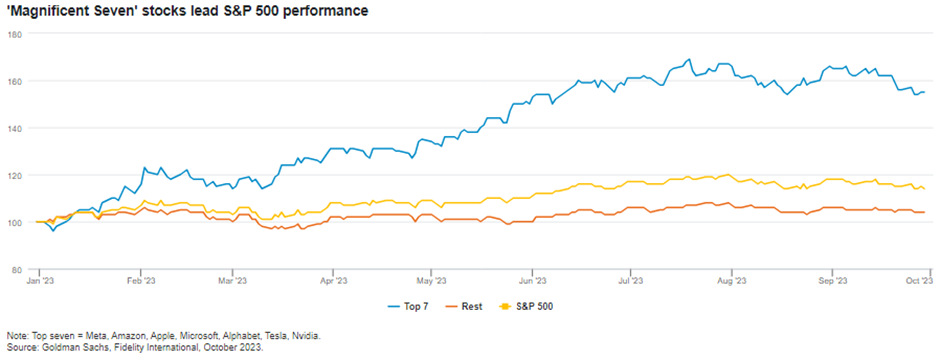

We regard a cyclical recession as a mildly risk-off scenario in which there would still be good opportunities for investors who are discerning about sectors and geographies. Investors shouldn’t be scared of holding select equity investments because markets anticipate an economic recovery later in the year. US equities would be especially well positioned. In particular, mid-cap stocks look attractive along with much of the S&P 500 that have not shared the incredible performance this year of the ‘Magnificent Seven’ stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla). Valuations look reasonable for these well-run companies with solid growth prospects. US small-caps would be more challenged in a slowdown or recession scenario given their greater debt refinancing needs.

This reflects our broader preference for playing high-quality equities and credit against low-quality names in recession scenarios, with refinancing concerns feeding into a preference in the base case for investment grade credit and higher-rated high yield issuers.

We expect inflation in a cyclical recession would be sticky for a while before it fell back to target, and so inflation-linked bonds (offering ‘real yields’) would be preferred to nominal bonds in this scenario. Markets already price inflation returning to target, but investors expect that very high real yields will be needed to achieve that. In this scenario, real yields would fall in line with growth and central bank expectations.

We would take long positions in certain emerging markets in any scenario, given attractive valuations and idiosyncratic economic cycles, but our preferences change depending on which scenario emerges. In a recession, India and Indonesia are markets with good defensive qualities that are less tied to the global cycle. We also favour some emerging market local currency bonds (with exchange rate hedging) as global interest rates decline, but without any significant growth concerns impacting the creditworthiness of major emerging markets.

- Henk-Jan Rikkerink, Global Head of Solutions and Multi-Asset

Fixed income

Our cyclical recession scenario starts with a period of above-consensus inflation in the first half of 2024. We would expect a series of upside inflation surprises to generate another spell of outperformance for inflation-linked bonds. This would be similar to 2020/2021 when inflation accelerated and 1 to 10-year inflation-linked bonds outperformed all-maturity nominals by about 15 per cent. Upside inflation surprises would suggest a tricky period for nominal bonds in the first half of 2024, and we would therefore favour medium-duration inflation-linked bonds over nominal ones in this scenario.

If the yield curves remain inverted in all major currencies, we would suggest money market funds as a respectable alternative for more cautious investors, as they offer higher yields than government bonds with almost no risk.

Central banks on high alert for persistent inflation should help here. Short-dated, high-quality credit (in GBP, for example) could also work well.

The later part of 2024, when we anticipate faster-than-expected cuts from the US Federal Reserve, would be a strong period for nominal bonds. It would be the hardest of all asset allocations to time, but for investors with a higher risk tolerance, nominal yields at cycle highs will be irresistible at some point and offer higher betas than are available with inflation-linked bonds.

- Steve Ellis, Global Chief Investment Officer, Fixed Income

Private credit

In a cyclical recession, our approach would be to focus on further reducing risk and allocating to borrowers with the strongest balance sheets. We would expect some support to valuations given the expected reversal in interest rates.

In the senior secured loan market, we would favour defensive sectors and firms with capex-light business models that have strong visibility on their earnings. Companies with contracted rather than discretionary sales would be the focus, as well as those that are likely to have more stable cash flows, such as healthcare, technology, and business services firms. Debt service costs would start to decrease as interest rates came back down.

In this scenario, we recommend being overweight on both structured credit and direct lending strategies, with a particular focus on lending to defensive sectors and those with business-to-business income streams. A cyclical recession demands a conservative approach to credit selection to avoid over-leveraged firms, and a focus on companies where we can have a direct influence over the structure and documentation of deals.

There is already plenty of downside risk priced into the lowest end of the market. And so heading into a cyclical recession there would be a moment to reallocate into interesting, lower-rated assets that the market has over-discounted - once we had sight of the recovery.

- Michael Curtis, Head of Private Credit Strategies

Equities

Current consensus earnings forecasts look too optimistic for this scenario so we would expect them to be downgraded. It would be worth looking for cheap stocks in markets such as Europe and Japan where valuations are far from pricing in any kind of recession. Japan is especially positive for equity owners thanks to a series of corporate governance reforms which have focused on shareholder returns. We would also expect the yen to strengthen if there were interest rate cuts elsewhere.

In a cyclical recession we would be cautious around European cyclicals like industrials but would expect to find opportunities among financials, which are attractively valued. Bond proxies like utilities, consumer staples, and healthcare also typically do well in a cyclical recession.

The UK meanwhile would do poorly in this scenario because around a fifth of the market is made up of energy and mining companies. These would suffer from slowing economic growth. We would favour international names, in particular high-quality, economically-insensitive names with recurring revenue and good pricing power that should see them through a storm. These businesses can be found across several sectors, from consumer staples to computer software.

There could be an interesting dynamic around small and mid-cap stocks in this scenario. These companies were derated in 2023 as they grappled with higher interest rates, and so have already cheapened in relation to forward earnings estimates (although some nervousness about their ability to meet those estimates remains). If there is further economic pressure in the early part of the year, then small caps could come under pressure, but when we do see some relief on interest rates, smaller stocks may have more recovery potential. Unlike Big Tech, which supercharged the market in 2023, smaller companies are not ‘priced for perfection’ so could offer more of a margin of safety.

- Ilga Haubelt, Head of Equities, Europe; Martin Dropkin, Head of Equities, Asia Pacific

Real Estate

In many ways, a cyclical recession would be the ‘Goldilocks-zone’ for property investment because a small amount of inflation is positive for real estate. Furthermore, given that property prices have already adjusted (particularly in Europe and especially in the UK), and if interest rates have peaked, then there would only be upside to come. In this scenario, there would certainly be opportunities to take on more risk. There is already a good balance of supply and demand across European markets, meaning 2024 should prove to be a strong vintage to invest in real estate under this scenario.

It is important to note that as well as dealing with the shifting macroeconomic backdrop, the real estate market is undergoing a structural change, moving out of a period of sustainable income and into one of sustainable growth. Previously, in a world of near-zero interest rates, property was invested in chiefly for its yield (especially compared with other asset classes such as bonds). Now, we expect it to return to its traditional role of a ‘hybrid’ asset class combining sustainable income with equity-like capital growth.

-Neil Cable, Head of European Real Estate Investments

The view on the ground

How our analysts think their sectors would fare in a cyclical recession.

“Real estate investment trusts typically trade like bonds. If rates come down, at least the valuation should expand, although fundamentals will be hit in line with the overall economy.”

- Real estate equity analyst, North America

“Consumer cyclical is a higher beta sector dependent on discretionary consumer spending. These companies would be among those more severely hurt by a recession of any size.”

- Consumer discretionary fixed income analyst, North America

“This scenario should lead to an increase in commodity prices, which should have a negative impact on materials companies.”

- Materials equity analyst, India

Alternative macro scenarios