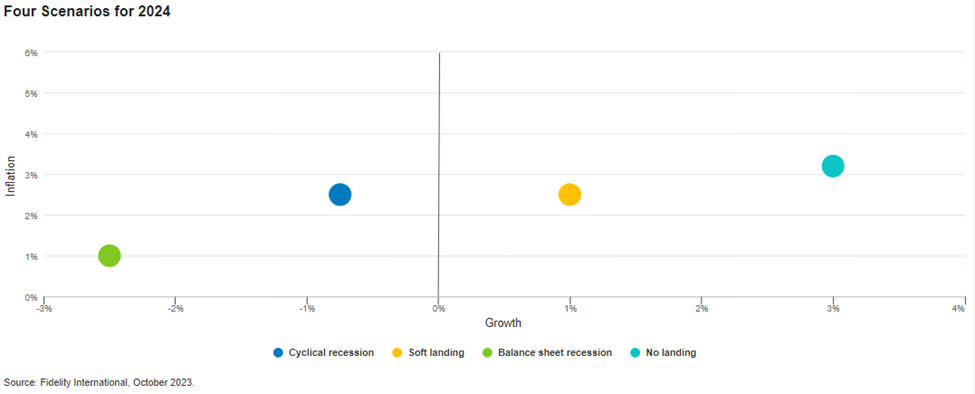

The economy continues to deliver surprises but we are confident of one thing: if US and other developed world interest rates have not peaked already, then they will do so soon. And against this backdrop growth will stall. We detail four potential scenarios for 2024 and the next leg of a business cycle which has seen the most intense round of monetary tightening in a generation.

Much of what has surprised central bank officials and financial markets in 2023 stems from our lack of understanding of the deeper economic effects of the past fifteen years - including the pandemic - on households and corporations. We will get more clarity in the months ahead - on inflation, the optimal level of interest rates, or the stubborn resilience of the US job market. But investors are rightly nervous that the next stage of this cycle will bring more volatility.

Markets, where those betting on a downturn have already been burned once, are however now lined up behind a Goldilocks ‘soft landing’ where the rate hikes and the tightening of the past two years will do just enough to gradually return the economy and labour market to equilibrium. We have a different view.

Our base case for 2024 is a cyclical recession

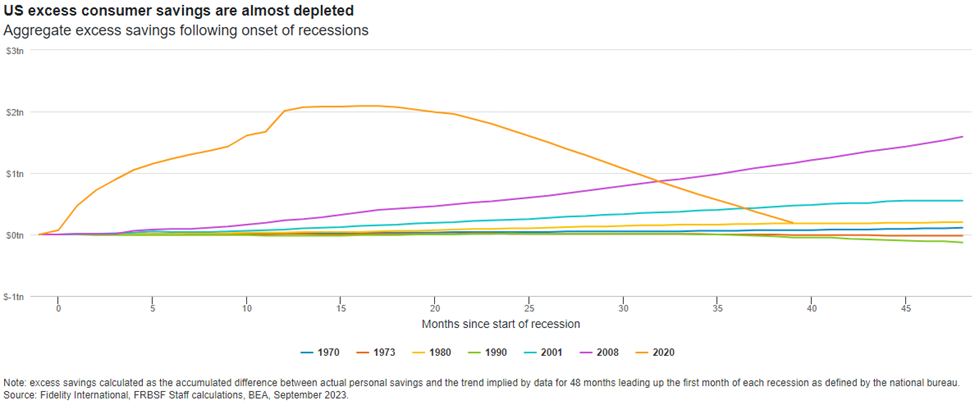

Resilience driven by fiscally supported consumers and companies has been the biggest surprise of 2023, but barring something extraordinary, next year we expect to see the economy finally turn lower. There are signs it is already doing so. The buffer of savings built up by households and the corporate sector in the pandemic is almost drained, fiscal support should narrow, and there is likely to be a pick-up in refinancing needs at a time of credit tightening across the board.

All of this supports our base case for a cyclical recession in 2024; inflation has begun to fall but interest rates will stay higher for longer until there are clearer signs it is heading back to target. Central banks will then pivot and cut rates as the damage to growth becomes obvious.

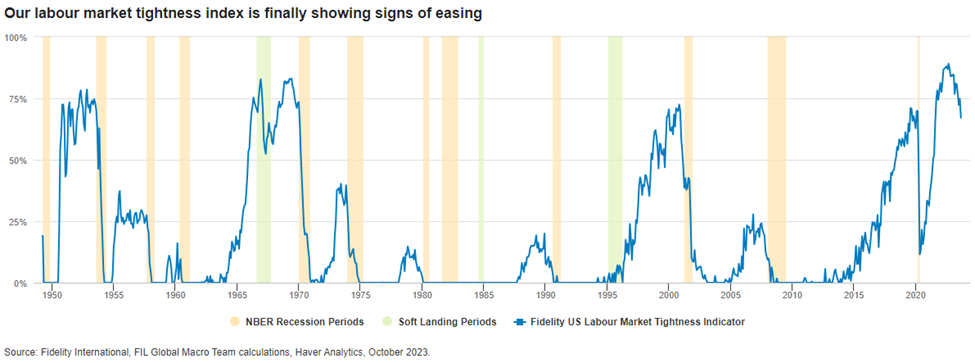

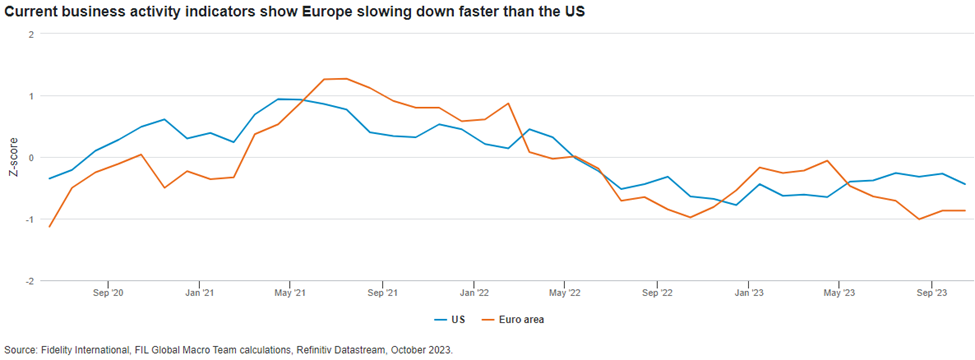

Fundamentally, we continue to think there is simply a lag between policy tightening and the effects on the real economy. The transmission channel is delayed, not broken and the continued stickiness of inflation points to misaligned expectations that have to be balanced out. A moderate recession should achieve that, driven by tight monetary policy as the effects of lagged fiscal support melt away in the developed world. Labour markets will normalise and restore price stability before we move towards a recovery at the end of 2024.

Signs of a recession are already apparent in Europe where the transmission channel is more effective. This has led the European Central Bank to start focusing on growth - a trend we think will take hold in the US next year.

Alternative endings

We still see room for other possibilities. Alongside a cyclical recession, to which we give a probability of 60 per cent, our 2024 outlook considers the investment implications of a more severe balance sheet recession (10 per cent probability) that prompts widespread cutbacks in spending by companies and consumers alike and judders through the economy, even into 2025, driven by a disruptive reaction to very high real rates. We consider the chances of the more benign soft landing scenario (20 per cent); and a case in which there is no landing in 2024 at all (10 per cent), in other words, where the economy holds at current levels of growth and inflation, provoking central banks into another, albeit incremental, round of policy rate rises.

The path of Federal Reserve policy, together with inflation and growth trajectories, will look dramatically different in each scenario and will inevitably be subject to high levels of uncertainty both in terms of timing and end points.

Markets are still optimistic

Under the soft landing scenario backed by current market pricing, the decision to keep interest rates higher for longer could further reduce inflation to a level where policymakers are comfortable. The Fed and others would then respond by loosening policy, removing the threat of crippling rises in debt payments for households and companies. Pressure for bigger rises in wages would abate as inflation expectations eased and the labour market steadied.

However, our research shows such a scenario to be at odds with current inflation and labour market dynamics. Surveys of Fidelity’s equity, fixed income, and private credit analysts show that pressure on company labour costs is alive and well. Geopolitical tensions and the demands of the energy transition will keep upward pressure on commodity prices. This in turn will force central banks to keep interest rates high and sooner or later deliver a more dramatic shock to growth.

Don’t forget the tails

There are other real threats to growth. China’s much feted path to recovery has proved rockier than hoped. The country’s unique story demands a set of its own scenarios for 2024 and, on balance, we think Beijing will manage to hit its growth targets this year but will do little more as a period of controlled stabilisation comes through.

A US election year crystalises the partisan division that threatens its government’s ability to spend and has the potential to shift geopolitical goalposts meaningfully, in both Europe and Asia.

The Russia-Ukraine war continues to fuel commodity prices at a time when supply is already tight. Risks emanating from a widening of the Israel-Hamas war into a regional conflict remain, including a potential rise in oil prices which would lead to another shock to headline inflation. That shock could lead to damaging rises in interest rates as well as the risk of stagflation down the line.

Policymakers will continue to test the limits of the financial system. As the world makes its first ever exit from QE there is much we don't - and can’t - know. Expect narratives to shift rapidly. Prepare for shorter cycles. Watch for imbalances between demand and supply, and for lags in the effects of policy. A volatile macro-economic environment demands vigilance.

The view on the ground

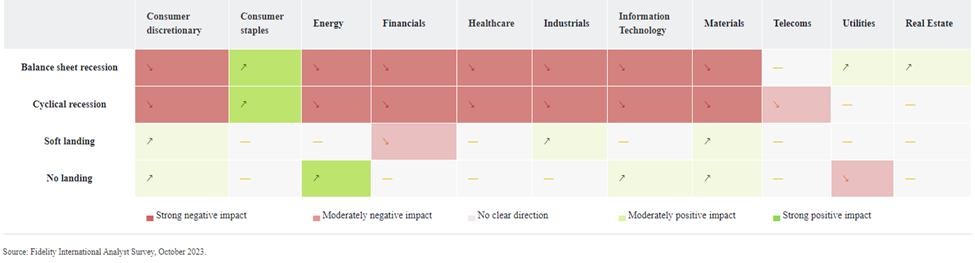

We surveyed analysts across our equity, fixed income, and private credit teams to hear how their sectors would fare in the different scenarios.

In the table below, upward arrows indicate that most of the responses in the sector are implying a positive effect and the background colour indicates the strength of those responses. For example, most consumer staples analysts answered that a cyclical recession will have a positive impact on their sector. The downward arrow indicates a negative impact, with the shade of red reflecting the strength of responses. The neutral/no change “-” has a light grey background and indicates lack of clear direction.

Note: Real estate analysts consider both earnings/valuation of listed securities within the real estate space as well as the yield on underlying real assets.

Source: Fidelity International Analyst Survey, October 2023.

Read next

CIO Outlook: More risk, higher yields, and four ways forward