10 per cent probability

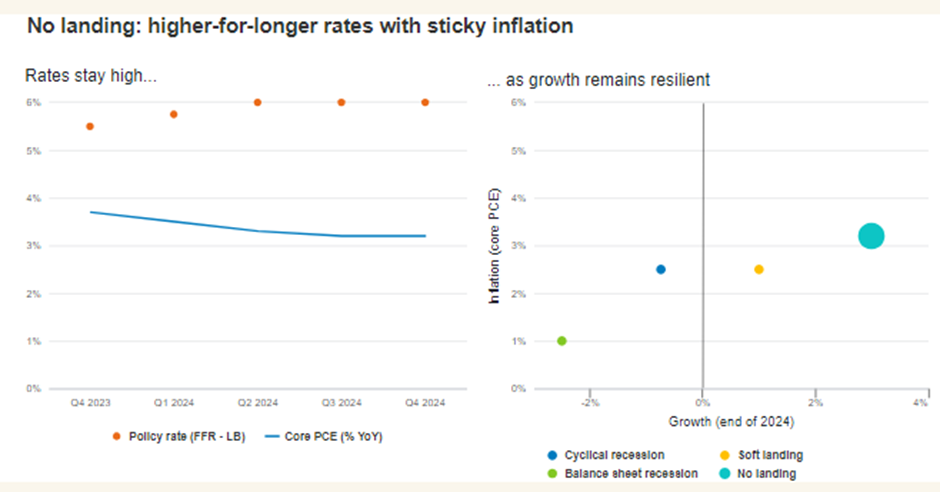

In a no landing scenario, US economic growth would continue to be resilient while Europe’s current slowdown would reverse. Core inflation would remain sticky and settle one or two percentage points above central bank targets, encouraging monetary policy makers to keep nudging interest rates higher.

Investment implications

A no landing scenario could be more varied than it sounds. With interest rates staying high or even rising, floating rate options across the private credit market would be favoured, while mid-cap companies and commodities would also be of interest. However, this scenario would present a challenge to the real estate market, to firms looking to refinance, and to government and investment grade bonds.

- European exporters expected to perform well, with growth accelerating in emerging markets

- Mid-cap companies likely to outperform the mega-growth stocks that have dominated headlines in 2023

- Refinancing rates could be challenging for higher-leveraged names across bonds and senior secured loans

Multi asset

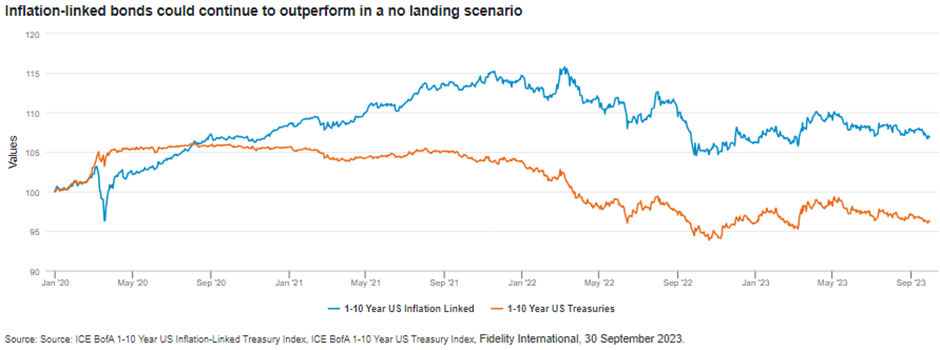

Higher for (even) longer interest rates translate into bearishness on duration. Our preference for this scenario would therefore be high-quality credit and cash over government bonds, and for inflation-linked rather than nominal debt as markets would have to re-price for structurally higher inflation.

In equities, we would favour US mid-caps over the mega-cap growth stocks as we would also do in a soft landing. Mid-cap valuations look far more reasonable and would be well set to benefit from the resilient economic growth environment that a no landing scenario implies. Outside the US, this higher-for-longer interest rate scenario would also be good news for interest-rate-sensitive cyclicals like European and Japanese banks. Other cheap cyclicals such as Chinese equities, Asia high yield, and more liquid alternative assets would also benefit.

If we do see an upturn rather than a downturn from here, then we would also expect more cyclical emerging markets like Korea and Taiwan to benefit given their exposure to the growth-sensitive semiconductor cycle. Higher beta and commodity-exporter EM assets, such as Brazilian equities, should also do well under this scenario.

- Henk-Jan Rikkerink, Global Head of Solutions and Multi-Asset

Fixed income

This would be the most dangerous scenario for government and investment-grade bonds, with inflation continuing well above target and a renewed series of hikes from the US Federal Reserve, as the economy miraculously resists the pressures brought to bear by higher rates and quantitative tightening. Those of us who have tiptoed into longer-duration nominal bonds would suffer.

Money market funds would benefit as cash rates rose and in general we would prefer shorter-duration, and good-quality, cyclical assets. Note that not all cyclical assets - low-quality high yield for example - will feel the positive boost of strong growth, because lower-quality names will be hurt by worse liquidity and higher rates.

Ever-higher refinancing rates for highly-leveraged companies would present a growing danger, generating an environment of heightened idiosyncratic risk. Sub-10-year inflation-linked bonds could outperform, boosted by upside surprises in inflation, and sheltered by their relatively short duration and lower beta than nominal government bonds. Geographically, the US would have better growth and higher inflation and therefore US yields would rise by more than the European alternatives, making it a yet tougher environment there for duration.

Private credit

Faced with the growing inflationary pressures of a no landing scenario, the floating rate nature of private credit products would be attractive as a potential hedge against inflation.

In this scenario we could position less defensively and be willing to take on more risk, focusing on industry leaders and companies with strong pricing power and the ability to pass costs through to customers. However, if rates stayed higher for much longer, we would look to avoid names with higher debt-to-ebitda leverage or lower interest-coverage ratios and would be cautious around traditionally defensive sectors, such as healthcare and technology, that often have higher leverage and might not have the pricing power to pass on higher costs. Similarly, companies where wages make up a large proportion of costs are likely to be less attractive in a high-inflation scenario, although there may be exceptions.

With rates staying high or even rising further, there would be more erosion of valuations and refinancing would become more difficult for certain credits. While the maturity wall would not be an imminent worry, refinancing needs over the next couple of years might start to present a greater challenge.

- Michael Curtis, Head of Private Credit Strategies

Equities

Assuming that one driver behind a no landing scenario is a strong economic performance from China, then some exporters in Europe, particularly Germany, should be in pole position to benefit. Japan, also sensitive to Chinese growth, would react positively too and we would expect to see growth accelerate across emerging markets, again benefiting exporters.

In terms of style, we would expect the higher-for-longer interest rate environment to favour value over growth, with earnings steadily improving during the year. The US economy would be resilient in this scenario, with full employment and consumers still able to spend. However, it is worth bearing in mind that with rates remaining elevated, this scenario could end up being challenging for equities.

Among US equities we would pick companies with two key characteristics. The first is pricing power - companies that have control over their input and output costs. The second is a well-structured balance sheet with limited leverage, and companies that can create free cashflows on an annual basis. Railways, which have fixed assets and in many cases monopoly power, would be one example that ticks both boxes.

Commodities, especially oil, would also do well in a no landing scenario, benefiting the UK market with its heavy weighting to those sectors. By contrast, sticky inflation would be bad news for companies sensitive to input costs and would see margins come under pressure. Certain consumer staples companies we favour in a cyclical recession would suffer from higher commodity prices.

It may be tempting to think that the ‘Magnificent Seven’ big tech companies that have done so well in 2023 would carry on their winning streak in a no landing scenario. But it’s all about valuation. Some have great business models, dominance in their sub-sector, and can continue to generate free cashflows sustainably. Others now have their best years behind them, making it difficult to justify higher valuations from here.

- Ilga Haubelt, Head of Equities, Europe; Martin Dropkin, Head of Equities, Asia Pacific

Real estate

Higher for longer rates and surging inflation present a challenge to the real estate market. Tenants would face increasing costs, although we wouldn’t expect them to go bust in large numbers as buffers have been priced into the market.

From an investment perspective, a no-landing outlook would be a time to retreat to core holdings and wait out the cycle. The fundamentals across real estate should remain relatively robust, so once this phase is past and rates finally come down, it would be possible to sell and crystalise any gains. There could be opportunities to take advantage of the repricings taking place in the sector to add value, but broadly we believe this would be a time to remain defensive.

- Neil Cable, Head of European Real Estate Investments

The view on the ground

How our analysts think their sectors would fare in a no landing scenario.

“Given valuations remain very rate sensitive, expect higher rates to exert continued pressure on valuations - especially if the market becomes concerned this is longer-term. Additionally, continued high inflation would be negative for earnings given limited pricing power in the sector.”

- Healthcare equity analyst, Europe

“Most utilities benefit from higher inflation protections (particularly regulated utilities) but continued high inflation will cause capex, opex, index-linked debt, and interest costs to rise which is likely to hurt credit metrics, particularly in light of high investment requirements across the sector.”

- Utilities fixed income analyst, Europe

“If inflation continues to remain high, the deterioration in asset quality is likely to override the continued benefit of higher rates.”

- Financials fixed income analyst, Europe