20 per cent probability

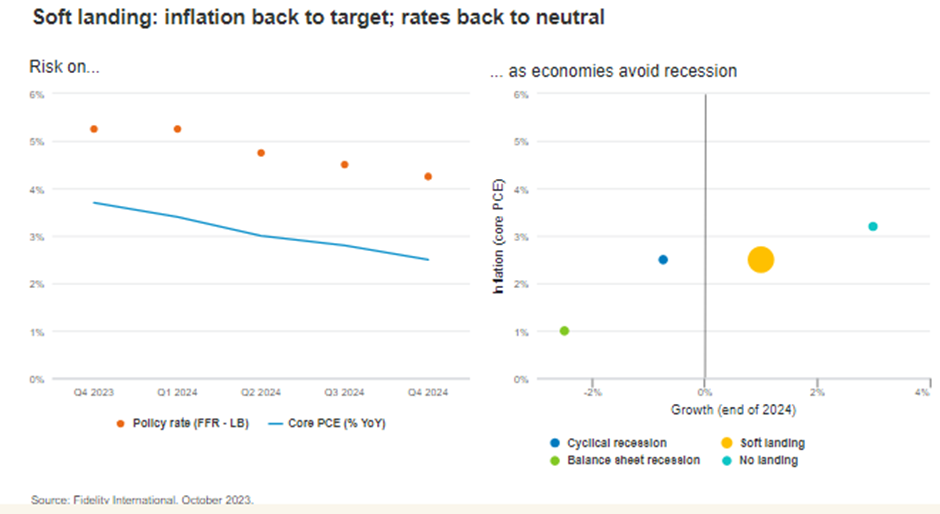

A soft-landing scenario would involve a slightly below trend slowdown across major economies, with no major shocks to knock markets off track. The decision to keep interest rates higher for longer would bring inflation to a level with which central banks are comfortable. This would then allow them to pivot and cut interest rates, easing pressure on indebted households and companies.

Investment implications

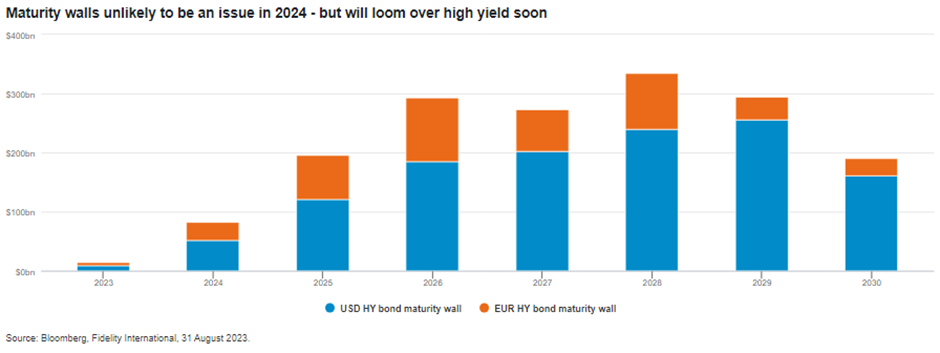

A soft landing would allow investors to lean into risk across many asset classes, and with inflation returning to target levels there would be particular opportunities for growth stocks, real estate logistics, and cyclical credits. Some defensiveness though would still be needed around the coming maturity walls in the fixed income market, and around the US dollar’s role as a ‘safe haven’.

- A benign backdrop for nominal bonds, European real estate, and consumer-linked companies

- Less defensive and mid-cap names likely to outperform the market

- Money market funds would offer interesting opportunities early in the year

Multi asset

A soft landing would be very much a risk-on scenario in our view, and good news for equities - especially those beyond the big names that have driven S&P 500 performance in 2023 - and moderately positive for bonds. We therefore favour US mid-caps over mega-cap growth stocks, with the latter already having benefitted from a ‘flight to quality’ this year as economic uncertainty remained high.

A soft landing would be negative for the US dollar because it would reverse the ‘safe-haven’ inflows that have boosted it over the past two years, eroding its yield. For a cyclical upswing we would favour markets like Korea and Taiwan, which are exposed to the growth-sensitive semiconductor cycle, and ‘higher beta’ markets like Brazil. The prospect of interest rate cuts from the US Federal Reserve and a softer dollar could also encourage a resurgence in high-yielding emerging markets FX. Elsewhere, we would regard a soft landing as beneficial for beaten-up cyclical names including Asia high yield credit and more liquid alternatives.

- Henk-Jan Rikkerink, Global Head of Solutions and Multi-Asset

Fixed income

With nothing to upset the apple cart, this scenario should present a benign environment for nominal bonds. Longer-duration paper would obviously offer the best results thanks to the reduction of headline interest rates by the end of the year. High yield would also do well in a good environment for risk assets thanks to a solid performance on growth.

There is still some danger in investment grade credit from the higher-for-longer rates environment that is likely to remain for at least the first part of 2024, and from the maturity walls that we can all see coming for corporate borrowers over the next three years. But, in a situation of continuing - but not overwhelming - growth, there should be room for both investment grade credit and some careful, well-researched purchases in high yield assets, where there are high single digit yields on offer.

If anything, money market assets and shorter dated inflation linked paper might underperform because of their relatively short duration, although they could do well in the early part of the year before capital gains from government and corporate bonds began to take over and favour those asset classes.

US assets would probably do better because we should see a sharper fall in yields from what is currently a higher starting point than in other developed markets. European financials might be another interesting play, starting from a relatively cheap level in what would be a benign environment for fixed income.

- Steve Ellis, Global Chief Investment Officer, Fixed Income

Private credit

In a soft landing scenario, we would expect less-defensive names to outperform. It could bring a reprieve from defaults and a lower refinancing risk for borrowers across the market, and in the more economically friendly environment there would be a real opportunity in lower rated senior secured loans or structured credit.

The best returns might be found in assets that are currently priced very wide to the market, and we would shift our allocation towards names that could rally where more adverse scenarios have not played out. For example, triple-C rated names, which typically make up between 1 and 10 per cent of the European leveraged loan index, can contribute as much as 25 to 30 per cent of performance at times when market expectations shift to a more benign outlook.

Cyclical names with a higher risk profile are likely to give the strongest returns, while in structured credit the high-yield tranches should offer the most attractive returns. We would therefore allocate to sub-investment grade structured credit tranches. In direct lending and senior loans, higher incomes, falling rates and a more benign default environment would be constructive for refinancing and capital appreciation opportunities.

- Michael Curtis, Head of Private Credit Strategies

Equities

The most important element of a soft landing scenario is that inflation would return to target levels, and central banks could declare victory. Growth stocks should do well in this scenario (financials and commodities names in particular) as inflation returns to target levels and central banks pivot. We don’t think value stocks would have much benefit over growth.

Consumption is particularly interesting in a soft landing. Salaries would have risen with inflation but mortgage costs would then begin to fall as interest rates came down. That would put more money into householders’ pockets. It would be a good time to look into retail names.

However, a soft landing scenario would still demand a defensive approach, especially compared to ‘no landing’.

We would double down on diversification plays that should help protect a portfolio from any macroeconomic shocks, and be even more mindful of high valuations.

Geographically, we would expect Japanese equities to benefit in this scenario. If central banks across the rest of the world were cutting rates, and with real rates coming down quickly, the yen would start to appreciate. Domestic consumer stocks would do well off the back, while firms that rely on exports might face pressure from the strong currency.

- Ilga Haubelt, Head of Equities, Europe; Martin Dropkin, Head of Equities, Asia Pacific

Real estate

With growth returning to major economies and interest rates coming down to historic levels, this would be the perfect opportunity to lean into the property sector.

In particular, we would anticipate a stronger outlook for logistics, given how tightly this market is currently supplied in Europe. Because of the rise of online shopping, logistics is now a better indicator of consumer health than traditional retail real estate and should benefit from increased consumer activity. This sector has had a good run recently but there is still room for growth and for rents to rise, given the surprisingly low vacancy rates that remain for warehouses.

Over recent years there has been a shift in tenants’ focus to the sustainability profile of the buildings they rent, and this is only set to continue in any of the scenarios we might face. Tenants’ interest in green buildings is not only driven by regulatory changes or even by the opportunity to cut energy costs, but by their own ambitions towards net zero, stakeholder pressures, and their efforts to attract and retain staff.

-Neil Cable, Head of European Real Estate Investments

The view on the ground

How our analysts think their sectors would fare in a soft landing scenario.

“The healthcare sector’s valuation is highly rate sensitive, and earnings are vulnerable to inflation. So, this is the most positive scenario. I would expect an increase in absolute valuations.”

- Healthcare equity analyst, Europe

“Utilities are considered defensive. A soft landing would be positive for most industries but only neutral for utilities.”

- Utilities fixed income analyst, North America

“I think market expectation is currently somewhere between a soft landing and cyclical recession and therefore a soft landing will be positively received for cyclical names.”

- Consumer discretionary fixed income analyst, North America

Alternative macro scenarios